Last Updated on 2023-05-16 , 10:10 am

The latest bidding exercise for Certificate of Entitlement (COE) premiums in the new quarter, held on 4 May 2023, saw a slight price decline.

Premiums for Category A, which covers smaller cars and electric vehicles, closed at $101,001, down from $103,721.

In contrast, Category B’s premiums, including more extensive and powerful cars, fell to $119,399 from $120,889.

Open category COEs, which can be used for any type of vehicle but primarily for larger cars, also decreased to S$124,002 from S$124,501.

However, analysts predict that COE prices will remain high despite this slight drop due to limited supply and high demand.

In the previous tender that ended on 19 April 2023, premiums closed at $103,721 for Category A and $120,889 for Category B.

COE Premiums Observed to Dip Slightly

In the latest bidding exercise, motorcycle premiums experienced the sharpest price drop, falling from $12,179 to $7,117, a difference of $5,002, due to new measures requiring higher deposits from bidders.

On the other hand, commercial vehicle COEs rose to $75,589 from $75,334, and open category prices decreased to $124,002, down by $499 from the previous bidding exercise on April 2023.

However, despite the price decline, analysts noted that the dips were not significant and were within expectations.

Mr Raymond Tang, a Yong Lee Seng Motor market analyst, predicts that the COE premiums might rise again in the subsequent few bidding cycles.

Category A, B, and E’s premiums only dropped by a few hundred to a few thousand dollars, which Mr Tang considers too “tiny of a percentage” to conclude that prices would fall any lower in future biddings.

According to him, significant price differences of at least $15,000 would be required for drivers in Singapore to consider the price dips as a positive development.

Mr Tang also expects Category A and B car premiums to hover around the $100,000 mark with only slight fluctuations until the end of 2023.

COE Prices Rising Across the Board

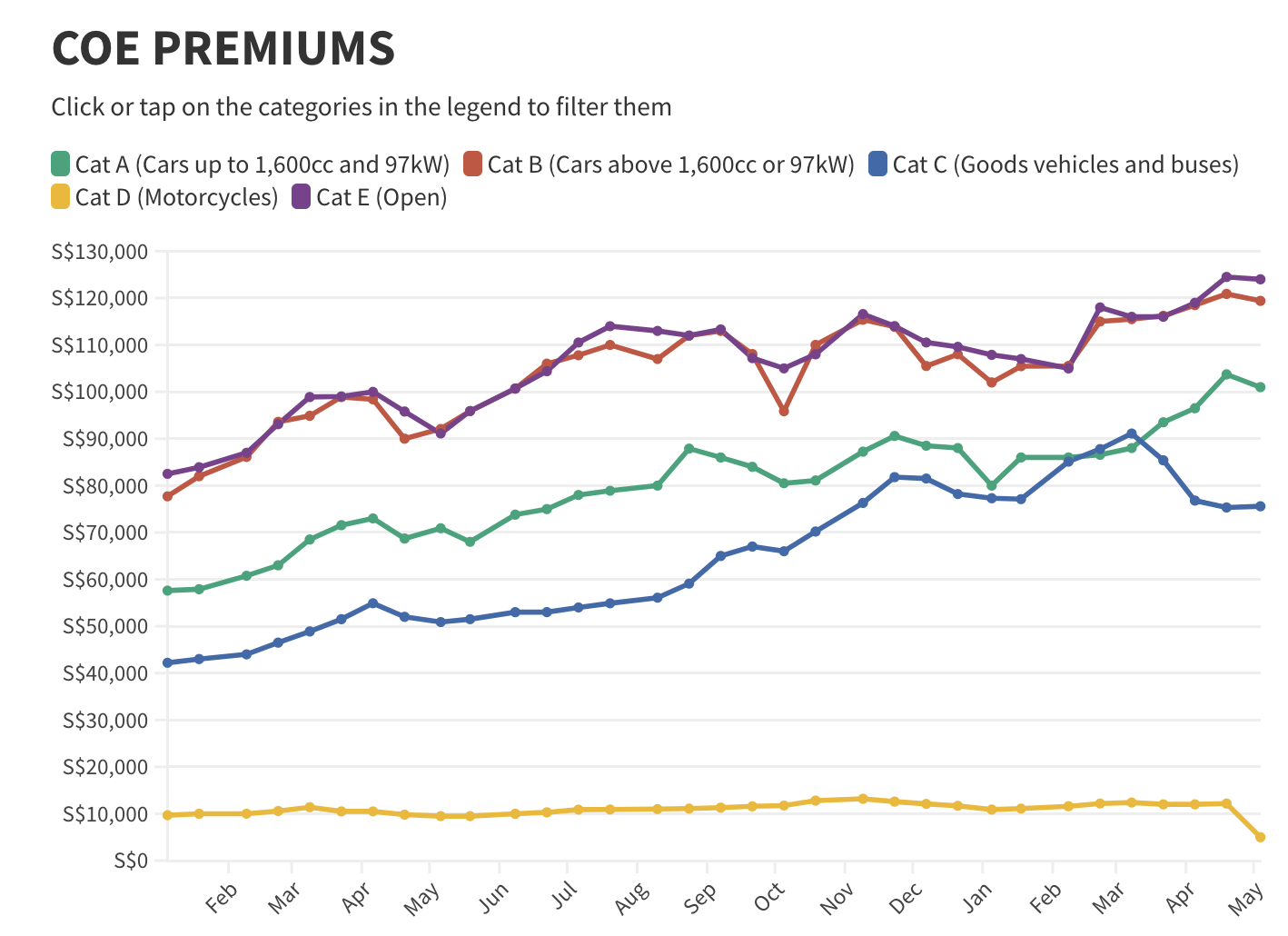

Since the bidding exercises resumed after the COVID-19 circuit breaker in April 2020, COE prices in Singapore have been reaching record-breaking heights.

In March 2020, premiums for small or fully electric cars were priced at $31,210, while those for larger or fully electric cars cost $30,012.

Advertisements

Little did drivers in Singapore know that 2020 would be the last year they could actually afford a car in Singapore without having to survive on Cai Png forever.

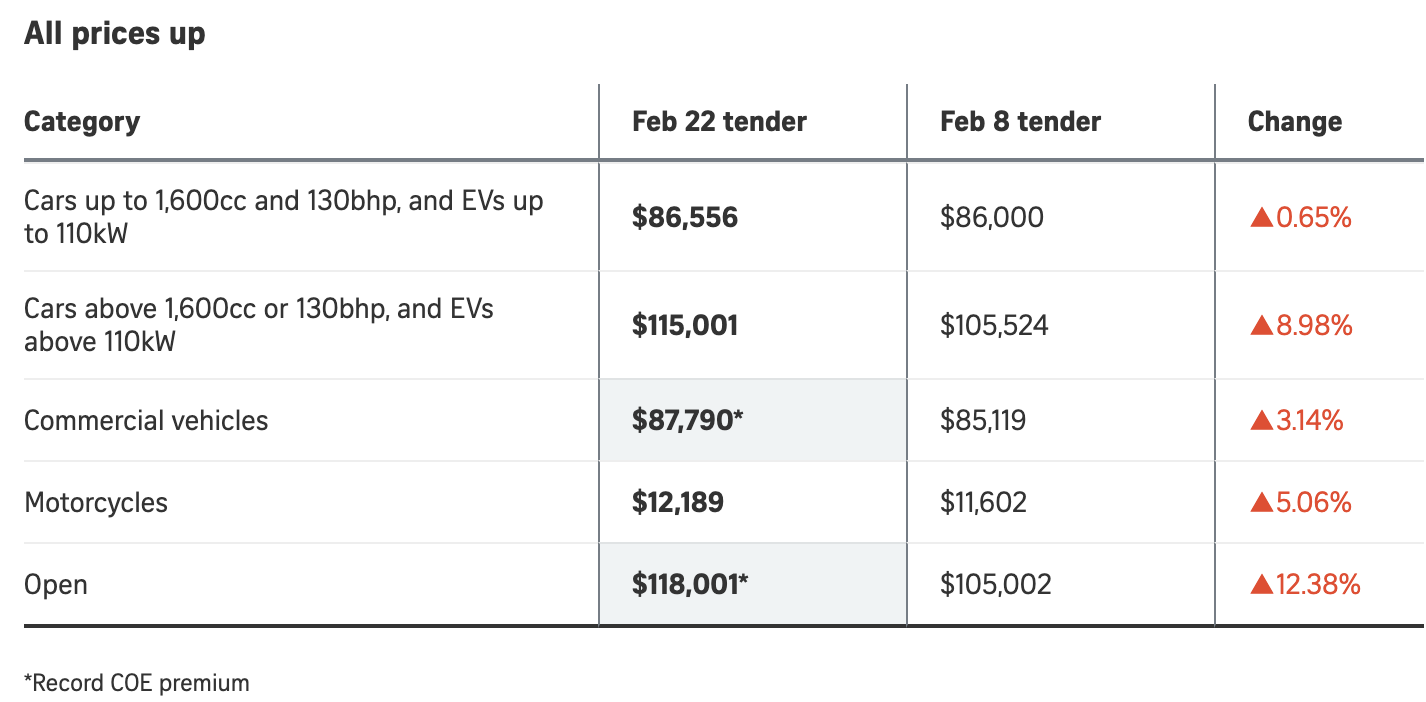

In contrast to 2020’s price points, COE premiums across almost all categories of cars went up in February 2023.

Open category premiums reached a record high of $118,001, representing a 12.4% increase from the previous price of $105,002 in January 2023’s tender exercise and exceeding the $116,577 price point set in November 2022.

COEs for commercial vehicles also set a new record price of $87,790, with premiums for all other categories also increasing.

Industry insiders attribute these high prices to a lack of COEs in the market as increases in premiums came amid a significant surplus of bids across all five categories of vehicles.

Advertisements

19.7% more bids were observed for Open category COEs compared to a tender exercise conducted in January 2023.

Similarly, the motorcycle premium was also up at $12,189, 5.1% higher than the previous round’s $11,602 and approaching the record of $13,189 set in November 2022

Tighter Supply Results in Higher Resale Prices

The demand for COEs from drivers across the board has far exceeded the “archive” of COEs left from the pandemic, which suspended around 2,890 COEs from April to June 2020.

The supply of COEs for commercial vehicles has also sharply declined by 38.6% since.

This has resulted in a higher demand for commercial vehicles, with COE traders charging over $100,000 in 2023 for Open COE premiums obtained earlier in the resale market.

This trend is also attributed to people’s willingness to pay the excess funds to avoid higher taxes under the new additional registration fee (ARF) structure announced in February 2023.

Advertisements

Since COEs are transferable, using them to register expensive cars can save buyers up to $434,431 in taxes, as the COE premiums would not be counted under the new ARF structure.

Similar observations were noted in showroom traffic from various car dealerships, which has doubled since January 2023.

Increased sales, particularly for larger cars, were also observed.

This trend is reflected in the additional 32.4% of bids in the COE category for larger cars in February 2023.

Demand Exceeding Supply An Ongoing Issue

Since 2021, the supply of COEs has decreased, with an average of 3,792 car COEs issued monthly from May to July, down from 4,241.

Advertisements

The drop in supply affects Category A, Category B, and Open category vehicles and affects both buyers and dealers.

Commercial vehicle dealers who sold vehicles like vans and buses rushed to secure COEs before the end of March 2023 to be registered before the updated Commercial Vehicle Emissions Scheme (CVES) and Early Turnover Scheme (ETS) took effect on 1 April 2023.

Under the revised CVES, electric vans will receive $15,000 fewer incentives, while diesel-powered vans will be subject to an additional $5,000 surcharge.

Similarly, economist Mr Walter Theseira, an associate professor at the Singapore University of Social Sciences (SUSS), does not expect a significant change in premiums for private cars.

Demand would remain high as luxury car buyers are willing to pay COE premiums, which make up less than half of the total cost of a premium car.

Additionally, the number of COEs available monthly in 2023 is significantly lower than in previous years, with only 474 COEs available in Category A and 410 in Category B as of May 2023.

Similarly, Mr Tang believes that it is only a matter of time before demand exceeds supply again, resulting in an increase in premiums.

Mr Tang also notes that the supply of COEs cannot be forced to increase as it depends on the number of deregistrations made by drivers across the nation.

Advertisements

This process would usually take ten years for each driver, a duration too long for most new buyers to wait.

Associate Professor Raymond Ong from the Department of Civil and Environmental Engineering at the National University of Singapore (NUS) echoed the same sentiment.

He observed a surplus of bids compared to the supply of COEs available, with 189 more bids than the quota for Category A and 103 more in Category B.

Measures to Regulate Vehicle Population

While it has been a major factor in driving up car prices in Singapore, the COE system is crucial in managing the vehicle population in this small and densely populated country.

To purchase and register a new vehicle in Singapore, drivers must first secure a COE through open bidding exercises conducted twice a month.

Upon successful bidding, drivers are granted a document that gives them the right to own a vehicle and use limited road space in Singapore, with a lifespan of either five or ten years.

However, drivers must either deregister their vehicle or renew their COE after ten years by paying the Prevailing Quota Premium (PQP) for their respective vehicle categories.

The PQP prices are determined by the Vehicle Quota System (VQS), which limits the number of new vehicles registered in Singapore.

COE prices of COEs have been fluctuating due to the limitations set by the VQS, resulting in recent price increases.

As a result of these high prices, drivers often seek loans from financial institutions such as United Overseas Bank (UOB) and Hong Leong Finance, which offer such loans at varying interest rates.

More Restrictions to Curb Speculative Market Deals

New measures have been introduced by the Land Transport Authority (LTA) to curb individuals from manipulating already rising market prices further.

These measures included increasing the bid deposit for motorcycles from $800 to $1,500, a deterrent for dealers who conduct reckless bidding.

As a result, a significant decline in COE premiums for motorcycles was observed in May 2023’s round of bidding.

The motorcycle premiums closed at $5,002, a considerable reduction from the $12,179 price point recorded in February 2023.

The LTA also reduced the validity period of Category D’s temporary COEs from three months to one month.

According to Assoc Prof Theseira, this could help prevent motorcycle dealers with large COE stocks from manipulating the COE market price.

He cited examples where dealers would purchase and hold onto a significant stock of temporary motorcycle COEs to register motorcycles in their business name “when needed”.

When COE premiums rise, they price their motorcycles based on the current COE prices, even though they bought the certificates at a lower price, resulting in significant profits.

However, the new increase in bid deposit makes it more expensive for dealers to give up an unused COE, while reducing the temporary COE period to one month also makes it difficult for dealers to hold onto a certificate speculatively.

As a result, these new measures will likely prevent motorcycle dealers from controlling the COE market price.

Read Also:

- Real Mercs Driver in Tampines Accident Responded; Said He Sped Up to See Saab’s Car Plate Number

- If You’re a PME, Here’s Another Reason Why You Should Join a Union

- TikTok CEO Chew Shou Zi Responds to TikTok Ban; Confident to Win Legal Challenge

- Popular Peach Garden in Thomson Plaza Suspended After 43 People Allegedly Had Food Poisoning After Eating There

- Driver in Tampines Accident Engaging Lawyer After Being Charged

Advertisements