Flash Coffee’s Sudden Closure in Singapore Leaves $14.9M Debt to Creditors

Flash Coffee in Singapore literally disappeared in a flash last month, leaving employees uncertain about the recovery of their unpaid salaries.

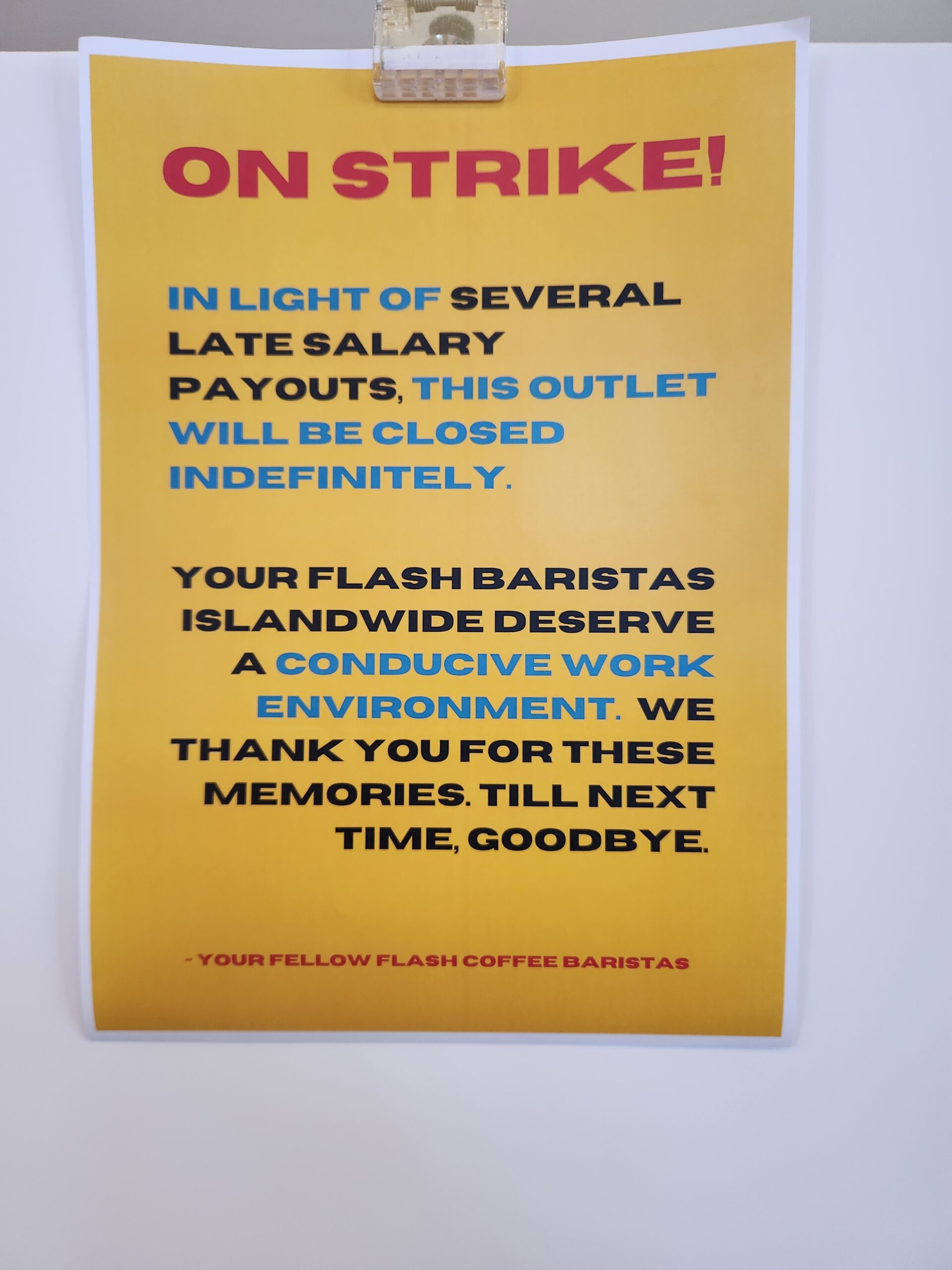

On 12 Oct, several posters, seemingly from Flash Coffee employees, appeared islandwide, indicating a strike.

These posters expressed frustration over delayed salary payments with messages like “In light of several late salary payouts, this outlet will be closed indefinitely.”

Contrary to the appearance of a strike, Flash Coffee clarified that employees were “not required to report to work” due to the company winding up a day earlier.

The Business Times, after examining the filings, reports that founders David Brunier and Sebastian Hannecker attributed the shutdown to “reason of liabilities.”

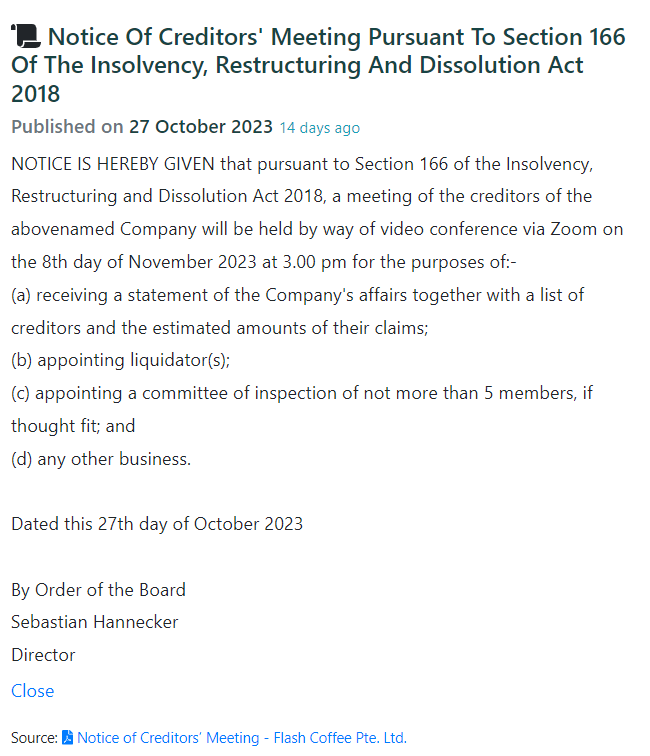

Subsequently, Flash Coffee entered provisional liquidation, appointing BDO Advisory as its liquidator.

120 Creditors, $14.9 Million in Debt

BDO Advisory disclosed to The Straits Times that Flash Coffee owes a staggering $14.9 million to 120 creditors.

Among these, the largest debt is to Digital Services SG Four, Flash Coffee’s holding company incorporated in 2019, amounting to $13.4 million.

Flash Coffee, once known for its rapid expansion across Singapore, now faces substantial debts to landlords of its former outlets in prominent shopping malls including Jurong Point and Orchard Gateway, ranging from $80,000 to $140,000.

Additionally, the company owes over $300,000 to employees for more than two months of unpaid salaries and other contractual benefits.

Just imagine how much salary is owed if a part-timer at Flash Coffee gets paid $10/h.

Creditors to Rely on Committee of Inspection

At a creditors’ meeting held online on 8 Nov, 34 creditors, including 18 former employees, gathered.

They were informed about the estimated assets and liabilities and participated in forming a Committee of Inspection to oversee the liquidation process, aiming to maximise recoveries for all stakeholders.

Flash Coffee’s main assets include bank accounts, equipment like coffee machines and fridges, and receivables from debtors.

BDO Advisory is currently securing assets stored with third parties, planning to sell them after consultations with the Committee of Inspection.

Flash Coffee Just Raised US$50 Million in May 2023

Founded by former foodpanda CMO David Brunier and ex-Bain and Company executive Sebastian Hannecker in 2020, Flash Coffee gained popularity for offering premium coffee at affordable prices.

Operating in several Asian countries, Flash Coffee raised significant funds in 2022 and 2023, earmarked primarily for expansion in Indonesia.

This includes US$32.8 million (S$44.8 million) raised in the first close of its series B funding round in July 2022.

And in May 2023, Flash Coffee raised US$50 million (S$68.5 million) in an extended Series B round of venture funding.

Despite the challenges in Singapore, Flash Coffee has reported profitability in its 92 stores in Indonesia.

David Brunier told Singapore-Jakarta-based news, Tech in Asia, “With 100% of our 92 stores in Indonesia being profitable, we have found a solid product-market fit and are eager to expand our presence into additional cities in Indonesia to further drive sustainable growth.”

The company’s success in other Southeast Asian markets raises the question of whether these funds could be utilised to settle outstanding debts in Singapore.

Find out more about the Flash Coffee saga here:

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: