Amid people flocking to social media to find new housing listings, the Singapore Police Force (SPF) continues to warn of scams in the rental community.

A recent advisory issued by the SPF has revealed that as of January 2023, more than 305 victims have fallen prey to scams carried out by con artists who pose as legitimate property agents, resulting in losses amounting to at least S$1.7 million.

Here’s what you need to know.

How The Scam Works

Typically, scams will come in the form of a sponsored online property rental listing, which is widespread on various advertisement sites like Facebook and Carousell.

Victims would usually initiate contact with the scammer via Whatsapp using the contact numbers listed in the fake online listing.

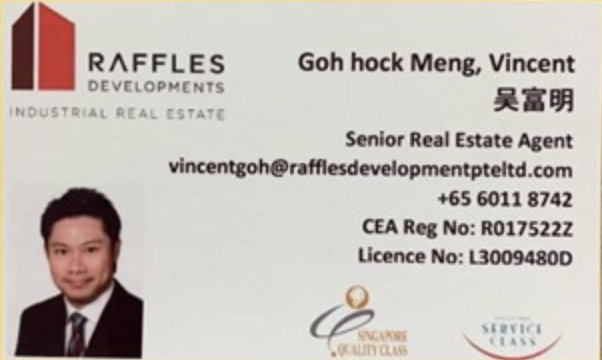

During the conversation, the scammer would attempt to convince the victim of his credentials by impersonating and sending a picture of a legitimate property agent’s Council for Estate Agencies (CEA) registration number, business card, and pictures or virtual tours/videos of the property to be leased.

This picture shows a business card of a registered property agent that’s been misused by a scammer.

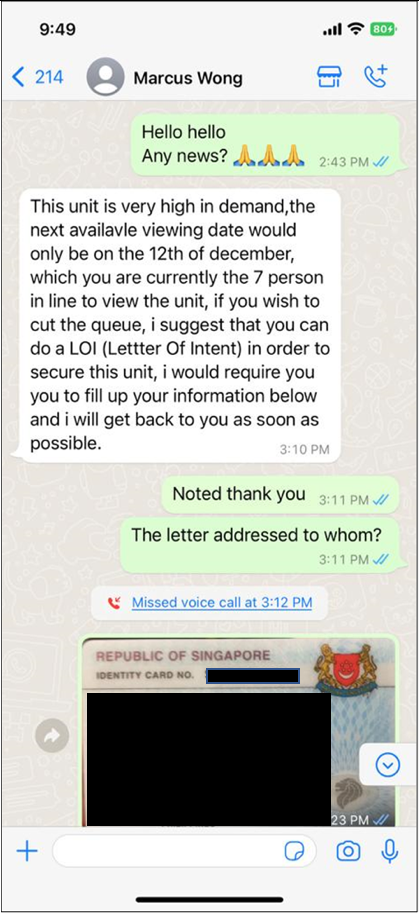

When a property viewing is requested, scammers would often redirect the conversation and pretend the property is in high demand in order to urge victims to make rental deposits into a local bank account quickly.

Here’s a screenshot of a chat with a scammer:

In some cases, the scammers would request the victim’s personal details, for the purpose of “preparing the lease agreement”. They will then send a copy of it with their name and NRIC before asking for their signature and the rental deposit.

Once the deposit is submitted, the scammer ceases contact abruptly and victims quickly realise that they’ve been scammed.

What Are Some Measures You Can Take?

In response to the resurging cases of online rental scams, the police have issued several pieces of advice on precautionary measures you can take to deal with these situations.

According to the SPF, you can download the Scamshield application as a safeguard. It blocks and filters scam calls/messages based on crowdsourced reports and police-blacklisted contacts.

Since 2022, ScamShield has blocked around 200,000 scam calls and detected at least 3.5 million scam messages.

You can also look into enabling other security features like two-factor authentication (2FA) for banks, social media, and Singpass accounts. Transaction limits can be placed on banking apps like PayNow or Paylah as well.

Additionally, remember to check for scams through official sources when making contact with agents seen on online listings.

This can be done by verifying the phone numbers of the properties listed and confirming whether they belong to the property agent registered with the CEA.

You can use the CEA Public Register accessible to members of the public and key in the advertised phone number to perform a search.

If the search does not lead to the property agent’s profile page, it would mean that the phone number is not registered with the CEA and that the property listing is most likely a scam.

Alternatively, you can contact the agent’s property agency to verify the authenticity of the listing.

Finally, do not hesitate to alert the authorities, family, or friends of any potential fraudulent pages on online platforms. This will help raise awareness and prevent others from potentially falling victim to such scams.

Not The First Time?

Not too long ago, another high-profile case popped up in which 16 people were caught for allegedly lending their bank accounts in a series of rental scams worth 1.3M.

A five-day-long islandwide law enforcement operation was conducted from 9 March to 13 March by the Anti-Scam Command Division in response.

The scammers had similarly posed as real estate agents and asked their victims to pay a fee to secure a housing unit, even before they’d viewed the house.

They then borrowed these bank accounts to receive funds from around 480 rental scams totalling S$1.3 million in earnings.

In yet another scam, a woman paid $10k in deposits to rent a flat that was already occupied, and got ghosted by her landlord when she asked for her money back.

“The prevalence of scams continues to be high in Singapore. At least 90 per cent of scams in Singapore originate from overseas,” said the SPF.

It is advised to look out for numbers with the +65 prefix, especially on WhatsApp and property listings on non-mainstream platforms, as scammers would often use spoofed numbers with +65 prefixes in an attempt to disguise themselves as local.

Those who are found guilty of aiding others in receiving proceeds from a crime may face a maximum prison sentence of 10 years, a fine of up to $500,000, or both.

What Do I Do if I’ve Been Scammed?

If you’ve (touch wood) fallen victim to a rental scam, the next step should be to file a police report via the SPF website immediately, or you can visit your local police station to do it in person.

Refer to the National Crime Prevention Council’s Scam Alert page for guidance on what information to include in the police report.

You should also immediately contact your bank to stop any further scam-related payments or transactions, in case scammers have gained access to your account.

Subsequently, you can consult legal practitioners for advice on exploring your options to recover any financial losses incurred.

If you have information relating to such crimes, call the Police Hotline at 1800-255-0000, or submit an online report at www.police.gov.sg/iwitness. Information sent will be kept strictly confidential. As you probably know, always dial ‘999’ if you require urgent police assistance.

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: