New Framework Holds Banks and Telcos Accountable for Phishing Scams

Do you remember the day when our SMS inboxes began to display sender IDs labeled “Likely-Scam” (even from Google’s 2FA SMS)?

This significant change was brought about by the mandatory SMS Sender ID Registry introduced in January of this year. As a result, by March 2023, there was a remarkable 70% reduction in SMS scam cases.

It’s intriguing to note that despite being recognized as one of “The Four Asian Tigers” since the 1960s, a staggering S$330 million was lost to scams in the first half of 2023 alone, as reported by the Singapore Police Force. What’s even more surprising is that the majority of these scam victims are our very own young adults.

In response to this, the Government has devised another strategy to further reduce these scam incidents, and banks and telcos might not be happy about it.

Soon, S’pore Banks & Telcos Might Need to Pay When Victims Lost Money to Scammers

You read that right. In certain circumstances, banks and telecommunications companies might be held responsible for compensating you for 100% of your losses.

Nevertheless, banks and telecommunications companies are now being urged to step up and play a more proactive role.

This initiative is a result of the Shared Responsibility Framework (SRF) for Phishing Scams, a collaboration between the Monetary Authority of Singapore (MAS) and the Infocomm Media Development Authority (IMDA).

Introduced on Wednesday, 25 October, the SRF mandates financial institutions (FIs) and telcos to compensate scam victims, but only under certain conditions.

To the readers wondering about the fine print, yes, there’s a catch: the compensation is provided “if applicable.”

What are the “conditions”?

Constraint 1: Scammers Must Impersonate Legitimate Entities

The SRF isn’t a blanket solution for all scams. It specifically targets scams where fraudsters pose as legitimate organizations.

This means malware scams aren’t covered by this framework.

Watch this video to know more about the malware scam, and what banks are doing:

For instance, phishing scams that impersonate DBS Bank, a renowned durian seller, or even the local police are included.

If your FI, such as a bank or major payment institution, or your telco fails to safeguard your interests, they could be liable for your losses.

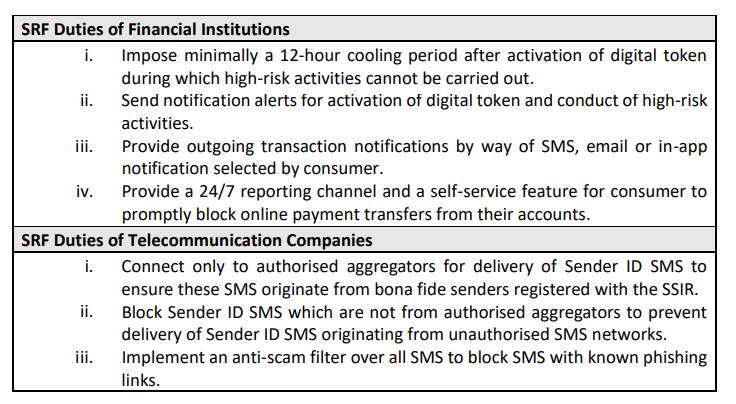

Notably, FIs have a greater responsibility compared to telcos.

Wondering about their specific responsibilities? Below is the list by MAS:

In other words, the FIs and telcos must be responsive…and hopefully, we won’t be hearing “all our customer service officers are currently busy” when we might have become a scam victims, and time is of essence.

Constraint 2: The Fine Print Matters

While the SRF seems promising, a detailed examination of the Consultation Paper on SRF reveals specific criteria for eligibility.

Consider this scenario: You receive a call from someone claiming to be the police, stating they need access to your account due to allegations of money laundering.

If you willingly share your account details and OTP, you’ll still bear the loss, even if it’s a phishing scam.

The reason?

You provided your details verbally over the phone, not via a deceptive digital platform.

In conclusion, it’s still imperative that we remain vigilant against scams.

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: