Singapore Family Loses $150,000 Life Savings in E-commerce Scam Triggered by Deceptive Online Egg Purchase

The year 2023 has unfortunately witnessed numerous Singaporeans falling prey to various scams, including the infamous WhatsApp Web scam and rental scams. These scams had inflicted a staggering loss of S$606,000 and S$1.8 million respectively, on unsuspecting victims.

Regrettably, another family has now become the latest casualty of an e-commerce scam.

The Singh family had lost their entire life savings of S$150,000.

As usual, it all started from a Facebook advertisement (again).

The Scam Took Place through the Purchase of Eggs

The incident took place on 26 November 2023 when Mr Singh’s wife stumbled upon a Facebook advertisement selling organic eggs.

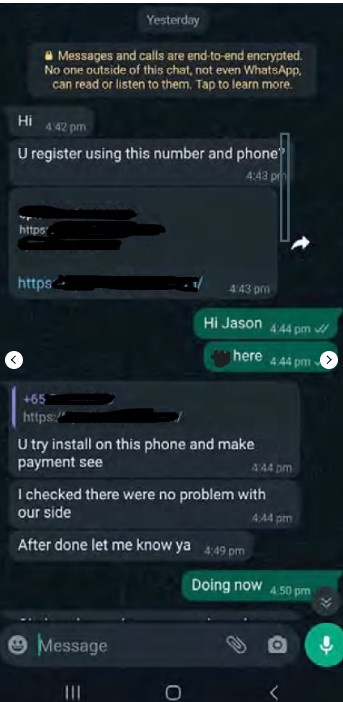

Mr and Mrs Singh decided to place an order for these eggs, which led them into a WhatsApp conversation with a seller named “Jason.” Jason requested a deposit via a mobile app, assuring them that the remaining amount could be paid upon delivery.

Following Jason’s instructions, Mr Singh installed the app and placed an order of 60 eggs. When he was placing the deposit, he was directed to a payment page resembling UOB.

Mr Singh noticed that the transaction failed after he entered his UOB account login details. He promptly contacted Jason to report the problem and attempted to cancel the order. Surprisingly, Jason insisted on continuing with the delivery, assuring Mr Singh that the eggs would arrive the following day.

However, the promised eggs did not arrive never arrived.

Instead, Mr Singh received an unexpected call from a UOB customer service officer who questioned a substantial credit card transaction which Mr Singh denied.

After the call, he checked his UOB and DBS bank accounts and found that all his funds were diminished. Speaking to CNA, he described the overwhelming shock he experienced, as both he and his wife trembled during their visit to the police station.

The Aftermath of the Scam

The family had reached out to the banks involved.

Mr Singh uncovered a series of outgoing transactions totaling S$15,000 from his UOB account, while his DBS account suffered a loss of approximately S$30,000.

In total, he lost $150,000 across four bank accounts and a credit card.

What struck him as particularly unusual was the alleged absence of any notifications or alerts regarding these transactions.

He believed that the banks should shoulder at least some responsibility, considering his unawareness of the scam, and that they should have detected and halted the fraudulent activities.

The impact of this scam extended beyond financial loss. Mrs Singh fell into depression after the incident and was referred to a psychiatrist. Tragically, the family’s original intention was to use their savings for their children’s university fees, the medical expenses of their 81-year-old grandmother, their housing loan, and retirement planning.

However, they now find themselves in dire financial straits, borrowing money from relatives to cope with their predicament. Even their loyal domestic helper of 16 years offered her ATM card to assist with groceries as a testament to their unfortunate circumstances.

The Banks’ Response

Both DBS and UOB are aware of the case and were in contact with Mr Singh.

When responding to CNA, A UOB spokesperson emphasized their commitment to protecting customers and outlined the various security controls and measures in place. They also stressed the importance of customer vigilance in preventing falling victim to scams.

Similarly, DBS stated that they assess the circumstances of victims and offer goodwill payouts on a case-by-case basis. Additionally, they partner with counselling centres to provide emotional support to victims.

Police Advisory Against Malware Scams

The police have issued advisories to guard against malware scams, which have been prevalent in the first half of 2023. Similar to Mr Singh’s case, in this variant of scam, victims encounter advertisements for various services on social media platforms, such as food purchases and home cleaning.

The scammers send victims a URL to download an Android Package Kit (APK) file or an app for Android’s operating system. After downloading, victims are instructed to make a PayNow transfer of $5 as a deposit, which ultimately results in the theft of their internet banking credentials and unauthorized transactions. A factory reset is then initiated on the victim’s phone.

The victims would only discover the unauthorised transactions after calling the bank or by downloading the banking apps again.

To prevent falling victim to such scams, the police recommended precautionary measures such as downloading the ScamShield app and implementing security features like the two-factor authentication for banks. They also advise members of the public to install applications from official app stores and avoid downloading unknown apps.

Or…you can also consider using an iPhone instead of an Android.