Early this month, Singapore-based cryptocurrency hedge fund, Three Arrows Capital, filed for bankruptcy. The two founders, Zhu Su and Kyle Livingstone Davies, haven’t been cooperative in the liquidation process—a process to sell off the firm’s assets to pay off creditors.

Zhu Su is a Singaporean, and got into the news last year when it was reported that he was buying a Good Class Bungalow (GCB) at Yarwood Avenue in Bukit Timah area for S$48.8 million as a trustee for his child.

Liquidators haven’t been able to locate the two founders in Singapore, and they believed that the two founders could “whisk away 3AC’s cryptocurrency assets”.

According to The Straits Times, the liquidators of Three Arrows Capital are now working in Singapore to freeze Three Arrows Capital’s assets so as to pay off creditors. To do that, they’ve appointed advisory firm Teneo and are seeking an order from the high court to recognise Teneo’s appointment to carry out its duties here.

Simply put, they’re now working to have legal basis here in Singapore, as the bankruptcy is being made in the US.

For a start, they’d have to apply for something to determine the assets of Three Arrows Capital, and also conduct examinations of individuals like Zhu Su and Kyles Davies.

That would be the first step of the many steps, of course.

Now, we might be talking about billions of dollars, so do the founders have that much money?

The Straits Times reported that they’ve seen documents that show that Zhu Su didn’t just have one house here in Singapore: he apparently owned at least two good class bungalows, one in Dalvey Road and another in Yarwood Avenue (the one that got into the news).

In addition, he had another house in the Balmoral Road area.

The liquidators had obtained permission to subpoena founders Kyle Davies and Zhu Su: in other words, they can kind of obtain court order to force then to appear in court.

But the founders are still uncontactable…though, for some reason, Zhu Su posted a cryptic tweet three days ago.

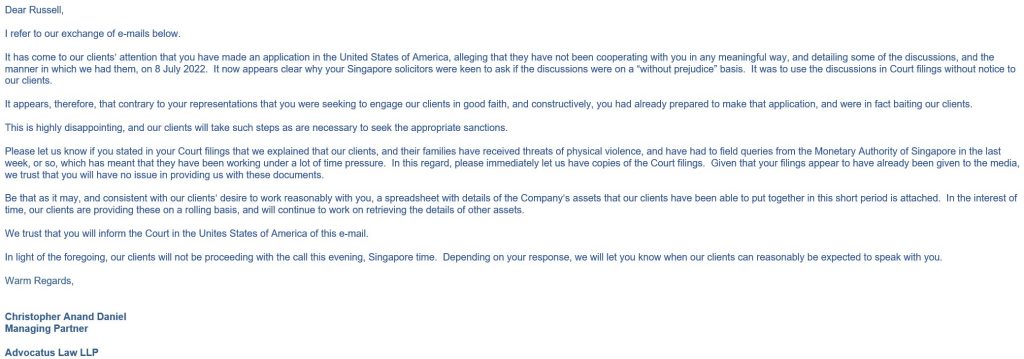

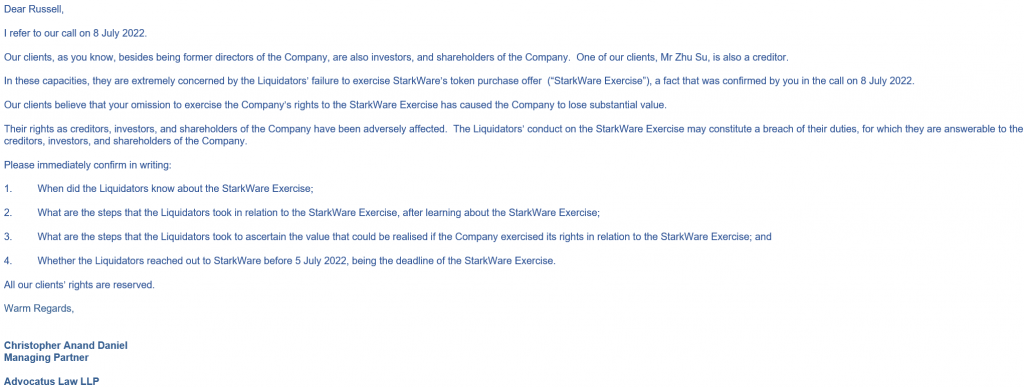

Accused Liquidators of ‘Baiting’

On 12 July, after over a month of silence, Zhu Su suddenly posted on Twitter.

He claimed that their “good faith to cooperate with the Liquidators was met with baiting,” and attached screenshots of an email exchange between the his lawyer and an executive in charge of liquidating Three Arrow Capital.

In the email exchange, Zhu’s lawyer claimed that the liquidator didn’t exercise a token warrant that expired on 5 July, which causes some losses. Simply put, they accused the liquidator of baiting: which is to annoy them by purposely not doing what should be done.

In the email exchange, they also claimed that Zhu has received “threats of physical violence”.

What Happened

For the uninitiated, hedge fund is like a pool of money managed by a person (or a company). The person, often called the Chief Investment Officer, can invest the money in any way he desired, as long as the returns are positive. This means that even if the market is going down (e.g. a recession), the CIO can still grow the money.

Only the super-rich can invest in hedge fund as it’s too risky for retailer investors like you and me. However, the returns are usually good—though there might be some bad hedge funds.

Usually, people working in hedge fund firms are rich, too: to know more about how hedge fund works, you can watch Billions on Netflix.

While hedge funds aren’t new, cryptocurrency hedge funds are: the funds usually focus just on cryptocurrencies.

And as you might know, it isn’t a good year for cryptocurrencies, and so, it’s kind of expected that Three Arrows Capital, which claimed to have USD$10 billion in its assets under management in March this year, had to file for bankruptcy.

Hedge funds would sometimes also borrow money so that they’d have enough to invest for higher returns. After all, a 1% return of $1 billion is a whopping $10 million worth of “profit”, while a 1% return of $100 million is only $1 million worth of “profit”.

And well, this is when shit hits the fan, because Three Arrows Capital invested heavily in LUNA as well, and we all know what happened to LUNA.

You can also watch this video to know why people are hating on the founder of LUNA:

Three Arrows Capital was unable to meet margin calls last month—simply put, they need to return some money because they’ve invested some money they “borrowed”, but couldn’t return—and so, they had to file for bankruptcy.

To simplify things, just think of the hedge fund as a business: it’s losing money and creditors are asking for money, so they had to sell off all their assets (that might or might not be making money) to return the cash to the creditors.

Read Also:

- Founders of Three Arrows Capital, Zhu Su and Kyle Livingstone Davies, Allegedly Fled Singapore

- Mum & Son in Viral Road Rage Have Been Arrested by M’sia Police

- Origins of Hungry Ghost Festival, Which Starts from 29 July 2022

- 10 Facts About Hungry Ghost Festival 2022 in Singapore

Featured Image: Twitter (@zhusu) & Google Maps

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: