Many of those whose businesses have been affected by COVID-19 would be familiar with the Jobs Support Scheme (JSS).

It was introduced at the Unity Budget in February 2020 as a way to support employers and help them retain local employees. This also served as a way to ensure that the jobs of local employees are protected.

Well, to struggling employers out there, I’ve got great news for you.

From 30 September onwards, more than $900 million will be disbursed to over 43,900 employers under the JSS. This amount will be used to help support the salaries of more than 570,000 local employees.

After this payout, more than $27.6 billion would have been used to benefit employers and employees in Singapore.

September and Subsequent Payouts

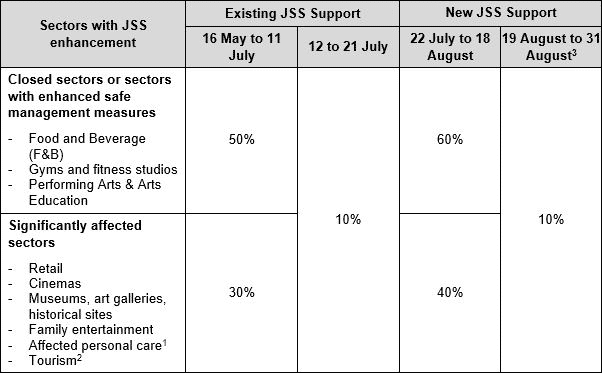

The payout that is disbursed from 30 September will be used to cover the wages that have been paid by employers between April and July 2021, and also to provide some cash flow support to employers.

The amount given will include the enhanced JSS payouts that are supposed to be given for the phase two and three (heightened alert) periods in July and August.

Employers who are curious about how much they would receive during this payout can simply check the amount via their myTax Portal closer to the end of the month.

From there, they will be able to see a digital copy of their JSS scheme letter.

Companies that have existing Giro arrangements with IRAS or have registered for PayNow Corporate by 24 September 2021 will be able to receive the payouts starting from 30 September.

Other companies that do not make such arrangements would have to wait for their cheques to arrive from 15 October onwards.

For those who are eager to know more about the next payout after this September’s, you would be happy to know that it will come in December this year. And this payout will cover the wages that are paid from August onwards.

A Big Help

Evidently, the disbursements by the government have helped many businesses to tide through the pandemic, especially during this period of uncertainty where more cases are emerging each day.

Some companies also shared that despite zero revenue during this period, they did not cut costs by reducing the salaries of their employees.

The JSS payouts were able to fund their employees and support them whilst not taking a toll on the business.

In fact, some of the employees could even be sent to take courses to upgrade their skills and gain more knowledge.

Furthermore, with the government’s establishment of the SGUnited Traineeship Programme, many people benefitted when they were later converted into full-timers.

$23 Million Withheld, 500 Employers Pending Eligibility

In order to prevent anyone from taking advantage of the support that the government is giving to its citizens, the Inland Revenue Authority of Singapore (Iras) is currently reviewing the submissions of 500 employers to determine if they are indeed eligible for the payout.

Iras wants to ensure that all payouts are disbursed fairly and correctly. As such, $23 million in payouts for the 500 employers is still being withheld.

They will take this time to verify the companies’ claims and documents, and their payouts will be given once they are deemed to be eligible.

Should there be any discrepancies found, companies will not only have their application for the payouts denied but they may also be charged under Section 420 of the Penal Code. If convicted, perpetrators may be sentenced to a jail term of 10 years and be fined.

To prevent such cases, the Ministry of Finance (MOF) and IRAS urge employers to make sure that the correct amount of CPF is awarded to employees based on the salaries that they each receive.

Reporting Malpractice

While there are checks and balances to ensure that no one is able to take advantage of the JSS payout, there may be some people who will still try their luck. As such, if you know any individual or business that is conducting such malpractice, you can file a formal report via this website.

The website requires you to log in with your SingPass, but rest assured that your identity and all information will be kept confidential.

Also, if you are an employee and you believe that you are being unfairly treated by your company, you may lodge a complaint directly with the Tripartite Alliance for Fair and Progressive Employment Practices (TAFEP).

Read Also:

- Govt Giving Over S$200 Million in Rental Support Scheme To Eligible Businesses From 22 Sep

- Update To Employer’s WFH Guideline When Employee Tests Positive For COVID-19

Feature Image: Igor Plotnikov / Shutterstock.com

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: