If you’ve been trying to forget about the goods and services tax (GST) increasing to 9%, I have bad news for you.

On 31 December and 1 January, petrol stations run by Esso Singapore and Shell will be closed for about an hour.

This move is to allow their systems to be updated to reflect the new GST rate.

What a lovely present for the new year.

Petrol Stations Run by Esso Singapore and Shell to be Closed

In a Facebook post on 29 December, Esso Singapore announced the one-hour closure.

Esso Singapore said that Esso stations will be temporarily closed in batches from 31 December 2023, 11:30 pm to 1 January 2024, 1:30 am.

It added that onsite posters will be displayed to help the public identify nearby Esso stations.

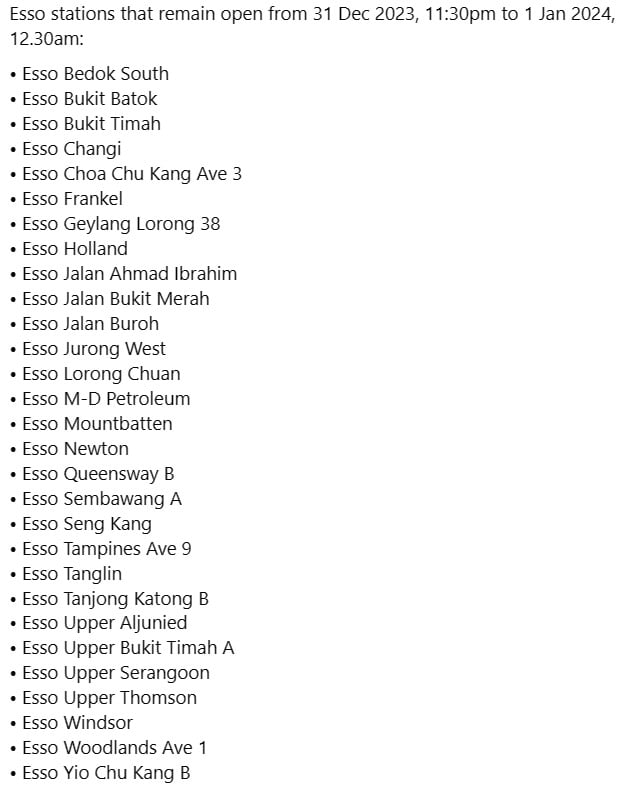

About 29 stations will remain open from 11:30 pm to 12:30 am:

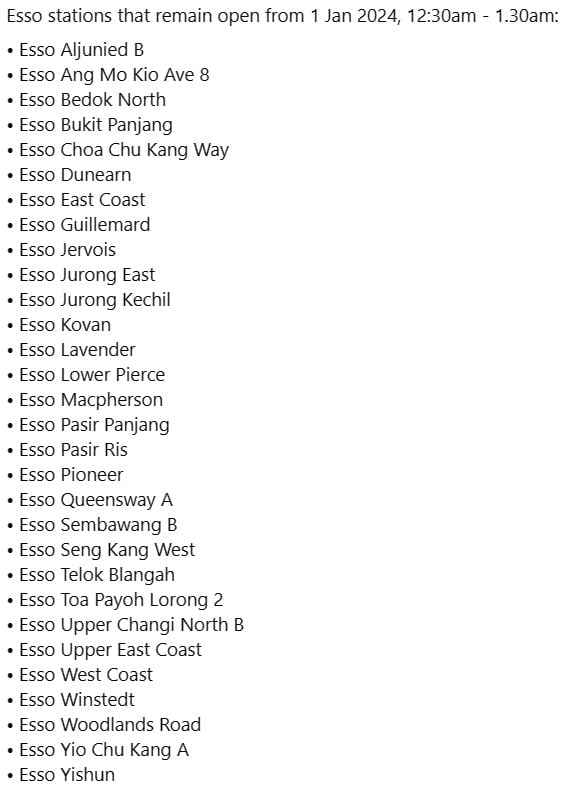

In addition, 30 Esso stations will remain open from 12:30 am to 1:30 am on 1 January 2024:

On 27 December, Shell posted a similar post on its Facebook page.

The post read, “To facilitate system changes on the GST increase, please note all Shell stations will be temporarily closed from 31 December 2023, 11:30 pm to 1 January 2024, 12:20 am.”

Notably, Shell Recharge will remain operational, so electric vehicle (EV) drivers can charge their EVs as usual.

Shell added, “We apologise for the inconvenience caused. Thank you for your patience and understanding.”

More About the GST Increase

In 2022, it was announced that the GST rate would increase from 7% to 9% in two stages.

The GST rate increased from 7% to 8% on 1 January 2023.

On 1 January 2024, the GST rate will increase from 8% to 9%.

Advertisements

It feels like it was just yesterday that Singaporeans were complaining about the GST rate increase from 7% to 8%.

Singapore first announced its plans to increase the GST rate from 7% to 9% in 2018.

However, this was delayed due to the COVID-19 pandemic.

While it is sad that Singaporeans have to pay more tax, there are reasons as to why the GST rate must increase.

Due to Singapore’s ageing population, healthcare expenditure will rise significantly.

Advertisements

The GST hike will aid Singapore in planning for its future.

It will also allow Singapore to provide accessible and high-quality childcare and early childhood education.

In addition, Singapore now faces more threats than before.

From terrorism to cyber attacks, the GST hike would ensure Singapore can invest more in security to keep the country safe.

What Companies are Doing to Help

To cushion the GST hike, some supermarkets will be absorbing it for most items.

For instance, Sheng Shiong will have discounts on essentials for three months.

Advertisements

NTUC FairPrice will also absorb the GST hike on 500 essential items in early 2024.

Giant will also absorb the GST hike for over 700 essential items for the first six months of 2024.

DFI Retail Group, which manages Giant, announced the news on 26 December.

The group added that the move would help Singaporeans mitigate the rising cost of living.

IKEA Singapore will also absorb the GST hike to ensure that its home furnishing “remains affordable to the many people in Singapore amidst rising living costs”.

Advertisements

In addition, the company pledged to maintain its prices on items.

IKEA Singapore previously promised to reduce the prices of more than 60 articles by 1 April 2024.

Read Also:

- You Can Soon See “Northern Lights” in Gardens by the Bay & It’s Free

- Everything About the Eta Aquarids Meteor Shower That’ll Be in S’pore Sky in May

- S’porean Killed in Spain Had Bought Insurance Policy from Suspect

- Everything About the 15YO Who Lived in a Circuit Road Market Stall

- Walk-Ins for Some Traffic-Related Service in TP Be Discontinued & People Have Book Appointments Instead

- Certain Parts of Telok Blangah Hill Park to be Closed for 2 Years After Slope Failure

Advertisements