You’ve worked hard enough to make money; now, it’s time to make your money work for you.

While that sounds like a cliche line from any of the thousand investing books and articles out there, the Singapore government is now making it a reality for Singapore residents with their new platform, SGFinDex.

Here’s what you need to know about it and why it’s such a bigly thingy.

What Is It

The Singapore Financial Data Index, or SGFinDex for short, is a free digital service announced by DPM Heng Swee Keat on 7 Dec 2020.

Basically, what it does is to pull every financial data you have from various different sources all into one page.

Developed by the public sector, the Association of Banks Singapore (ABS) and participating banks, the user is required to log in with his SingPass details and give explicit consent for his financial data to be pooled together.

What Financial Data Are We Talking About

Financial data includes:

- Account balances (both current and savings)

- Credit cards

- Loans

- Investments

Participating Banks

Currently, seven banks are participating in the SGFinDex:

- Citibank

- POSB/DBS

- HSBC

- Maybank

- OCBC Bank

- Standard Chartered Bank

- United Overseas Bank

Government Agencies

Users are also able to pull financial data from 3 government agencies via MyInfo:

- Central Provident Fund (CPF)

- Housing Board (HDB)

- Inland Revenue Authority of Singapore (IRAS)

Basically, this constitutes the three main sources of wealth that every Singaporean has:

- CPF monies

- HDB Loan / Property Value

- Income and Property tax

In the next phase, they are planning to include information on insurance policies and stock holdings at the Central Depository.

How Does This Help

Investment is often thought to be daunting and complicated.

What SGFinDex hopes to achieve, is to make the process of investment and sound financial decisions easier for people in Singapore.

By pulling financial data all into one platform, it gives an individual an overview of his entire financial situation, making it easier to make decisions without overlooking anything.

Digital tools like MyMoneySense can also be used to learn how to better manage your finances with the help of SGFinDex.

In fact, UOB, DBS and OCBC have already made use of the SGFinDex to offer financial planning services like insurance and retirement needs.

Also, by tracking your expenses, it teaches you what are the areas you can try to cut down your expenses on.

How To Use

Currently, there are eight different platforms which you can use SGFinDex on.

The new government financial planning platform, MyMoneySense, as well as the seven participating banks’ mobile app or financial planning website.

Once you log in with your SingPass, you’ll be directed to the SGFinDex page which allows you to choose which accounts to connect to.

Authorise the transfer of data and voila, you’ll be able to see the data displayed on your chosen platform.

Safety

Don’t worry about security as your data will be encrypted during the transfer. Only the website or platform that you’re requesting information on will have the key to decrypt the data.

Currently, there are security measures to safeguard personal data passing through SGFinDex and the infrastructure can only transmit data, and not store them.

Whenever you connect an account on any of the eight platforms, text messages notifying you about the connection will be sent to your mobile number registered with the various institutions.

Authentication and authorisation must always be verified through SingPass and to facilitate data retrieval, the user must explicitly consent every time.

And at any given time, if you want to take away the consent for the transfer of data, you can do so through any of the seven banks’ platforms or through MyMoneySense.

Duration Of Consent

The consent isn’t permanent, so if you forgot about it, your permission will eventually expire.

Currently, the duration of consent is 1 year from the time the first consent is given.

Meaning if you approve of bank A’s authorisation on 1 Jan 2021, and bank B’s on 3 Jun 2021, the permission for both will expire on 31 Dec 2021.

MyMoneySense

As mentioned before, pulling all your financial data into one space is just the first step.

The second step is to make sound financial decisions.

And the newest financial digital platform, MyMoneySense, seeks to do just that.

Developed jointly by the Ministry of Manpower (MOM) and the Government Technology Agency, the service is overseen by the MoneySense council which consists of the Monetary Association of Singapore (MAS), MOM and various government agencies’ representatives.

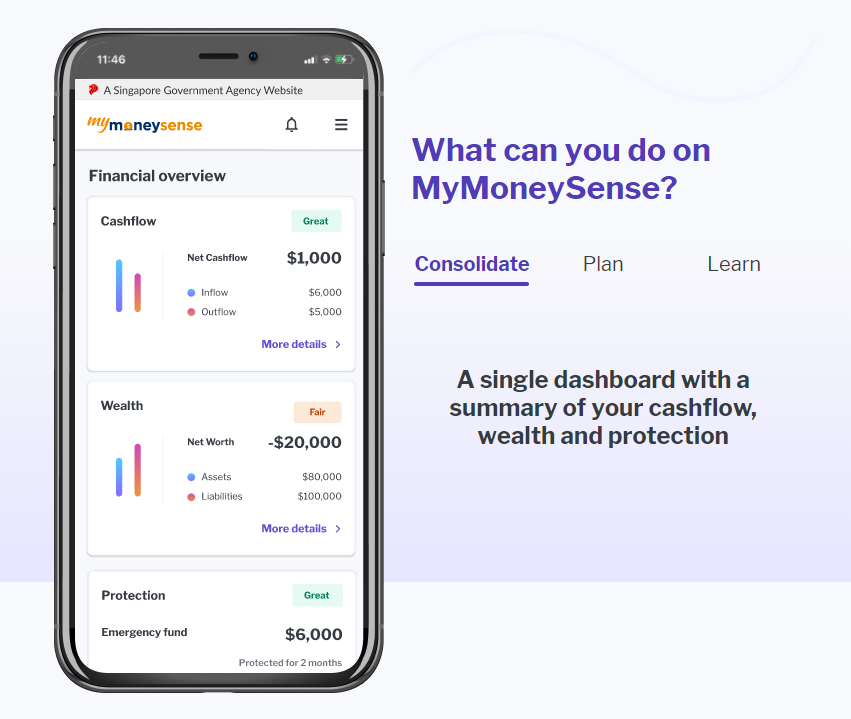

What You Can Do On The Platform

According to the platform’s introduction, it seeks to enable Singaporeans to better understand their finances and encourage them to take action in improving their financial situation.

Here are the three ways you can make use of MyMoneySense:

Overview

The first is, of course, to get an overview of your financial situation.

What assets do you have? How much do you have in each bank? What liabilities are you still paying for? In terms of the balance statement, are you in the red or in the green?

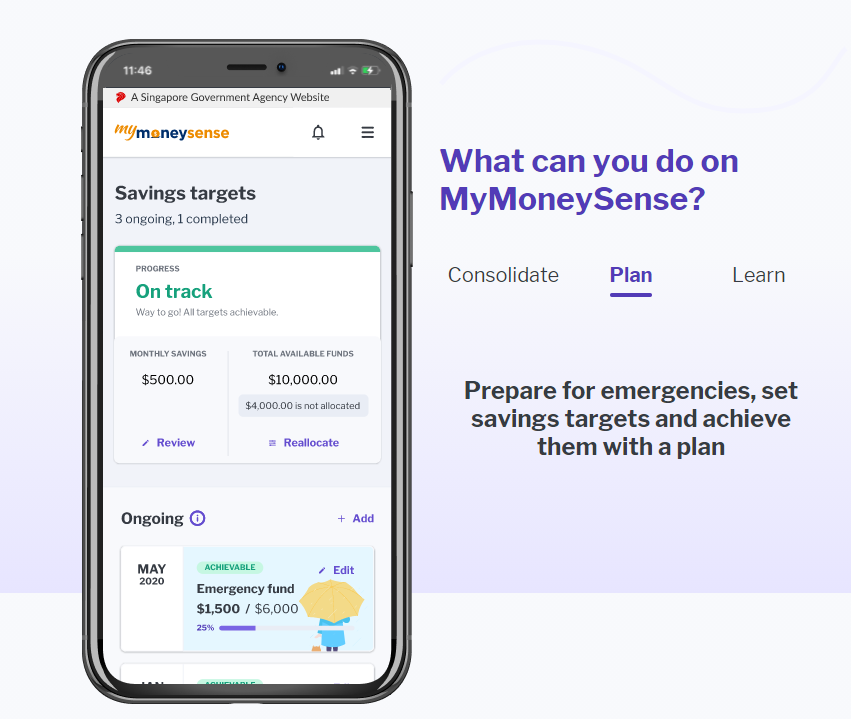

Plan

Think of MyMoneySense as a goal-setting tool.

On the platform, you can input your own financial targets and the platform not only keeps track of your progress but try to motivate you into achieving them.

In other words, your personal cheerleader for your financial journey.

Learn

Now, knowing how much you have and how much you want to get is only part of the equation.

The platform also provides financial lessons and give you simple explanations of financial concepts.

It’s like Goody Feed, just for financial matters.

You can check the platform out for yourself here.

Featured Image: Kenishirotie / Shutterstock.com