DBS digital banking services were down again, just around a year after the same thing happened in November 2021.

The outage on 29 March lasted almost the whole day, prompting angry users to slam the bank on the internet because of the major service disruption.

Here’s what you need to know.

The Outage

From around 7 am on 29 March, DBS customers and PayLah users started to notice that DBS online services like DBS digibank online, mobile services, and the PayLah app were all down.

Reports and complaints started emerging across websites, including Downdetector, which tracks possible outages. 630 reports were lodged on the website by 8.30 am by DBS customers, who found that they were unable to log in to the portal or access any online services.

DBS’s response only came at 10.20 am via Facebook, assuring customers that they were attempting to resolve the problem and would notify them when it was fixed.

They also reassured customers that their physical bank cards could still be used, and that data was not compromised while the system was down.

The post was updated again at 12.49 pm, with the bank saying that access to digital services like PayLah was now intermittent, and users might experience slowness during login.

However, users reported that one-time passwords (OTPs) were not received on mobile phones and they were hence unable to log in.

In their next update at 4.50 pm, they apologised for the inconvenience caused and stated that access to digital services was still unavailable. Instead, they extended the opening hours of all DBS and POSB branches, as well as Treasures Centres, by two hours to help frustrated customers.

Their systems only returned to normal at 5.45 pm, more than ten hours after its outage.

Users Inconvenienced

The outage drew the ire of users across the internet, and they took to DBS’s Facebook post to express this.

A few users expressed that this was a massive failing on the bank’s part, and that they would be opening accounts with other banks instead.

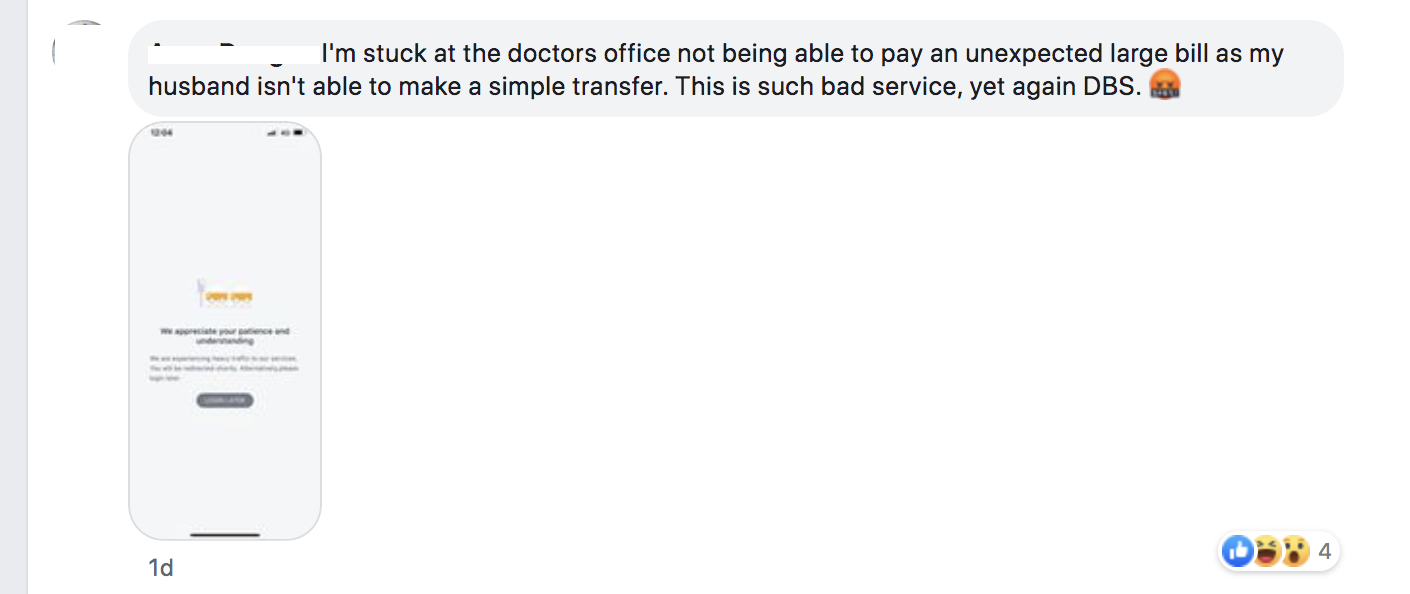

Others shared how this outage inconvenienced them. These anecdotes range from more minor things like not being able to pay for food to being unable to pay medical bills.

This user who could not pay for his cai png tried to inject some humour into the dismal situation:

Others were not so “lucky”—one woman found herself stuck at her doctor’s office after being unable to pay her husband’s sizeable medical bill.

Commenters also expressed that the app kept prompting them to reset their PINs, and reported being unable to retrieve OTPs, barring them from making any transactions online.

Not An Isolated Issue

Unfortunately, this is the second time the issue has happened in a little over a year.

In November 2021, DBS’s digital banking services experienced a two-day disruption, deemed a “serious disruption” by the Monetary Authority of Singapore (MAS).

As a result of that disruption, the MAS imposed additional capital requirements on DBS, mandating that they add a multiplier of 1.5 times to risk-weighted assets to account for operational risk.

This time, the MAS deemed the outage “unacceptable”, stating that the bank had “fallen short” of expectations.

MAS has expressed that they will “take the commensurate supervisory actions against DBS after gathering the necessary facts.”

CEO Piyush Gupta also apologised for the disruption, saying that the bank was “disappointed” that the disruption occurred.

Of course, some users on Facebook did not accept the bank’s apologies, and one lambasted Mr Gupta in a passionately-worded paragraph for giving “too much excuses”.