Nvidia’s Tech Boom in Singapore: A Billion-Dollar Chip Partnership Unveiled

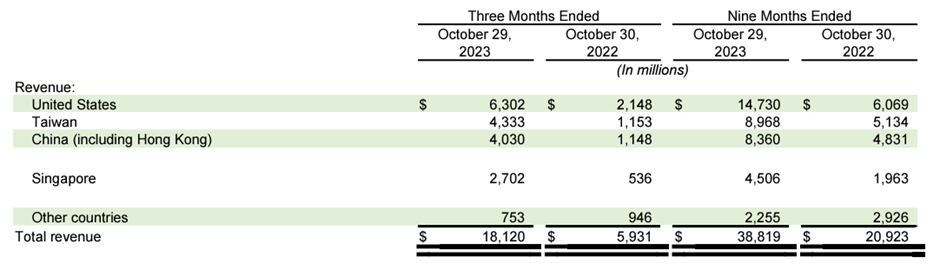

Nvidia, a prominent technology company, recently unveiled its third-quarter results, showcasing a record revenue of US$18.12 billion. This marked a 34% increase from the second quarter and an impressive 206% surge from the previous year.

Observations from industry experts highlighted a noteworthy contributor to this revenue – the small tropical nation of Singapore.

Sales from Singapore alone constituted approximately 15% (US$2.7 billion or S$6 billion) of Nvidia’s total revenue. This figure is nearly four times the revenue generated in the preceding year.

With individual chip prices ranging from a few hundred dollars to over S$15,000, this suggests a sale of anywhere from 200 thousand to potentially a couple of million chips to Singapore.

(Meanwhile, I didn’t even have enough money to buy bubble tea last week… damn…)

Singapore falls in third place behind the United States (34.77%,) Taiwan (23.91%) and China including Hong Kong (22.24%)

The same SEC filing disclosed that 80% of Nvidia’s total sales in the third quarter originated from the data centre segment, with gaming, professional visualisation, automotive, and other sectors constituting the remaining 20%.

Nvidia states, “Cloud service providers accounted for roughly half of the data centre revenue, while consumer internet companies and enterprises comprised approximately the other half.”

What is Nvidia in the First Place?

Nvidia prides itself as the world’s leader in artificial intelligence (AI) computing.

It is a software company that designs graphic processing units (GPUs), application programming interfaces (APIs) for high-performance computing.

Notably, they also manufacture system on a chip units (SoCs) for the mobile computing and automotive market.

(In simpler terms, whether we are talking about automated drones, self-driving cars, supercomputers or even robots, Nvidia most likely has a hand in creating the thingamabob that powers their AI)

According to their website, Nvidia’s work in AI and the metaverse is “transforming the world’s largest industries and profoundly impacting society”.

What does Singapore Want with Nvidia?

When asked about the possible reasons why Singapore has forked over such a significant amount of money on Nvidia chips, Maybank Securities analyst Jarick Seet told CNBC that it is likely because Singapore is home to many data centres and cloud service providers.

Seet also mentioned that these chips may be sent to Singapore for final assembly of electronic products before it is shipped out to other countries.

Sang Shin, former director of digital innovation at Temasek and head of digital strategy and architecture at GIC, quipped in a LinkedIn post, “What’s a tiny city-state doing with all those chips? Building data centres, of course!”

“Because the nation is stable and secure, there is a lot of talent, the digital infrastructure is solid, and the government policies are conducive to digital and data services,” Shin continued.

In January 2022, Singapore lifted a moratorium to allow more land for building data centres after pausing it in 2019 to control their growth.

Subsequently, they gave rights to companies like Equinix, Microsoft, GDS from China, and a partnership between AirTrunk and ByteDance to start new data centre projects.

According to a report by Cushman and Wakefield, Singapore ranked third globally and first in the Asia Pacific region in terms of data centre market rankings.

The top positions were tied between Northern Virginia and Portland USA, while Hong Kong secured the fourth spot.

Another report by the International Trade Administration states that there were over 70 data centres already operating in Singapore as of November 2022, making up 60% of total data centre capacity in Southeast Asia.

The same report predicts that demand for data centres in Singapore will continue to remain high with the fast expansion of digital applications, e-commerce, artificial intelligence, crypto-trading, blockchain activities, online gaming, and more.

More and more businesses shifting to adopt hybrid working arrangements and digitalization has also contributed to the demand for space in data centres.

Looking forward, it seems like Singapore and Nvidia are in for a sweet tech journey together.

With the nation positioning itself as a data hub and technology leader, the future holds promising prospects for Singapore’s continued contributions to the global tech landscape, making it a beacon of innovation in the Asia Pacific region.

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: