If you’re someone who bought Bitcoin when it cost just a slice of pizza, then you’re the latter, because for the first time, Bitcoin has surpassed the USD $100,000 mark.

Here’s what happened.

Bitcoin Surged Past US$100,000 for the First Time

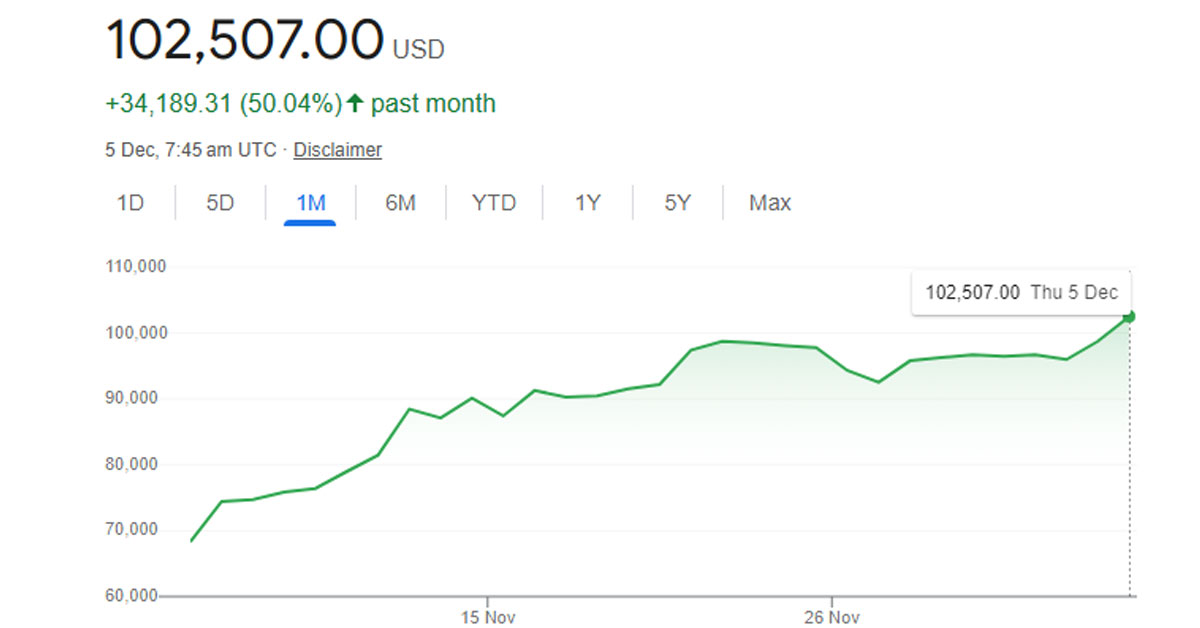

Bitcoin has surged past US$100,000 (S$134,195) for the first time, hitting US$101,114 this morning (5 December in Singapore, though it’ll be recorded as 4 December in the US).

This milestone has pushed Bitcoin’s market cap to a staggering US$2.7 trillion, while the total cryptocurrency market has climbed to US$3.86 trillion.

But what happened?

You might have already heard about Bitcoin’s record of US$76,999 on 7 November 2024, following the U.S. presidential election.

What caused this latest surge?

Still About Trump

There are many reasons.

For a start, the election of President-elect Donald Trump has instilled optimism among investors about a more favorable regulatory environment for cryptocurrencies, given that he himself is very involved in cryptocurrency.

Additionally, Trump’s nomination of Paul Atkins, a known crypto advocate, as the new Chair of the Securities and Exchange Commission (SEC), signaled potential easing of stringent regulations. Atkins, a former SEC Commissioner, is recognized for his support of blockchain technologies and digital assets.

However, the approval and subsequent success of Bitcoin exchange-traded funds (ETFs) played a significant role.

Notably, BlackRock’s iShares Bitcoin Trust ETF (IBIT) surpassed $50 billion in assets under management within 228 days of its launch.

In case you’re not aware, BlackRock is an American multinational investment management corporation founded in 1988, recognized as the world’s largest asset manager with approximately $11.5 trillion in assets under management.