GST fees amounting to a whopping $7.5 million were wrongly charged by six government agencies.

The agencies include Housing and Development Board (HDB), Land Transport Authority (LTA), Urban Redevelopment Authority (URA), Singapore Food Agency (SFA), Office of the Public Guardian (OPG) and the Council for Estate Agencies.

Here’s what happened.

Inconsistencies Found in Application of GST on Government Fees

In November 2023, an internal review by the Ministry of Finance (MOF) uncovered inconsistencies in the application of GST on certain government fees.

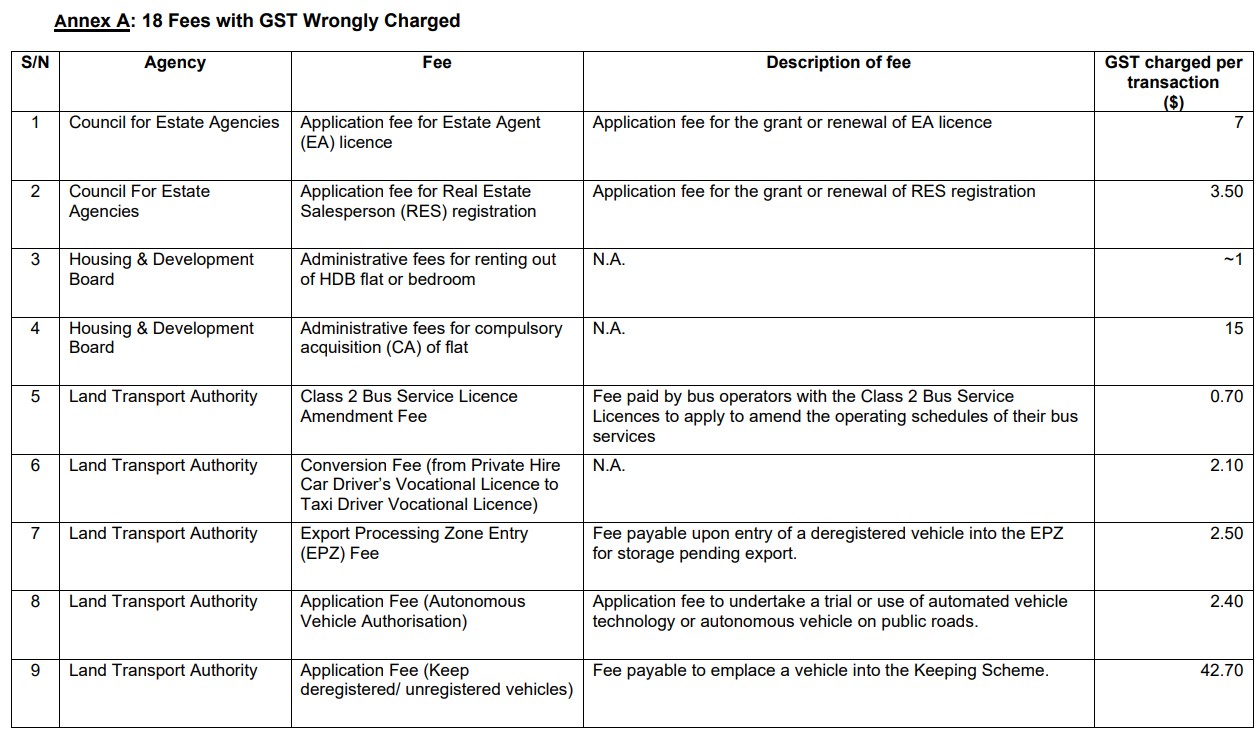

By January, it was determined that 18 fees across these agencies had been mistakenly subject to GST, affecting around 200,000 transactions annually. Notably, HDB transactions comprised 70% of these.

MOF explained that GST-registered businesses are only required by law to keep records for up to five years, so the current record they have only dates back to 2019. This means that the GST have been wrongly charged for years beyond 2019.

In response to these findings, effective from 14 February 2024, the involved agencies ceased charging GST on the identified fees.

MOF and the respective agencies have since issued an apology for the “erroneous charging of GST” and explained that refunds will be issues to those who are affected.

Why the 18 Fees are Considered “Wrongly Charged”

GST is generally charged on government services such as using public sports facilities or rental fees for hawker stalls.

However, it should not be charged on services that are “regulatory in nature” such as application fees or administrative charges.

In this case, the following 18 fees were actually regulatory in nature but were wrongly placed as processing fees by the agencies.

MOF highlighted that an agency charged GST on the application fee for a licence but not the licence itself. In reality, GST should not be charged on either the application fee or the licence fee.

Currently, government agencies are given the full reign to decide when GST should be imposed on their fees based on guidelines given by MOF.

However, after this incident, MOF is making legislative amendments to the GST Act. This way, there will be clearer and more distinguishable list of regulatory fees where GST should not be applied.

Eligibility for Refunds

If you were giving out and not receiving ang baos this CNY, I’m sure you’re eager to know if you’re eligible for the refund. Here’s how to check if you’re affected.

The MOF has outlined that individuals and non-GST registered businesses, unable to claim input tax, will be eligible for refunds.

Conversely, GST-registered businesses, despite having been erroneously charged, are ineligible for refunds due to their ability to claim the paid GST as input tax.

The estimated impact of this mischarge on individuals and non-GST businesses amounts to approximately $1.5 million annually. Although it is a large sum, most of the transactions including GST charges were $5 or even lesser.

Refund Procedure per Agency

These are the following refund plans per agency.

Housing Development Board (HDB)

Wrongly Charged GST

- $1 per application to rent flat / spare bedrooms

- $15 for compulsory acquisition of flats

Refund Strategy

- Refunds are inclusive of interest

- Refunds start from mid-March 2024 to 30 June 2024

- Affected households will receive a notification on Singpass and a hardcopy letter from HDB

- Details must be provided on HDB’s e-Service site to facilitate the refund

- An email will be sent once the refund is credited to the bank account

Land Transport Authority (LTA)

Wrongly Charged GST

- $0.70 amendment fee for Class 2 Bus Service Licence

- $2.10 conversion fee from Private Hire Car Driver’s Vocational Licence to Taxi Driver Vocational Licence

- $2.50 fee for Export Processing Zone Entry

- Application fees:

- $2.40 Autonomous Vehicle Authorisation

- $42.70 Keep deregistered/unregistered vehicles

- $12.20 Change garage address of Keeping Scheme Vehicles

- $20.10 Special Purpose Licence

- $4.40 Change of Vehicle Particulars Requiring LTA’s approval

- $15 Vehicle Accessory Approval

Refund Strategy

- Refunds will be credited to affected individuals to their bank accounts registered with LTA or valid PayNow accounts.

- LTA will notify individuals to update bank account details via One Motoring if they have not done so

- An e-notification and SMS, or hardcopy letter will be sent once refund is credited to the bank account

Urban Redevelopment Authority (URA)

Wrongly Charged GST

- $10-$1500 processing fee for Development Application to obtain planning permission to carry out development works

- $10-$84 processing fee for lodgement of documents as authorisation to carry out development works

Refund Strategy

- Refunds start from 1 March 2024 to 30 June 2024 for GST refund on and after 1 January 2019

- URA will contact affected individuals to request for information to facilitate refunds via emails

- For refunds before 1 January 2019, affected individuals will need to contact URA via GST Refund Form Sg from 1 July 2024.

Singapore Food Agency (SFA)

Wrongly Charged GST

- $10.30 – $13.24 application fee for licence to operate food processing establishment, coldstore and slaughterhouse

Refund Strategy

- SFA will contact affected businesses for refunds via registered email and business address by 30 June 2024

- Companies on GIRO or with Paynow (UEN), will receive the refund by end of April

- Businesses who paid before 1 January 2019, can enquire if they are eligible for a refund via sfa.gov.sg/feedback by 31 December 2024

Office of the Public Guardian (OPG)

Wrongly Charged GST

- $3.27 – $24.77 application fee for Lasting Power of Attorney

- $35.98 application fee for registration of Professional Duties

Refund Strategy

- Refunds will be made starting March 2024 – 30 June 2024

- OPG will reach out to affected individuals and companies via letters

- Refund will be made via PayNow or the registered bank account for disbursement schemes such as GST Voucher Scheme

Council for Estate Agencies (CEA)

Wrongly Charged GST

- $7 – $10.80 application fee for EA licence

- $3.50 – $4.50 application fee for RES registration

Refund Strategy

- Refunds will be made starting March 2024 – 30 June 2024

- Licenced EA can check details of refund on CEA’s e-Services

- Former EA can submit a refund request from 1 May 2024

Do keep a look out for the refunds if you were affected. If you had not received your refund by 30 June 2024, you can always reach out to the agencies to seek a refund.