Do you have a really soft spot for apps that don’t entirely originate from “official” sources?

Are you a faithful subscriber to OCBC’s bank services?

If you tick both boxes with aplomb, then I’m afraid I have some terrible news for you.

If you haven’t already encountered them, anyway.

OCBC App Now Doesn’t Allow Users to Have Certain Apps That Aren’t from the Official App Store

With OCBC’s latest malware-wary initiative, your days of spamming “pirated” stuff may be over.

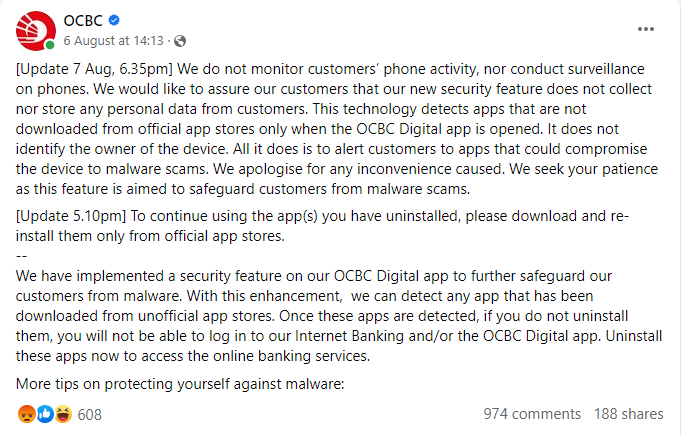

So lest you’re unaware, OCBC rolled out a new security feature a few days ago (on 6 August 2023). With this new update, OCBC users will not be able to log onto their Internet banking and OCBC digital app if they have certain apps from unofficial platforms.

With the feature, OCBC aims to safeguard customers from malware-utilising scammers.

OCBC has, however, clarified that not all unofficial content would be flagged under the initiative.

Only Android apps with risky permission settings, said head of anti-fraud at OCBC group financial crime compliance Beaver Chua, will trigger the alarm.

These permission settings are supposedly security loopholes that could be exploited.

The bank has also stressed that the update would not allow them to see what you’ve been up to on your phone; and that everything’s exclusive to you and you only.

Concerns

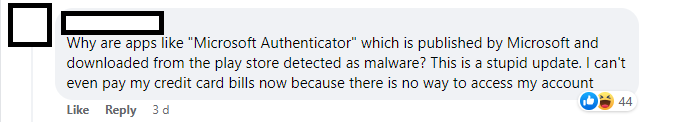

Even though the feature has benign intentions, several disgruntled users have since taken to the bank’s Facebook page to air their annoyance, especially after it was uncovered that the likes of Douyin, Microsoft Authenticator, Alipay and even LG’s appliance control app had been flagged by the warning system.

Meanwhile, apps such as Singapore Pools have purportedly managed to pass the test, even though they were, too, downloaded from a third-party source.

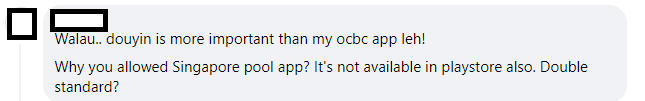

In fact, some were so dissatisfied that they deleted the app altogether.

And some even stated their intentions to close their accounts.

A self-proclaimed cybersecurity personnel has also stepped up with his own misgivings, stating that the approach is “absolutely ridiculous.” He reminded OCBC that even apps that are downloaded from official stores could be ridden with malware, and that some apps can only be procured from third-party platforms.

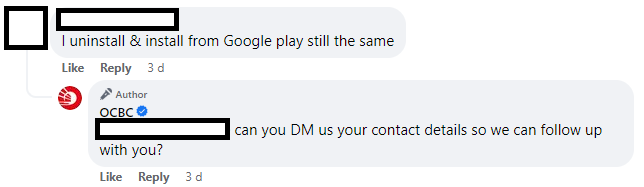

Some Netizens have also questioned why their access is still blocked, even after uninstalling and downloading from the official platform.

It should be noted, however, that some have also shown their appreciation for the feature.

Those who are more elderly, for instance, have lauded the update as a way to assist the less tech-savvy.

Response

Despite the backlash, OCBC has persisted with its stance and uploaded the relevant stats to support its decision.

Before 5 August 2023, the bank reportedly had to deal with at least one malware scam report per day. Since the update, no malware scam reports have emerged. Or at least from those with the updated app.

OCBC has, however, acknowledged that official apps aren’t necessarily safe, but there’s still a lower chance of malware because “there is a review process, in comparison to apps from websites or other unknown sources.”

They also conceded that the security feature is imperfect and that they are still seeking feedback.

Meanwhile, the Monetary Authority of Singapore has approved, stating that such initiatives will help to maintain “confidence in digital banking.”

They, however, also conceded that enhancement will be needed to avoid unintended inconveniences.

The Association of Banks in Singapore (ABS) is reportedly releasing a more potent security feature, and OCBC expects other banks to develop their own measures soon.

Scams

Inconveniences aside, scams are objectively becoming more potent and sophisticated, with rectified grammar usage, more socially acceptable intros and more believable profile pictures. Even their impersonation tactics are advancing.

Just a while back, it was revealed that scammers are now using the Anti Scam Centre as a premise for their ploys.

From the looks of it, the scammer would send you an SMS claiming to be from the Anti Scam Centre. They would ask you to download an anti-scam app that purportedly safeguards your device with its scam identification and prevention capabilities.

You’re prompted to click on a link in the SMS, and once you’ve done so, you’ll be brought to this dodgy ASC-looking site with yet another link. If you choose to download the app, you’ll be asked to permit access to your device.

That’s when the scammer takes control of your phone. Surprise.

Indeed, scams are getting increasingly worrying.

In 2022 alone, scam victims here lost a staggering $660.7 million.

That figure eclipsed the $632 million lost in 2021.

There were also 31,728 scam cases in 2022, up from 23,933 in 2021.

If you wish to learn more about scams, you can either go to www.scamalert.sg or reach the Anti-Scam Helpline at 1800-722-6688.

Alternatively, if you have any relevant scam-related information, you can dial the police at 1800-255-0000 or submit it online at www.police.gov.sg/iwitness.

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: