The Singapore Customs and the Immigration and Checkpoints Authority (ICA) recently apprehended 115 travellers at Changi Airport for failing to declare and pay duties and Goods and Services Tax (GST).

The joint-enforcement operation, which took place from 15 to 21 May 2023, involved intensified inspections of inbound travellers at all terminals of Changi Airport.

The arriving passengers’ luggage was thoroughly examined for undeclared dutiable and taxable goods and prohibited or controlled items.

The authorities highlighted several notable cases, including one Singaporean man and his girlfriend who were caught with five luxury bags they had purchased overseas without declaring.

Multiple Travellers Caught With Undeclared Goods During Investigations

In an effort to strengthen border security, joint investigations conducted by Singapore Customs and the ICA implemented enhanced inspections on incoming travellers at the Arrival Halls of all Changi Airport Terminals.

These inspections aimed to identify undeclared goods, such as cigarettes and tobacco products, liquors exceeding duty-free allowances, and taxable items surpassing GST import relief limits.

As a result of these operations, a total of $18,491 worth of duty and GST were successfully recovered, and fines totalling approximately $28,000 were imposed on the individuals found to be in violation of customs regulations.

Among the notable cases, a Singaporean couple was apprehended for failing to declare five luxury bags upon arrival.

The total value of the bags was $13,825, with an associated GST amount of $1,106.

Meanwhile, a Singaporean woman was discovered to possess an undeclared luxury watch and bag valued at $5,637, with an associated GST of $450.96.

Additionally, a male foreigner was found attempting to conceal six packets of cigarettes within a “Happy Birthday” foil wrapper.

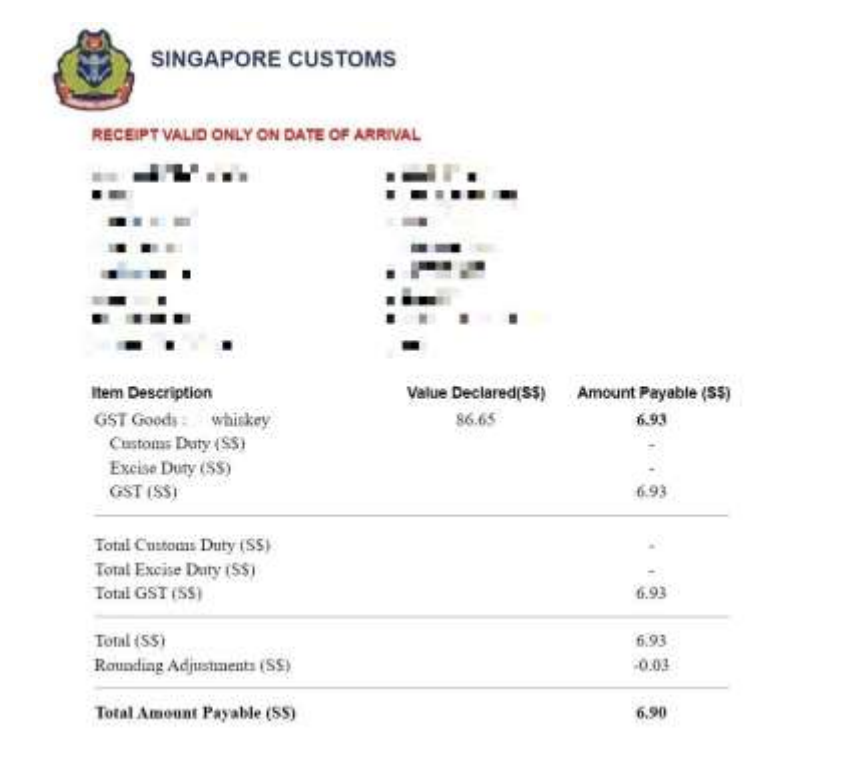

Meanwhile, another incident involved a male employment pass holder who utilised the Customs@SG web application to falsely declare a bottle of whisky as GST goods, evading payment of $15.14 in excise duty.

According to screenshots from the application, the bottle had been wrongly categorised as “GST goods” instead of “dutiable and taxable goods”.

Stricter Regulations Around Undeclared Goods at Customs

Violations of customs duty or excise duty evasion are subject to penalties as outlined in the Customs Act.

Those found guilty of fraudulent evasion or attempts to evade such duties may face fines of up to 20 times the amount of duty, and GST evaded.

Alternatively, they may also be subject to a maximum prison sentence of two years.

Stricter enforcements have been erected against offending travellers due to rising cases of individuals not declaring goods, like when a Singaporean woman was fined $5,500 in 2022 for evading GST charges on several luxury bags.

Ms Sung Pik Wan, Senior Assistant Director-General (Checkpoints) at Singapore Customs, emphasised that local authorities would continue to maintain a zero-tolerance approach towards such illegal activities.

She stated that it’s the responsibility of all arriving travellers to wholly and accurately declare all dutiable and taxable items they possess upon arrival.

Consequently, she shared that the authorities will regularly conduct joint-enforcement operations to protect Singapore’s borders from crime, security threats, and smuggling activities.

No Excuses For Travellers Who Fail To Declare Goods Upon Arrival

To avoid hefty penalties and for convenience, travellers are encouraged to make advance declarations and payments for their dutiable or GST goods up to three days before their arrival.

This can be done through the Customs@SG web application.

Alternatively, those who prefer to pay upon arrival can do so at the Customs Tax Payment Office located at various checkpoints.

Meanwhile, Ms Sung stressed that travellers have resources available to them, such as the Customs website and assistance from officers at the checkpoints, to seek guidance on how much duty or tax to declare.

As such, an individual would have no excuse to “not know how much to pay” since they can also contact the Singapore Customs hotline at 6355 2000 or refer to the official website for more information.

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: