Singapore has one of the world’s best public transport systems, but until the gahmen builds an MRT station directly outside our door, we’ll still want a car.

Why?

Because there’ll always be a comfy seat available and no uncles will demand to get into your car without a mask.

The only problem is that cars in Singapore, to put it mildly, are bloody expensive.

Here are a few Hollywood celebrities struggling to keep their jaws from meeting the floor when they hear some local car prices:

But telling you that cars in Singapore are expensive is like telling our BFF that she has drunk too many bubble teas; it’s not exactly news.

But did you know that owning a car on this tiny island can be just as expensive as buying one?

Here are some hidden costs of car ownership that first-time buyers may not be aware of:

Finding an Affordable Car isn’t Simple

Since new cars are so costly, many Singaporeans opt for second-hand cars instead. But it’s not like second-hand cars are cheap either; most people who visit these dealerships expecting to find a reasonably-priced car usually end up running away clutching their wallets and purses.

That’s why some customers go for the cheapest car in the lot, especially if it looks like it won’t explode or break apart after a few trips.

So, you pay the deposit and go home with countless images of your “new car”, and post it repeatedly on Instagram because everyone needs to know this.

A few days later, you realise you need to pay more for what you’ve set aside for.

There’s a Road Tax which you thought is paid for by the Government instead of you.

And there’s something known as a “basic car insurance coverage” that cost even more than your monthly instalment.

Your dealer then slowly reveal all the other costs to you, because hey: you’ve already paid your deposit, so it’s time to take off the mask (figuratively; please don’t do that if you’re a dealer if not your commission will be used to pay a fine instead) and list down the real costs.

Parking / ERP / Road Tax

Sadly, not every day is Sunday, and parking is rather expensive.

Even if you’ve purchased season parking, drivers can spend up to $200 a month on parking fees, as charges at malls and in the city are not exactly low.

And if you have to pass through one of those much-detested blue-and-white gantries daily on your way to work, this could go up to $250.

Taking into account ERP charges and the Road Tax fee, you might have to shell out $300 a month.

Maintenance/Servicing

Unless you want your shiny new car to quickly turn into a pile of junk, you’re going to have to make an effort to maintain it.

And this doesn’t just mean washing it every week.

Besides changing your oil, consumables such as tires and brake pads have to be replaced when they’re worn down, which can be every year or so, depending on how much you drive.

And since city drivers will use their brake pads more than those living in rural areas, these pads will wear out even faster.

As a result, some drivers may have to pay up to $2,000 a year just to keep their car running smoothly. If you’re driving an old car, that could be more.

Minor Accidents/Summons

Even if you’re the safest, most conscientious driver in the world, you will eventually get a parking ticket.

You’ll probably also get into a couple of minor accidents.

Speaking from experience, as someone who thought they were a good driver but then backed into a fire hydrant one day, this is an unavoidable part of driving a car.

And then you’ll have to visit that mechanic again, who by now looks to you as his main source of income.

You’ll also become more aware of Traffic Police officers, magical creatures who appear out of nowhere when you park your car along a yellow-lined road for 5 seconds.

If you’re a particularly unlucky driver, this could amount to a few hundred bucks a month. Even if you’ve got comprehensive car insurance, you’d still need to pay the excess if you’re involved in an at-fault accident.

Petrol

Yes, you were already aware that your car wasn’t going to run on your love for it, but did you know that city drivers typically pay more for fuel?

That’s because of all the traffic lights and jams, which increase your car’s fuel consumption.

After all, as Informed Infrastructure says, “the engine is running but you are going nowhere.”

On average, the fuel for a Toyota Corolla Altis would cost you around $2,400 a year, which amounts to $200 a month. If you live in Pasir Ris and work in Tuas, then expect the amount to double.

Car Insurance

This… this is the real killer.

Do you need car insurance? Yes.

For those who don’t know, the government has made it mandatory for motorists to purchase motor insurance.

And depending on your car, profile, and driving experience, it can be less than $1,000 or more than $4,000 a year.

New drivers usually have to pay a higher premium, and if they buy a lavish car, this can go up to $5,000 a year.

If, for example, you’re paying a monthly instalment of $400 for your car, and your insurance is $5,000 a year, this means that you’re paying more for insurance than your actual car.

Since there’s no fixed price on insurance premiums, and because it’s impossible to estimate, we often have to hire agents to get quotations from different insurers.

Some drivers also get these quotations from their dealers, though this may not be the best strategy as dealers have their own contacts and may earn a commission from it.

This means they may not actually choose the best car insurance deals out there, but those who offer the highest commission instead.

This is why choosing an insurer for your beloved car is a tougher task than many new owners anticipate.

But what if I told you there’s a website out there that could calculate the cheapest and most suitable insurance premium for you in seconds, and you can buy car insurance online?

How to Choose Car Insurance with GoBear

Originally launched in 2015 as a metasearch engine, GoBear is now the go-to comparison site for complex financial products like car insurance, health, travel, and loans.

In other words, a car insurance comparison platform.

With GoBear, there’s no need for agents or underhanded dealers when you get your car insurance quotes because they’ll do all the important calculations for you.

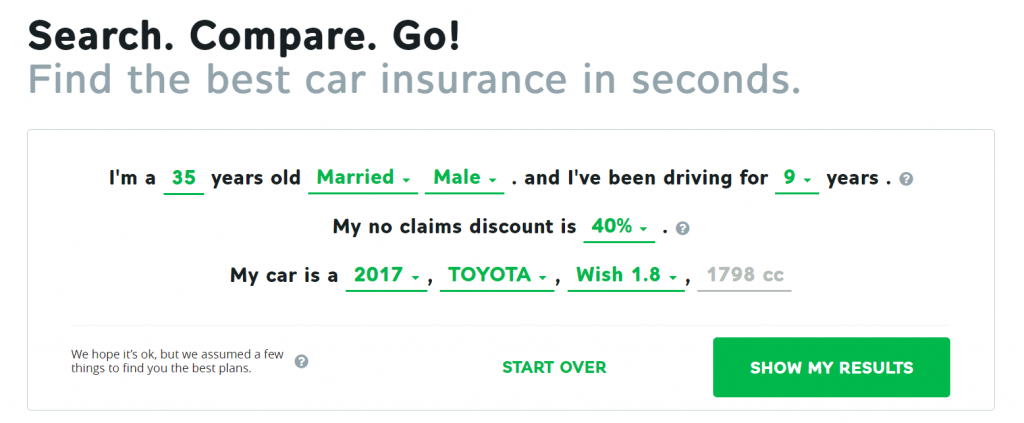

All you have to do is head to GoBears’ website and enter your particulars such as your age, driving experience, and car model.

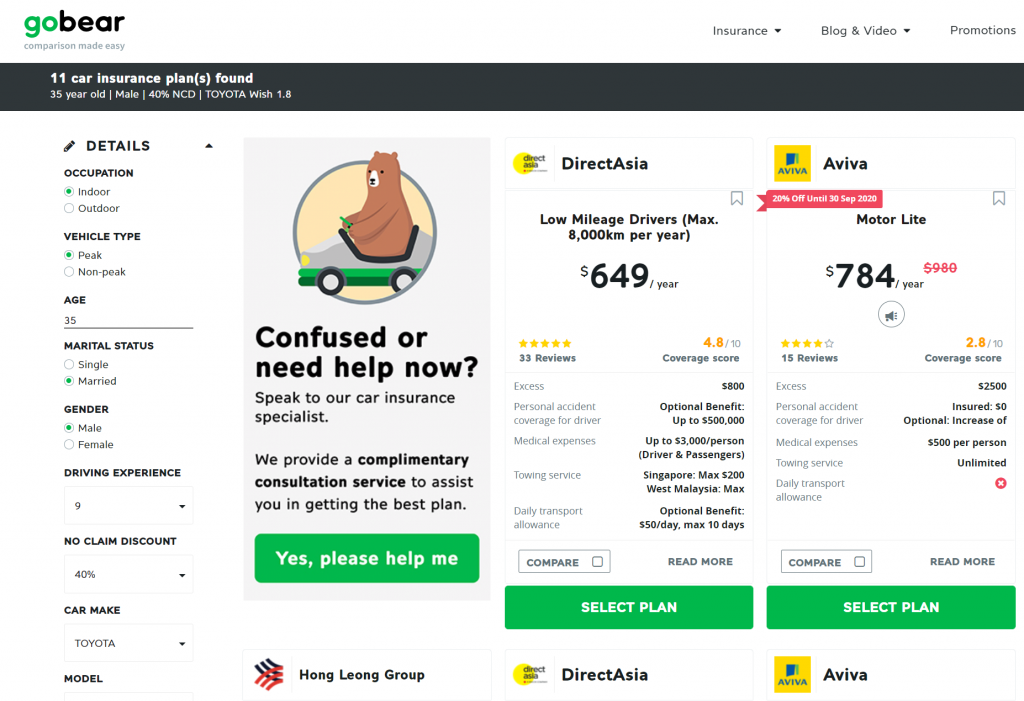

Seconds later, GoBear will show you the cheapest premiums available for your vehicle!

If you’re a confused bear and wonder if you should get a comprehensive or third party car insurance, they even have a free consultation service to assist you as well.

And that’s not all.

In each plan that’s displayed, GoBear will also list things like the excess, personal accident coverage, as well as the medical expenses covered.

But you can’t be sure that a product is good unless others have used it too, right?

That’s why GoBear includes reviews and even a coverage score from previous users, to let you know which insurer is most popular with motorists.

So, why spend money on agents when you can get access to the best and cheapest insurance premiums for free?

Owning a car in Singapore is expensive enough. Don’t end up paying more for insurance just because you didn’t have all the necessary information!

This article was first published on Goody Feed and written in collaboration with GoBear.