Customer satisfaction with taxi and private-hire vehicle (PHV) services has increased from 2022 to 2023, based on an annual survey conducted by the Public Transport Council (PTC).

Between 14 and 27 August 2023, PTC surveyed 1,500 commuters who used these two point-to-point (P2P) services three or more times in a typical week, and had used the services on the same day of completing the survey.

The survey measures users’ satisfaction with taxi and PHV services to gain a deeper understanding of customer expectations and pinpoint areas for improvement.

Results of the 2023 PTC Survey

For each of these attributes, those who gave a score of 6 and above (out of 10) were deemed satisfied.

96% of commuters surveyed were satisfied with the taxi and PHV services, giving a mean satisfaction score of 8.2, an increase from 8.0 in 2022.

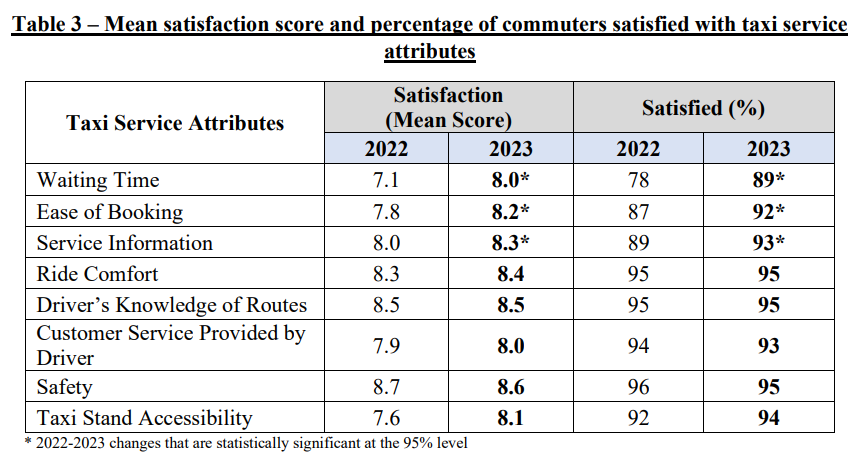

The mean satisfaction score for taxis increased from 8.1 in 2022 to 8.3 in 2023.

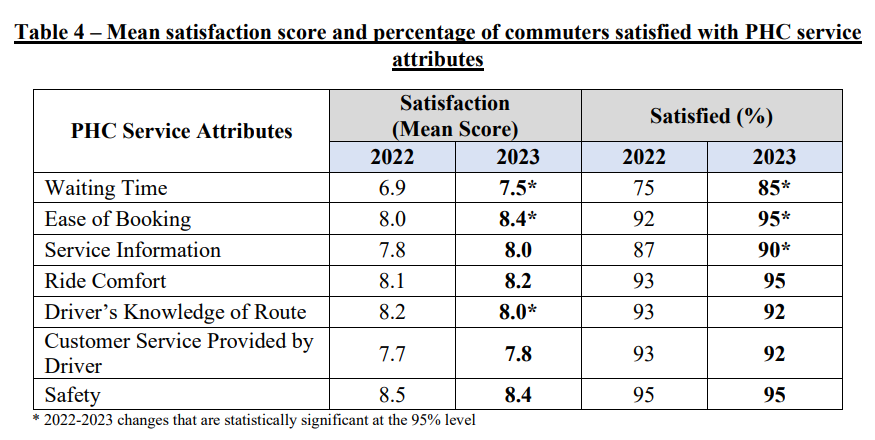

In the same period, that of PHV services such as Grab and Gojek increased from 7.9 to 8.1.

PTC noted that there were significant increases in satisfaction level regarding waiting time and ease of booking.

89% of respondents (1,355 out of 1,500) were satisfied with the waiting time of taxis, an improvement from 78% the previous year. The satisfaction score for waiting time increased from 7.1 in 2022 to 8.0 in 2023.

85% of respondents (1,275 out of 1,500) were satisfied with the waiting time of PHV services, an improvement from 75% the previous year. The satisfaction score for waiting time also increased, from 6.9 to 7.5, in the same period.

The satisfaction scores for ease of booking of P2P services increased from 7.8 (2022) to 8.2 (2023) for taxis and 8.0 (2022) to 8.4 (2023) for PHV services.

Similarly to previous years, safety was once again rated as the most important attribute in P2P services. This was followed by ease of booking and waiting time.

From the tables below, it can be observed that there were increases the satisfaction mean score for every attribute for taxis and PHV services, other than a decrease in “Driver’s Knowledge of Route” for PHV services (there’s always GPS) and a slight, non-significant decrease in “Safety” for both P2P services.

The increased satisfaction may be attributed to the increased number of P2P vehicles from 2022 to 2023, reducing waiting times.

In a Facebook post, Senior Minister of State for Transport Amy Khor said P2P service operators recruited more drivers and increased the taxi and PHC fleet from around 60,500 vehicles in 2022 to around 67,000 vehicles in 2023.

Moreover, the number of drivers with a valid private-hire car vocational licence increased from 48,309 in December 2022 to 54,156 in December 2023, based on figures from the Land Transport Authority.

2022’s Satisfaction Ratings Were Lower Than Previous Years

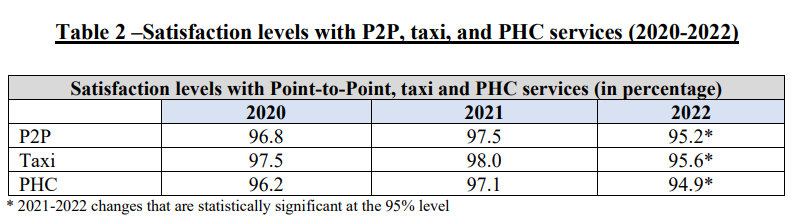

The PTC satisfaction ratings for P2P services took a hit in 2022, being lower than the previous two years.

In 2022, 95.2% of respondents were satisfied with P2P services. This was lower compared to 97.5% in 2021 and 96.8% in 2020.

This decline can be attributed to a number of factors.

During the peak of the COVID-19 pandemic, the demand for P2P services was extremely low, and even non-existent during the circuit breaker of 2020.

In fact, a man was jailed for providing carpooling services during the circuit breaker.

Due to the lack of demand, many drivers had to switch to other jobs to sustain themselves during this period.

When COVID-19 restrictions eased, the demand for P2P services exploded, overwhelming supply. Many drivers who had left the industry in 2020 did not return as it would mean going through the hassle of switching careers again.

After settling down in a new industry, switching careers once again seemed too mafan.

As the demand picked up, the shortage of available drivers caused waiting times to increase.

The increased demand, which could not be met by the supply at that time, drove prices up. Surge or dynamic pricing for rides became more frequent, contributing to consumer frustration.

Additionally, as costs generally rose in Singapore, this made fares feel unpalatable even when they remained technically comparable.

These various factors led to decreased customer satisfaction with P2P services, reflected in the PTC survey results.

Thankfully, the higher fares for P2P services have attracted more drivers to join the industry, increasing the supply of available drivers and vehicles.

Higher fares have also managed the demand for these services, balancing the market.

As the P2P services market evened out once again, PTC survey figures showed that satisfaction increased.