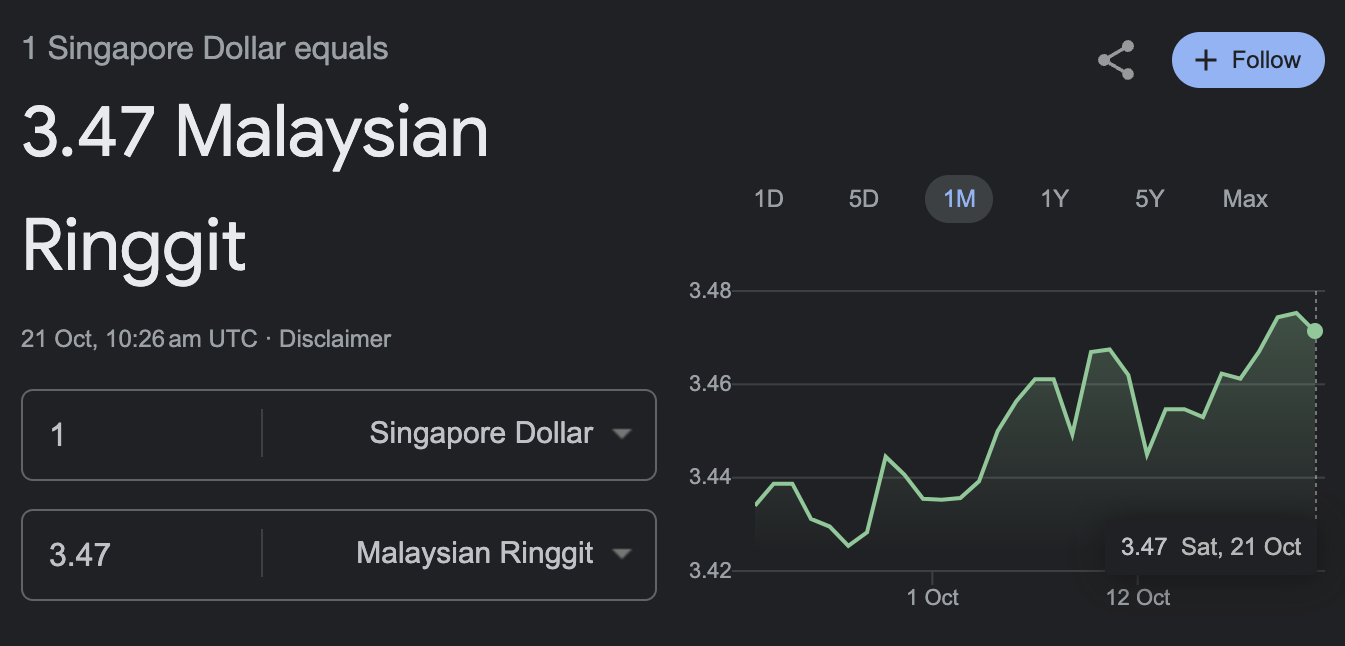

It’s time for another trip to JB—the Singapore dollar is at an all-time high against the Malaysian ringgit.

Currently, it’s at 3.47.

Here’s everything you need to know about it.

Singapore Dollar Now at All-Time High Against Malaysian Ringgit

If you search SGD vs MYR, you’ll see a graph that seems always to be going higher than higher.

And now, it has reached an all-time high. Currently, for S$1, you can get 3.47 ringgit.

Yes, you read that right. Those coins you only bring out when it’s Chinese New Year Blackjack season can be exchanged for that much ringgit.

Yet, the current value isn’t even the highest.

On Friday (20 October), the Singaporean dollar rose as high as 3.4826 against the Malaysian ringgit.

Value Town. In other words, heng, ong, huat!

There’s no need to play Blackjack to get your extra lunch money anymore—just exchange some currency and take a trip to JB for lunch. Perhaps make a TikTok while you’re at it.

Why the Singapore Dollar Has Been Surging Against the Malaysian Ringgit

You might be wondering why the Singapore dollar has been rising that much against the Malaysian ringgit.

Here’s a quick economics crash course on why, so you don’t look so sua ku in front of your kakis (disclaimer: this is a very simplified explanation).

Exchange rates are affected by a couple of factors—let’s look at interest rates first.

Put simply, higher interest rates usually lead to more foreign capital flowing in, which subsequently increases demand for your currency and strengthens your currency.

And if you’ve been keeping up with the news, you would know that Bank Negara Malaysia, the central bank of Malaysia, paused interest rate hikes in July.

Yet, that’s far from the only reason the Malaysian ringgit has been weakening—it has weakened so much that it has taken the title of the worst performer in Asia this year, after the Japanese yen.

Advertisements

For all you know, when Singapore’s GST hits 9%, S$1 could equal 4 ringgit.

The Malaysian ringgit has also been struggling due to a fall in exports—China hasn’t been importing as much from Malaysia, and it doesn’t help that China is Malaysia’s largest trading partner.

To make things worse, global funds sold US$214 million of Malaysian stocks this month.

Huh? So what?

Well, it’s not that difficult to grasp. Say you and your friends all bought some ngoh hiang for yourselves. Suddenly, all your friends are starting to throw their ngoh hiang away.

Advertisements

You’ll probably think that the ngoh hiang has gone bad, or perhaps the ngoh hiang just isn’t that good, and end up throwing the ngoh hiang away as well.

So, when everyone worldwide is selling Malaysian stocks, sentiments on the Malaysian ringgit probably aren’t that great either.

The only good sentiments left? It’s probably just Singaporeans who are more than happy to take that trip to JB.

Read Also:

- You Can Soon See “Northern Lights” in Gardens by the Bay & It’s Free

- Everything About the Eta Aquarids Meteor Shower That’ll Be in S’pore Sky in May

- S’porean Killed in Spain Had Bought Insurance Policy from Suspect

- Everything About the 15YO Who Lived in a Circuit Road Market Stall

- Walk-Ins for Some Traffic-Related Service in TP Be Discontinued & People Have Book Appointments Instead

- Certain Parts of Telok Blangah Hill Park to be Closed for 2 Years After Slope Failure

Advertisements