2025 has just begun, and there are many new changes this year.

Do you know that if we lose our job in 2025, we might get up to $6,000 for six months while we’re looking for a job? And that the CPF contribution will increase from 2025?

But don’t worry, it’s just for some people, so read on as I list down the eight major changes that’ll happen in Singapore from 2025!

If you prefer to watch a video about this topic, here’s a video we’ve done:

Still here? Okay, here goes.

You’ll Be Paid for 6 Months If You Lose Your Job

For a start, from April 2025, the SkillsFuture Jobseeker Support Scheme will start.

This was announced during PM Wong’s first National Day Rally last year.

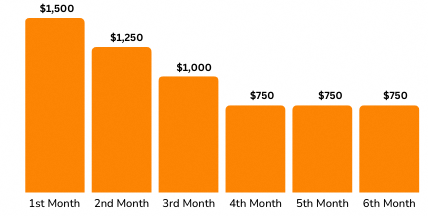

If you lose your job involuntarily from April 2025, which means if you’re retrenched or let go, you can apply to receive up to $6,000 for six months.

You don’t get the full $6,000 at one go; instead, you’ll get $1,500 for the first month, $1,250 for the second month, $1,000 for the third month, and $750 for the fourth, fifth, and sixth months.

This scheme is only for Singaporeans aged 21 and above. For Singapore PRs, this will start from 2026 instead.

Also, you must earn less than $5,000 a month on average for the last 12 months, and during this period, you must have worked for at least six months.

To qualify, you must actively look for jobs.

More details will be released when this scheme takes place.

Private Hire Vehicles & Food Delivery Will Be More Expensive

From 1 January 2025, be prepared to pay higher fees for private hire cars and food delivery.

A new law protecting the interests of platform workers, like private hire drivers and food delivery riders, will kick in.

You can watch this video for more info:

Other than ensuring that platforms buy insurance for them, the key change is that CPF contribution will become compulsory for platform workers born on 1 January 1995 or later, which includes anyone aged 30 and below.

For those over 30, it’s not compulsory, but they can opt in.

But why does this lead to higher fees?

For employees like us, those below 55 contribute 20% of their salary to CPF, and employers contribute an additional 17%. This 17% is an extra cost to employers.

For example, if my pay is $1,000, $200 is deducted for CPF, and my employer tops up $170 to my CPF account.

Previously, platforms like Grab or foodpanda didn’t have to pay this extra cost, but starting in 2025, they have to.

To cover this, platform fees will increase.

On average, expect an increase of $0.40 to $0.50 per trip or order.

You can read this article to read all the changes.

CPF Contribution for Platform Workers

Since we’re on this topic, let’s look at the CPF changes in 2025, starting with the CPF contributions for platform workers.

As mentioned earlier, from 1 January 2025, platform workers aged 30 and below must contribute to CPF, and their platform operators must also contribute. For workers over 30, they can opt in voluntarily.

Initially, platform workers will contribute 10.5%, and platform operators will contribute 3.5%. This rate will progressively increase each year, reaching the familiar 20% (employee) and 17% (employer) by 2029.

While it sounds high, remember that self-employed individuals already contribute to their MediSave account annually.

In the first year, platform workers will pay slightly more but receive additional contributions from their platform operators.

However, note that this rule applies based on the year of birth, not age, meaning anyone born on or after 1 January 1995 will be required to contribute.

Some People Will Contribute More to CPF

The CPF contribution changes don’t stop there. Another significant change affects higher-income individuals.

Before September 2023, CPF contributions were capped for salaries above $6,000. This is called the CPF monthly salary ceiling.

For example, if you earn $10,000 a month, only $6,000 was subject to CPF contributions.

Starting 1 September 2023, this ceiling increased to $6,300, and on 1 January 2024, it went up to $6,800. By 1 January 2025, it will rise further to $7,400, and by 2026, it will reach $8,000.

This change primarily impacts those earning above the ceiling. If your salary is less than $6,000, you’ve essentially been contributing based on your full salary, so this won’t affect you.

For high earners, this means a higher CPF contribution, which might reduce their take-home pay.

New Fathers Are Getting More Paid Leave

Starting 1 April 2025, new fathers will receive more paid leave.

Currently, mothers get 16 weeks of fully paid maternity leave, and fathers get at least two weeks of fully paid paternity leave, with some employers extending this to four weeks.

Mothers can also share up to four weeks of maternity leave with fathers under the Shared Parental Leave scheme.

From 1 April 2025, new fathers will receive a minimum of four weeks of paid paternity leave instead of two. Additionally, Shared Parental Leave will now default to three weeks for each parent.

This means the mother will get 16 weeks of maternity leave plus three weeks of shared leave, totaling 19 weeks. Fathers will get four weeks of paternity leave plus three weeks of shared leave, totaling seven weeks.

Together, couples will receive at least 26 weeks of paid leave when they welcome a newborn.

This will further increase from 1 April 2026, with Shared Parental Leave extending to five weeks for each parent, bringing the total to 30 weeks of paid leave for both parents.

You can read this article for more info.

MediShield Life Changes That You Probably Didn’t Know About

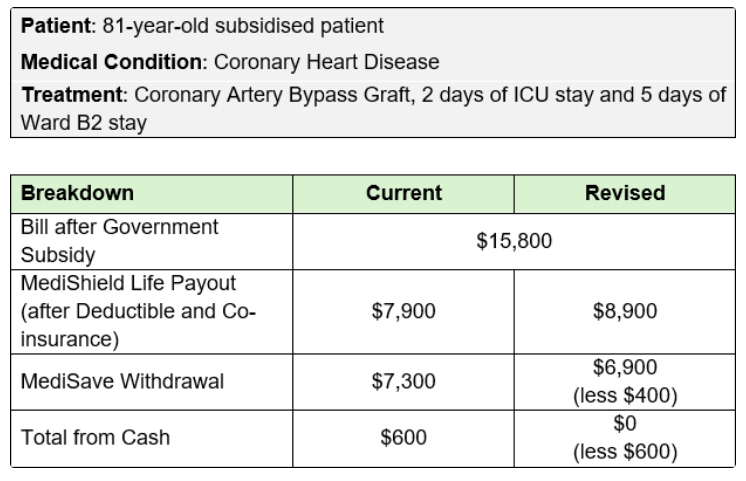

Singapore’s healthcare system heavily subsidizes public healthcare, and MediShield Life plays a key role in keeping costs affordable (or almost completely “free”).

MediShield Life, a basic insurance policy, covers all Singaporeans and PRs. Premiums for this insurance are paid using CPF MediSave accounts.

However, starting April 2025, premiums for MediShield Life will increase progressively.

The increase is due to expanded coverage, including new life-saving treatments like Cell, Tissue, and Gene Therapy Products (CTGTPs), and higher claim limits.

While the premiums rise, the amount you pay out-of-pocket may decrease.

For example, the MediSave withdrawal limit has increased, allowing patients to cover more expenses with their MediSave. In some cases, cash payments might no longer be necessary.

MOH provided an example of bypass surgery: previously, a patient had to pay $600 in cash for a $15,800 subsidized bill, but under the new system, no cash is needed.

You can read the example here.

So, while premiums go up, the benefits improve significantly.

More Hawkers Can (Hopefully) Survive

Manpower shortage is the number one complaint by hawkers.

From 1 January 2025, there might be a solution. Currently, hawkers can only engage long-term visit pass (LTVP) holders as assistants if they are family members, like a foreigner spouse.

However, from 2025 onwards, hawkers can hire any LTVP holders, regardless of familial ties. This new rule aims to alleviate the manpower struggles hawkers face.

While this is good news for hawkers, other business owners might feel the pinch of a different manpower law.

More Expensive to Hire Foreign Talents

Singapore mainly has three types of work passes: Work Permits (for labor-intensive jobs), S-Passes (for executive roles), and Employment Passes (E-Passes, for managerial positions).

Work Permits and S-Passes have quotas and levies, but E-Passes don’t have quotas. However, the qualifying salaries for S-Passes and E-Passes will increase in 2025.

For S-Pass holders, the current minimum salary is $3,150 for most sectors and $3,650 for the financial sector. From 1 September 2025, this will increase to at least $3,300 for most sectors and $3,800 for the financial sector. Additionally, levies for S-Pass holders will rise.

For E-Pass holders, the minimum monthly salary will increase from $5,000 to $5,600 for most sectors and from $5,500 to $6,200 for the financial sector starting 1 January 2025.

These changes mean businesses must either put in more effort to hire locals or pay more for foreign talents.

Either way, this could benefit locals seeking jobs.

Now, note that there are MANY more changes; these are merely the changes we thought would affect most people.