Lest you were in outer space, you’re probably aware that Chinese New Year is around the corner.

And you know what that means? Lots and lots of bak kwa…

… and hong baos too of course.

Of course, having a house visit restriction means it might be hard to give and receive red packets.

Which is why this year, people have been encouraged to use the digital alternative: e-hongbaos!

So here are 10 facts about the online red packet that you may or may not have known.

Concept Introduced By Tencent

The concept of it might not be as new as you think.

It was first introduced by Tencent, added as a function inside their messaging app WeChat in 2014.

For those who don’t know, WeChat is China’s most popular messaging app.

This new red packet function allowed users to directly transfer to each other.

Alternatively, users could send money to a group of people and the app would divide the cash among them.

Became Preferred Choice In China

The popularity of this function soared extremely quickly.

During CNY in 2017, over 46 billion e-hongbaos were sent over WeChat.

This was calculated from 27 Jan to 1 Feb that year.

And in 2019, over 820 million were sent over WeChat within China alone.

In fact, a survey done showed that the majority of people in mainland China would choose the cashless method over the classic physical one.

Was Not A Popular Choice In SEA

However, the same survey showed that this was not the case elsewhere.

In 2018, 98% of those surveyed in Malaysia and Singapore said that they would still prefer the traditional way instead of online.

Though I guess that number might change this year, seeing as we don’t have much of a choice.

Sees More Popularity From Younger Audience

Still, there is still a group that saw the use of e-payments more.

Particularly, the Millenials.

A UOB spokesman said that in the last two years, PayNow transactions during the festive season were mostly done by those between 21 to 40 years old.

He also foresees older generations picking up this method due to social distancing gatherings restrictions.

Tencent Sued A Company Regarding E-HongBaos

Not everything was smooth sailing for the concept’s originator as well.

in 2019, Tencent had to sue a company that allowed for the “snatching” of e-hongbaos without being logged in to WeChat.

Normally users had to manually tap the item, and only then would it activate communications on the app.

However, Tencent said that this app would allow users to be off the app while still grabbing the e-hongbao, reducing user activity.

They also alleged that this other app illegally checked on users chat records and fund circulation.

Can Help To Save The Environment

This one might be a no-brainer to some, especially since no physical red packet or money is being used.

The question is how exactly we are saving the environment.

The Monetary Authority of Singapore (MAS) estimates that every year, 330 tonnes of carbon emissions are produced from making new notes during the season.

According to the MAS assistant director, this is the same emission as charging 5.7 million smartphones, and the central bank is encouraging us to use e-hongbao instead to save the environment.

All Major Banks To Offer E-HongBaos By Next Month

Though e-hongbaos aren’t available for all banks currently, most major banks (i.e. the big banks in Singapore) should offer this service come February, The Straits Times reported.

The process is said to largely rely on the use of PayNow.

Using your mobile banking app, you would be able to use the e-hongbao option when available.

Input the recipient’s NRIC or phone number along with the amount you want to give.

Sending a message is optional, as well as customising designs or animations before sending.

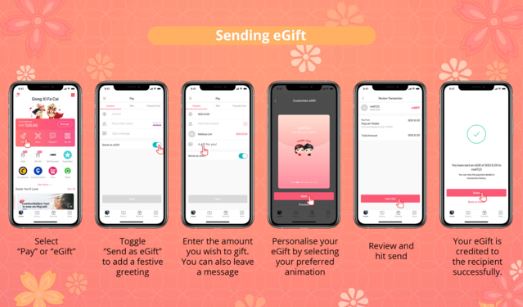

DBS Has An Option From PayLah!

DBS has a very easy method of sending an e-hongbao using the PayLah! app, and you can even personalise your e-hongbao.

Firstly, open up the app and select the ‘Pay’ or ‘eGift’ option. If you select the former than you have to make sure to toggle the eGift option on.

Next, enter the amount you want to give as well as who can receive it. You can even leave a message below as well.

Personalised animations can also be selected and the app will then prompt you to review all details one more time.

Hit send and unless you’re blur and hit the wrong number, your recipient should get the e-gift in seconds.

A ‘Physical’ E-Hongbao Option

I know it sounds like an oxymoron, but hear me out.

There’s actually an alternative version to the e-hongbao, while still having a physical feel to the whole process.

And this is done through the form of a QR gift card.

These cards are now available for free at DBS and POSB outlets.

Inside your DBS PayLah! app, you can scan the card and load money from your PayLah! wallet into the QR code.

You can even scan up to 10 cards at once, between S$0.01 and S$999 with each scanned card.

After customising your message and animation, review and confirm the transaction.

PayLah! recipients of the gift code just have to scan the QR code and open the gift. Kind of like a gift card.

You can read up more information here.

But…

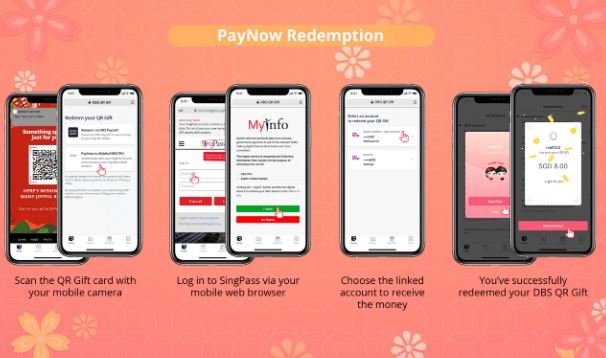

Receiving Gift Cards Without PayLah!

So your friend very nicely sends you a gift card and you happily go to scan it…

…only to realise you don’t have the PayLah! app.

Luckily, there are still methods for you to receive it as DBS has stated that you can still receive the gift card using PayNow, which is available for all banks.

Just scan the QR Gift card with your phone’s camera or any generic Qr scanner.

You can then authenticate yourself with SingPass and send the money to your account.

And if you don’t have PayNow, you should really register for one because living in 1995 isn’t really a good way to avoid COVID-19.

To know more about physical hong baos, you might want to watch this video to the end (and subscribe to our YouTube channel for more informative videos!):

Featured Image: DBS

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: