NFTs, or non-fungible tokens, have been all the rage lately.

Even celebrities are not exempt from the craze—recently, local-born celebrity Lin Jun Jie, better known as JJ Lin, took to Weibo asking fans to help him manage his finances, after losing more than SGD 100,000 in NFT investments.

It seems like there really is an appeal in owning “digital images”.

Suffered 90% Loss

According to the Chinese national securities newspaper China Securities Journal, JJ Lin spent USD 123,000, or around SGD 163,000, on three pieces of virtual real estate on the platform Decentraland.

The current value of his properties amounts only to USD 10,000 now, or SGD 13,300—a whopping loss of more than 91%.

Data from the metaverse analysis platform WeMeta displayed that the median transaction price on Decentraland, the world’s largest metaverse real estate platform, has dropped from USD 45 (SGD 60) to USD 5 (SGD 7), a similar 90% fall in value.

Last year, on 23 November, JJ Lin took to Twitter to show off his purchases, which consisted of virtual plots of land—Prime Gallery 1, Prime Gallery 2, and NEAREST to GENESIS PLAZA, hosted on Decentraland.

from apes to punks to metaverse land… who’s with me?#metaverse #nft pic.twitter.com/1ucyJkxU6B

— JJ Lin (@JJ_Lin) November 23, 2021

He purchased these on the NFT marketplace OpenSea, for 6000 MANA (Decentraland’s virtual currency) per piece, around SGD 41,000 in real-world money.

On Decentraland’s site plan, each pixel supposedly measures 52.5 square feet, so JJ Lin paid around $781 per square foot, $200 higher than the average HDB price of $507 per square foot.

The Land He Owns

Here’s a picture of one of his virtual plots, taken off the website Decentraland.

This one is NEAREST to GENESIS PLAZA, which cost him $41,000. Just like in real life, JJ Lin can refurbish and decorate the land he owns however he pleases, and even resell it on markets like OpenSea.

He’s chosen to decorate this plot of land with a portrait of an ape, a common motif amongst NFTs, and a huge wall painting of a man with elf-like ears, surrounded by sparse greenery.

His other plots of land, Prime Gallery 1 and 2, are adjacent to each other, and decorated with elements found in Super Mario Games, like a Thwomp and a few Piranha Plants.

His property-buying enthusiasm extends to real life too—in August 2021, JJ Lin spent a hefty sum of S$18.9 million on two apartments in Taiwan, where he’s primarily based.

In Singapore, he reportedly stays at the condominium OUE Twin Peaks, where units are sold for up to S$5.6 million.

Advertisements

Whether virtual or real, most of the properties he owns are simply unattainable to common folk like us.

NFTs: What’s the Appeal?

JJ Lin is actually an ardent NFT purchaser—on 8 November, he purchased a rare CryptoPunk NFT using 125 Ethereum, a blockchain (or cryptocurrency) that costs around S$2,400 for 1 ETH.

As of today, 125 ETH is worth S$311,000. At the time of his purchase, 125 ETH was worth S$761,000—more than enough to buy two BTOs.

But why are NFTs such a fad, even? Although they’re dubbed “digital pngs” by many, NFTs are still so prized because they’re immutable on the blockchain, which means their security is guaranteed because their data cannot be manipulated, altered, or removed.

Supposedly, they’re also rare. The NFT that JJ Lin bought, a Cryptopunk, only has 10,000 of it in circulation, making staking a claim to one feel like a badge of honour.

Advertisements

Not everyone agrees with these sentiments, though. Mark Cuban, a billionaire entrepreneur, once famously said that buying real estate in the metaverse is the “dumbest sh*t ever”.

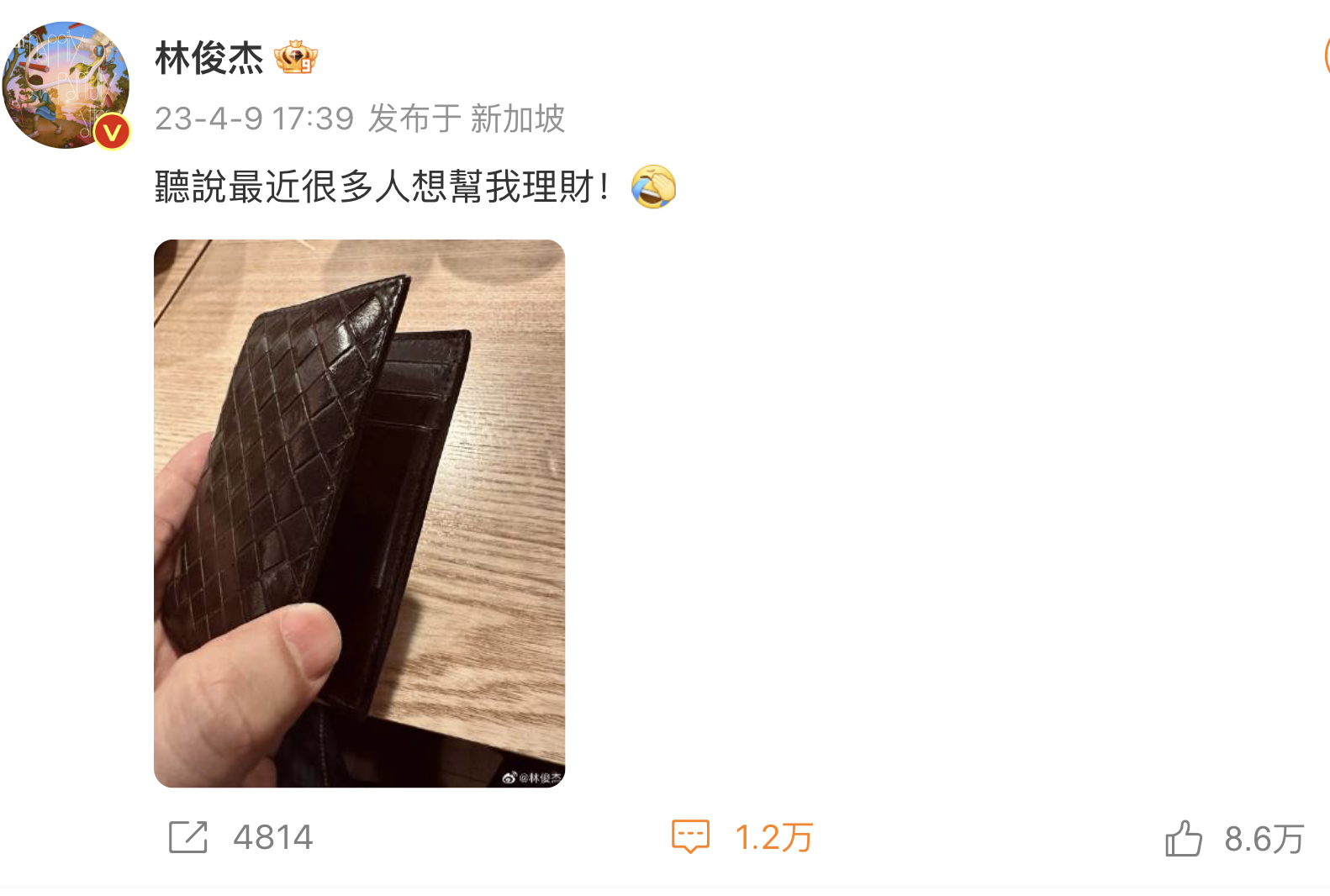

Maybe even JJ Lin is self-aware—on 9 April, he posted a picture of an empty wallet on Chinese social media platform Weibo, jokingly captioning it “I heard many people want to help me manage my finances”.

The post has since garnered more than 86,000 likes, with commenters mostly laughing at his “predicament”.

If you have enough money to spare, though, no one’s really stopping you from spending it all on these “digital pngs”.

Read Also:

- You Can Soon See “Northern Lights” in Gardens by the Bay & It’s Free

- Everything About the Eta Aquarids Meteor Shower That’ll Be in S’pore Sky in May

- S’porean Killed in Spain Had Bought Insurance Policy from Suspect

- Everything About the 15YO Who Lived in a Circuit Road Market Stall

- Walk-Ins for Some Traffic-Related Service in TP Be Discontinued & People Have Book Appointments Instead

- Certain Parts of Telok Blangah Hill Park to be Closed for 2 Years After Slope Failure

Advertisements