Unlike love, when it comes to insurance coverage, age is more than just a number.

The older you are, the more expensive the premium you have to pay; that’s basically the one rule of insurance everyone knows.

But what if your biological age is younger? For example, you might be 35 years old, but due to your healthy lifestyle, your biological age might be 30 years old instead?

Shouldn’t insurance companies take that into consideration?

SNACKFIT: Hold my water bottle

Believe it or not, SNACKFIT is doing just that. For example, they give up to 20% bonus coverage to a 35-year-old user whose biological age is 5 years younger, so all your exercising and dieting paid off after all.

Here are 7 facts about SNACKFIT You Need To Know, and you can thank me later for it.

1. SNACK

SNACK is the latest entrant to the burgeoning InsurTech (read: insurance technology) industry.

It works in the background by helping users accumulate insurance coverage and grow their investments as they go about their daily life.

Daily activities on SNACK include dining out, taking public transport or hitting your daily steps goal among others.

2. Insurance Coverage Should Not Only Be Based On Real Age

You might be 35 years old, but what if you’re fitter than the average 35-year-olds and have a biological age of a 30-year-old?

Well, the accepted way of life is for you to pay the premium of a 35-year-old but SNACK, the latest insurance app on the market, isn’t going to accept that.

SNACKFIT is SNACK’s answer to the problem.

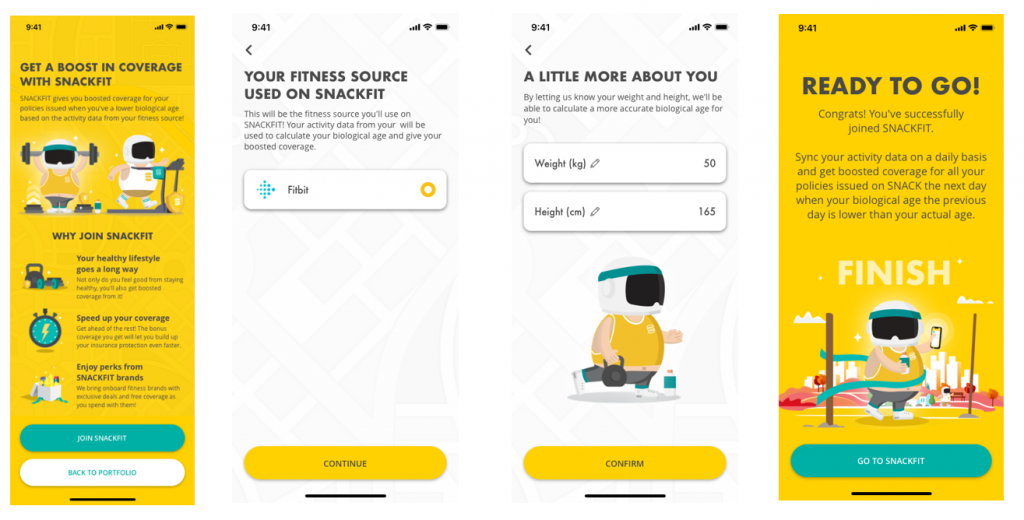

3. SNACKFIT: Bringing Biological Age To Insurance

SNACKFIT believes that not all is as it seems on the surface. A 35-year-old might have the biological age of a 30-year-old while a 30-year-old might have a biological age of a 35-year-old.

The app uses ReMark’s Biological Age Model to calculate the user’s biological age through a fitness tracker (think Fitbit, Garmin, Apple Health etc.) to track your metrics.

Metrics used in the model include:

- Steps

- Active Calories

- Resting Heart Rate

- Sleep Hours

- BMI

With this, they’ll be able to calculate the biological age of the user (instead of by how many birthdays he’s had so far) and if it’s younger, they’ll reward you with bonus insurance coverage on top of what you pay for.

If you’re the one who’s always saying on the first day of the year that you want to get fitter, or lose some weight, this app is for you.

After all, as previous programmes have shown, nothing’s more motivating to change your ingrained lifestyle habits than to enjoy short-term rewards, no?

4. Why Does This Make Sense?

Now, you might be thinking, Why so good? Well, there’s a rational reason behind their actions.

The reason why insurance premiums get more expensive as you get older is that the risk of getting into any unfortunate situation is higher.

Instead of putting a one-size-fits-all restriction based on age, the insurance app is diving deep into the cause (how likely you are to get sick despite your age based on your lifestyle and fitness levels).

This couldn’t have come at a better time where the frequently-changing COVID-19 restrictions mean there are more Singaporeans turning to fitness.

5. How It Works

On SNACK, you’ll accumulate insurance coverage based on the lifestyle choices you make, be it ordering food on Foodpanda, using Fave Pay for your shopping, etc.

For SNACKFIT, the goal is really simple.

They want people to get onboard the app and strive to live healthier; and in turn, reward them with bonus coverage. This game changes when you turn on SNACKFIT.

Say, based on your age, a 30-cent premium gives you a S$186 coverage for personal accidents.

When your biological age is calculated and it’s found out your biological age is younger than your actual age, you will enjoy a higher coverage while paying the same premium.

Walk more, get more bonus. What’s better than that? In other words, get healthier and be rewarded for it.

Kind of reminds NSmen of IPPT, eh?

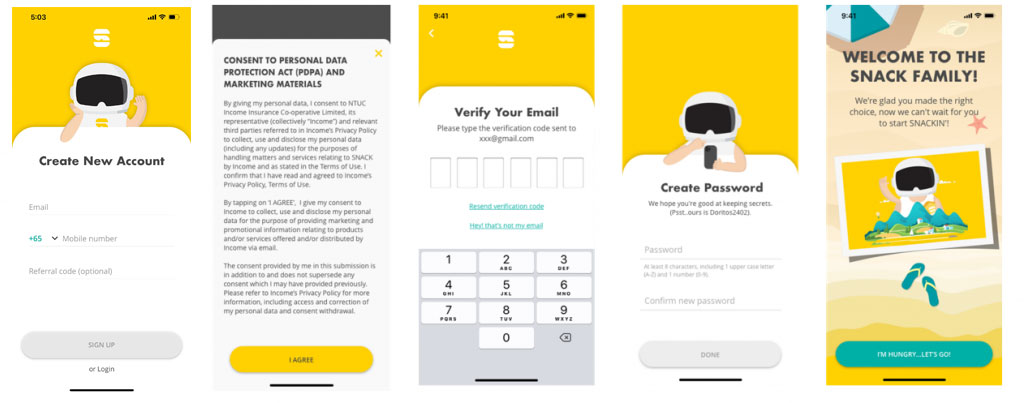

6. Signing Up Is Simple

Signing up for SNACK and turning on SNACKFIT is pretty simple.

All you need to do is to create a new account in the SNACK app, verify your email and you’re good to go.

If you’ve not yet started on any SNACK Insurance policies, simply follow these steps:

- Redeem $1,000 free coverage each for Accident, Critical Illness and Life insurance (T&Cs apply)

- Link the lifestyle activities and set up the preferred premium

- Scroll to Discover and tap on SNACKFIT to connect a fitness tracker (Garmin, Fitbit, Apple Health etc.) to SNACK

- Enjoy bonus insurance coverage when your biological age is younger than your actual age!

7. Promos You Can’t Miss

Still deciding on whether to try SNACK out? Hesitate no more because there are currently some irresistible promos that makes this an absolutely no brainer!

• COLLECT FREE INSURANCE COVERAGE

Get up to $3,000 FREE coverage when you explore your portfolio and link your Visa card.

T&Cs apply: ntucinco.me/s-3000tnc

• [LIMITED] $30 OFF YOUR MEALS

Get $30 GrabFood vouchers with promo code <SNACKEATS22> when you boost your LIFE / CRITICAL ILLNESS / ACCIDENT coverage by 30 April 2022.

T&Cs apply: ntucinco.me/s-mp-tnc

• GET COMPLIMENTARY INVESTMENT CREDITS

Earn $30 Investment credits when you complete your set up for INVESTMENT! No promo code needed.

T&Cs apply: ntucinco.me/si-wc-tnc

• [LIMITED] 20% BONUS RETURNS

Get 20% bonus Investment Credits for every dollar you invest on SNACK from now till 30 April 2022.

T&Cs apply: ntucinco.me/si-mp-tncs

And so, what are you waiting for? If you’re a fitness buff or someone who’s been wanting that extra motivation to get fit, this might just be the best way to get insurance coverage for you.

To find out more, download SNACK here!

This article was first published on Goody Feed and written in collaboration with SNACK By Income.

Feature Image: sportpoint/ Shutterstock.com