If you’ve already booked your flights to Japan for the upcoming months, you’ll be happy to know that you’re getting excellent value for your money.

Not only will you be escaping the sunny shores of Singapore to immerse yourself in Japan’s autumn or winter seasons, but you’ll also find your wallet significantly heavier.

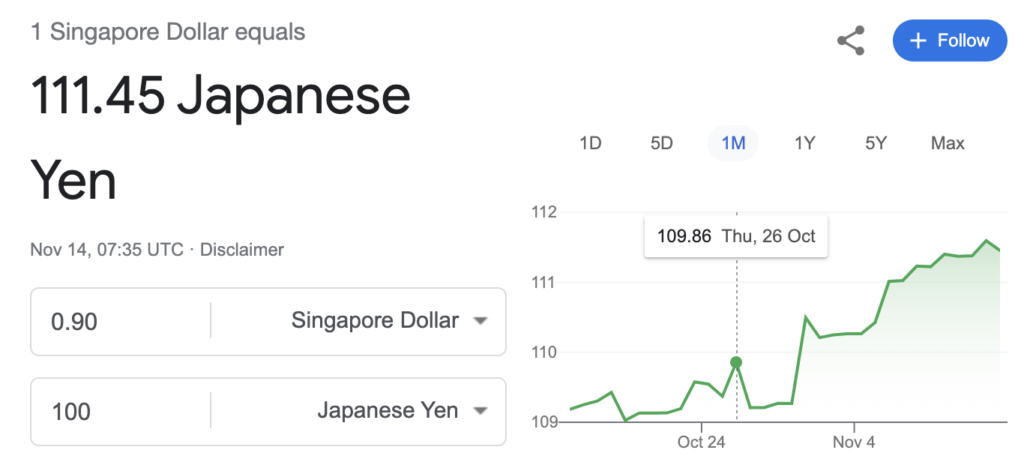

This is because the Japanese Yen is hitting a historic low against the Singapore Dollar, reaching a rate of 111.6 on Monday (13 November 2023).

This is the weakest performance since 2010, according to a report by financial data provider MarketWatch.

According to MarketWatch data, the Japanese currency has reached its lowest point against the US dollar, briefly touching 151.8 on the same day.

Japanese Yen Falls to Historic Low Against SGD

The Japanese Yen has plummeted to an all-time low against the Singapore Dollar.

In simpler terms, this translates to more spending power for your shopping and food budget.

We all know that a trip to Japan often costs thousands of dollars, especially with recent increases in the prices of the Japan Rail Pass and admission tickets for Universal Studios Japan, which now stand at 10,400 yen (S$97.90).

However, with the Yen’s weakening in value, Singaporean tourists have a silver lining of savings to be grateful for.

To put it into perspective, 100 Japanese Yen now roughly equates to about 90 cents in Singapore Dollars.

This means that indulging in your favourite hype beast brands like BAPE, Onitsuka Tiger, and even Uniqlo has become more affordable for us who love returning to basics.

Why Japanese Yen Is Falling

The Japanese Yen currency declined throughout the weekend, a trend further amplified by the recent guidance from the Bank of Japan (BOJ) released last Thursday.

According to this guidance, the BOJ intends to maintain its accommodative monetary policy immediately.

It was revealed that the central bank will closely monitor inflation levels, particularly in light of soaring import prices and expected wage hikes.

The overarching objective of the BOJ is to ensure price stability with an inflation target of approximately 2%, taking into account the expected wage increases starting next year.

Analysts anticipate this trend will continue, keeping the Yens value subdued compared to currencies in markets with stricter monetary policies, such as the United States and Singapore, where the Singapore Dollar can appreciate within a specified range.

Bank of Japan Considers Phasing Out Its Negative-Rate Policy

Reader: What is a negative-rate policy?

A negative-rate policy, also known as a negative interest rate policy (NIRP), is a monetary policy tool employed by central banks to stimulate economic activity in times of economic downturn or low inflation.

And well, Japan is one of the countries that adopt a negative-rate policy. Other countries that employ this are Switzerland, Sweden and Denmark.

If you wonder why, a weaker Yen can make Japanese exports more competitive in international markets, supporting export-oriented industries and potentially increasing demand for Japanese goods and services overseas.

Nonetheless, the summary of opinions from the BOJ’s latest meeting suggests that the central bank is considering phasing out its negative-rate policy eventually.

It recognises the necessity to engage with the market in preparation for a future where interest rates are a reality, keeping the transition from the current monetary policy in mind.

UOB analysts, on the other hand, anticipate that the BOJ will likely remove its negative-rate policy during its January 2024 monetary policy meeting and abandon its control over long-term interest rates in March.

Expected Increase in Tourism in Japan

As the Japanese Yen weakness is predicted to persist until the end of this year, it is also anticipated with a gradual strengthening of the Japanese currency against both the US dollar and the Singapore Dollar in 2024.

During this period, Japan is expected to remain an appealing destination for tourists.

In September, more than two million tourists flocked to Japan, accounting for 96.1% of the volume recorded during the same month in 2019, as the Japan National Tourism Organisation reported in October.

With the Yen currently at its lowest value, tourist spending will likely experience a significant boost.

According to a study by the Japan Tourism Agency, inbound visitors to Japan between 1 July and 30 September spent 1.39 trillion yen, marking a substantial 17.7% increase compared to the same period in 2019.

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: