You know how you feel scammed when you open a bag of chips and it’s 70% air, or when your friend says he’s reaching in five minutes but he hasn’t even left his house?

Yeah, these moments leave you feeling scammed and sometimes upset, but there’s actually way worse scams than that. In fact, you might even know someone who has fallen prey to these scams before.

Being scammed by a $3 bag of chips is quite sad, but you definitely wouldn’t want to lose thousands of dollars to the top 10 scams in Singapore in 2023, which has just been released by the Singapore Police Force. Read on to find out more about these scams and what to look out for.

Government Officials Impersonation Scams

In 10th place, we have government officials impersonation scams. If you pick up calls from unknown callers, you may have encountered this type of scam a couple times before.

In December 2023 alone, at least 120 people fell prey to this scam, with total losses amounting to at least $13.3 million. The Singapore Police Force (SPF) and Central Provident Fund Board (CPFB) reported that among these 120 cases, there were three cases involving about $488,000 in CPF withdrawals that were made from November to December 2023

Much worse than being scammed by a $3 bag of chips, right?

In this type of scam, victims received unsolicited calls from scammers impersonating bank officers and seeking validation of suspicious banking transactions that they allegedly conducted.

Of course, if a “bank officer” tells you there have been suspicious bank transactions involving your account, you would be worried, right? Who would hang up on such a “serious” call like this?

When victims denied making these transactions or possessing such bank cards, the scammer would transfer the call to another scammer claiming to be a government official such as an SPF officer or a China official.

This “official” would accuse victims of being responsible for criminal activities like fraud or money laundering.

Considering money laundering is a serious offence, victims may be too shocked or scared to think straight.

The scammers would come up with a story – like needing you to support investigations or needing to prevent the abuse of bank or CPF accounts – and instruct victims to transfer their monies to “security accounts”, which are specified bank accounts supposedly designated by the “authorities”, aka the scammers.

The scammers may also request for victims’ banking credentials, credit card details, or One-Time Passwords (OTPs).

We’ve all read or heard warnings that we should not share OTPs with other people and this is exactly why – you could be just one step away from being scammed.

Victims would realise they had been scammed when the scammers became uncontactable (like your situationship) or when they subsequently verified their situation with the banks or with SPF through official channels.

893 victims lost a total of $92.5 million to these scammers in 2023.

“Government officials will never ask members of the public over the phone to (i) transfer monies to them; (ii) provide their banking credentials or CPF-related information such as CPF balances,” said CPFB in a news release.

The following precautionary measures are advised:

- Download the ScamShield App to protect yourself from scam calls and SMSes.

- Set up security features such as transaction limits and enable Two-Factor Authentication (2FA) and Multifactor Authentication for banks and e-wallets.

- Check for signs of scam with official sources (ScamShield, WhatsApp bot @ https://go.gov.sg/scamshield-bot, call the Anti-Scam Helpline on 1800-722-6688, or visit www.scamalert.sg).

- Never disclose your internet/mobile banking or credit card details such as bank account user ID, passwords, Personal Identification Numbers (PINs) or OTPs to anyone through phone, email, or messaging applications.

- Do not allow anyone to access your bank account(s) or Singpass and do not authorise any authentication request via digital token or OTP if you did not initiate any internet/mobile banking transaction.

- Tell authorities and loved ones about scams and do not be pressured by the caller to act impulsively. Report any fraudulent transactions to your bank immediately.

Internet Love Scams

Next on the list is probably the most embarrassing one – internet love scams.

Humans are driven by the desire for connection but how can you truly trust someone you’ve never met before?

After all, we all know that one person who’s nice online but is very different in person.

Internet love scammers usually follow the same modus operandi.

Posing as an attractive person (usually foreign) online, these scammers befriend victims and gain their trust. The scammer will try to deepen the relationship and make it seem real and genuine, professing his/her love shortly after making contact with victims.

Most people view quick profession of love as a red flag, but 2023’s 913 victims either didn’t see the red flag or are colour blind and thought the red was green.

As proof of victims’ love and dedication, scammers will ask the victims to transfer them money. The victims, not wanting to lose the “meaningful and real relationship” they have with the scammer, would oblige.

After awhile, these scammers may tell victims a sob story about falling into trouble or hard times and ask for a loan from the victim. They may also ask for money from the victim to buy a plane ticket to visit said victim.

Some will ask victims to invest in a company or cryptocurrencies, or request victims to help them receive or transfer funds on their behalf using the victims’ bank accounts.

Once the money is transferred, the scammer disappears, along with the victim’s money.

In some cases, love scammers will ask victims for nude photos as “proof” of their love. Scammers will then threaten to leak these photos unless victims transfer them a sum of money.

Victims lost a total of $39.8 million to internet love scammers in 2023.

It’s already 2024 lah being single is also empowering what, you don’t need a boyfriend or girlfriend to be happy. It’s way better to be single and happy than in a relationship with a scammer, only to lose your “lover” and money within a few days or weeks.

Date safely by asking for a LIVE video call with the person you’re talking to, verifying their identity, and not sending money to someone you have not met.

Never allow others to use your bank account to conduct their transactions. You may actually be committing a crime by laundering money for criminals. Offenders may be fined up to $500,000 and imprisoned for 10 years.

Don’t do it, it’s not worth it.

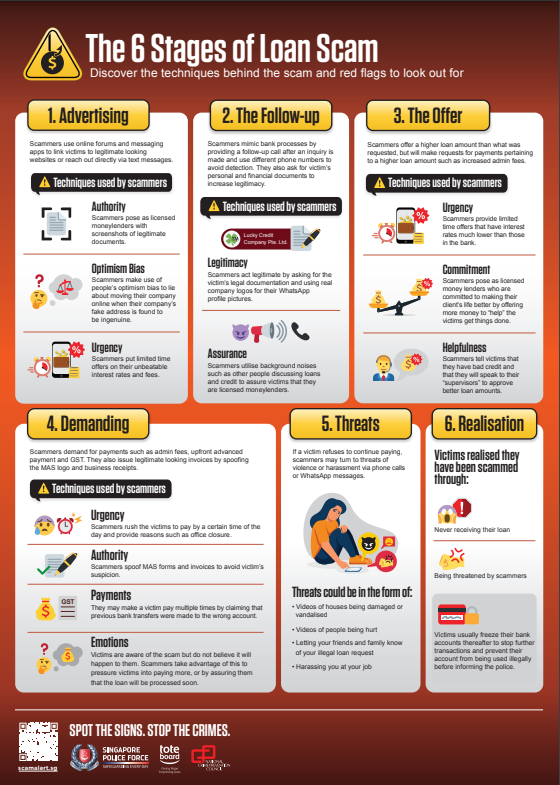

Loan Scams

The eight most common scam in Singapore in 2023 was loan scams.

These scams come in the form of phone calls, unsolicited text messages or advertisements online offering loans or loan services. They often promise instant, fuss-free loan approvals.

Scammers may claim to be staff from a licensed money lender and instruct you to transfer money before the loan can be disbursed. As with all other scams, the scammers disappear once the money has been transferred.

Some scammers may also ask you for personal information such as your NRIC and contact numbers, Singpass details, and bank account numbers. They’ll then use this information to harass or threaten you for more payments.

In 2023, 914 victims lost a total of $6.1 million to loan scams.

If you don’t want this to be you, seek financial help only from legitimate financial institutions registered with the Registry of Moneylenders.

Scammers may impersonate licensed moneylenders by using their names, licence numbers, and creating fake websites. Stay safe by only contacting licensed moneylenders via the contact details found in the registry.

The SPF would like to remind the public that licensed moneylenders:

- are not allowed to solicit loans via text messages, phone calls or social media platforms;

- will not request CPF contribution or Singpass login details to facilitate loan approvals;

- are required to meet the borrower in person at the approved place of business to conduct physical face-to-face verification of the borrower’s identity before granting any loan; and

- will not ask a loan applicant to make any payment (such as for GST, admin fee, processing fee, or any other fee) before the disbursement of a loan or to secure the disbursement of a loan.

Social Media Impersonation Scams

With hacking and the internet, anyone can be anyone.

Scammers can hack into your social media accounts or messaging apps such as WhatApp and ask your friends or contacts for help.

You can watch this video to know more about the WhatsApp scam:

Other than that, you’ve probably encountered a strange text from someone you know saying, “Hello, I need your help. Can you please help me?”

In this day and age of throwing away capital letters and punctuation in texting, as well as increased usage of short forms such as “u” instead of “you” and “pls” instead of “please”, this kind of text usually rings some bells in most people.

What normal person would text with proper English when chatting with a friend right? Wayyy too sus. You’re chatting with a friend, not writing an essay.

If the text above made you feel suspicious, good job on being wary.

If you don’t want to be like the 1,570 people who lost a total of $9.7 million to these scammers, it’s important to stay vigilant.

After hacking into your account or messaging app, these scammers will ask your friends or contacts for “help” before asking you to send them money due to their “dire financial situation”. They may also ask you to buy iTunes or other gift cards for them, or ask for your personal and bank details as well as OTPs for online shopping accounts.

Once scammers get hold of this information, it’s game over.

GG.

They proceed to make unauthorised transactions on those accounts and you’ve officially become a victim of a scam.

In the event that you shared details or OTPs with the scammers, you may find that you’ll have trouble logging into your online accounts through your usual passwords and devices. You may also notice unauthorised transactions on your online or bank accounts and you may find that despite your phone data usage being the same, your bill may be larger than usual.

Protect yourself from these scams by verifying if the person who texted you is really who they say they are. More often than not, you text friends on multiple platforms like WhatsApp, Instagram, and Facebook.

If you receive a suspicious text from your friend’s Instagram account, ask them about it on WhatsApp to verify its validity before transferring any money or sharing details and OTPs.

Wait, don’t even share any details.

Malware Scams

The sixth scam of concern is new but already managed to scam 1,899 victims of a total of $34.1 million in 2023. The police said the average amount lost per malware scam case was around $17,960.

According to SPF, more than 43% of malware scam victims were aged 30 to 49.

In this scam variant, victims would chance upon advertisements for various services (food purchase, home cleaning, pet grooming etc) on social media platforms like Facebook and Instagram.

Victims would contact the “sellers” via the social messaging platforms or on WhatsApp. The supposed sellers would then send a URL to the victims to download an Android Package Kit (APK) file, an application created for Android’s operating system.

After downloading and installing the APK file (which includes granting the app accessibility services), the victims would then be instructed to make a PayNow transfer of $5 as “deposit” for these services.

Little do they know, this seemingly harmless “deposit” is about to spell disaster for these victims.

Unknown to the victims, their internet banking credentials would be stolen by the malware’s keylogging function upon the transfer. After the scammers access and perform unauthorised transactions from the victim’s banking account, they would initiate a factory reset on the victims’ devices.

The victims would then discover the unauthorised transactions after calling their banks or when they re-install the banking apps on their devices.

Given that this type of scam only became a concern last year, you may not know how to protect yourself against this scam. Here are some precautionary measures you can take to stay safe against this new scam type:

- Download the ScamShield App.

- Set up security features such as transaction limits and enable Two-Factor Authentication (2FA) and Multifactor Authentication for banks and e-wallets.

- Ensure your devices are installed with updated anti-virus or anti-malware applications and that your devices’ operating systems and applications are updated regularly to be protected by the latest security patches.

- Disable “Install Unknown App” or “Unknown Sources” in your phone settings and do not grant permission to persistent pop-ups that request for access to your device’s hardware or data.

- Check for signs of scam with official sources (ScamShield, WhatsApp bot @ https://go.gov.sg/scamshield-bot, call the Anti-Scam Helpline on 1800-722-6688, or visit www.scamalert.sg).

- Only download and install applications from official app stores (the App Store for iOS users or Google Play Store for Android). Be wary if asked to download unknown apps in order to purchase items or services on social media platforms.

- Tell authorities and loved ones about scams. Report the number to WhatsApp to initiate in-app blocking and report any fraudulent transactions to your bank immediately.

Investment Scams

The fifth most common scam in 2023 was investment scams. This type of scam cost victims more money than other scams in 2023, robbing them of a total of $204.5 million.

Heart pain. Wallet also pain. Maybe even dead.

These scammers approach victims through social media platforms, communications and dating applications that include Facebook, Instagram, Telegram, WhatsApp, Coffee Meets Bagel, and Tan Tan.

They take two approaches to scam victims.

For the befriending approach, scammers would build rapport with victims over time to gain their trust before introducing “investment opportunities”. After having built trust, victims would believe the scammers and engage in these “lucrative investment opportunities”. Victims would generally receive small profits initially to improve the credibility of these “investments”.

They would then be prompted to invest larger sums, and would only realise they had been scammed when they could not withdraw their ‘profits’ or could no longer contact the scammers.

In the online advertisements approach, victims had searched online for investment opportunities or came across investment advertisements on social media platforms. When victims contacted scammers behind these “investments”, they would be lured in to invest in opportunities” with high returns in a short time. These claims are often accompanied by fraudulent testimonies.

Similar to the befriending approach, they would be asked to “invest” and would only realise they had been scammed when they could not withdraw their ‘profits’ or could no longer contact the scammers.

You may have encountered this type of scam on Telegram before. Find out more about this type of scam as well as why it’s so rampant on Telegram in this article.

Phishing Scams

Phishing is a method which cybercriminals use to fraudulently obtain your personal and financial information such as your login details, bank account numbers and credit card numbers.

These scammers often pose as legitimate individuals or a reputable organisation through email, instant messaging, and other communication channels.

They also tend to use urgent or threatening messages to pressure you to click on links. By doing so, they hope to instill panic and fear to trick you into providing confidential information.

The Cyber Security Agency of Singapore (CSA) warns the public to be wary of emails with phrases such as “urgent action required” or “your account will be terminated”.

These scammers may also create fake websites that are visually similar to legitimate websites to phish for personal data.

After obtaining the data they are after, these cybercriminals can gain access to your online accounts, and even impersonate you to scam the people around you. This is where the aforementioned social media impersonation scam comes into play.

Fortunately, phishing scams can be spotted. Sometimes, their emails or texts may have spelling or grammatical errors (although, now with ChatGPT, that might change).

CSA advises the public to also take note of the URL in the address bars of web browsers as scammers also often use tricks like substituting letters in a URL to mislead you into thinking that you are on a legitimate website. For example, the URL may be www.paypa1.com instead of the official www.paypal.com.

Phishing scams took a total of $14.2 million from 5,938 victims in 2023.

To not fall prey to these scams, be vigilant when receiving emails of urgent nature and be sure to check if email addresses and URLs used are official.

Fake Friend Call Scams

Now we move on to the top three scams in Singapore in 2023. In third place, we have fake friend call scams which scammed 6,859 victims of a total of $23.1 million last year.

This is alarming as the number of victims and the total amount of money lost tripled from 2,106 victims and $8.8 million in 2022.

In these scams, victims would receive text messages or phone calls from unknown numbers. These scammers would claim to be a friend or acquaintance and ask the victims to guess his or her real identity.

Familiar?

In response, the victims would then provide the name of a friend they believed the caller could be. The scammers would then assume the identity of the said friend and ask the victims to update their contact details.

It would be kind of funny if you guessed the scammer is Chloe Tan Le Xuan and the scammer says you’re right when actually, you don’t even know anyone called Chloe Tan Le Xuan. You can check if it’s a scam by scamming the scammer, I guess.

These scammers would contact victims subsequently to ask for a loan and would claim that he or she is unable to perform a banking transaction or is experiencing financial difficulties. Scammers would then provide victims with a local bank account to transfer the money to.

Since victims are “friends” with the person (who is actually a scammer), they would do so, would only discover that they had been scammed after contacting their actual friends whom the scammers had impersonated, or when their loans were not returned as promised.

Come on lah, if you can’t even notice that your friend’s texting style has changed, maybe YOU are the fake friend.

In 2023, the police noticed a new variant in which scammers would send victims malicious links and ask victims to help them in simple tasks such as making a purchase, making a restaurant reservation, or tracking a missing phone.

These links would lead victims to either phishing sites as mentioned above, or get them to download an APK file.

After victims enter their banking credentials or card details on the phishing sites, they would then realise that unauthorised transactions from their bank accounts have occured.

The malware in the APK file would give scammers access to victims’ devices remotely and allow them to steal passwords stored in the devices. Victims may also be directed within the app to fake bank application login sites to key in their banking credentials to make payment within the app. The malware with keylogging capabilities would then capture the credentials keyed by the victims in the fake banking sites and send it to the scammers.

Yes, it’s like this scam is a prequel to the malware scam.

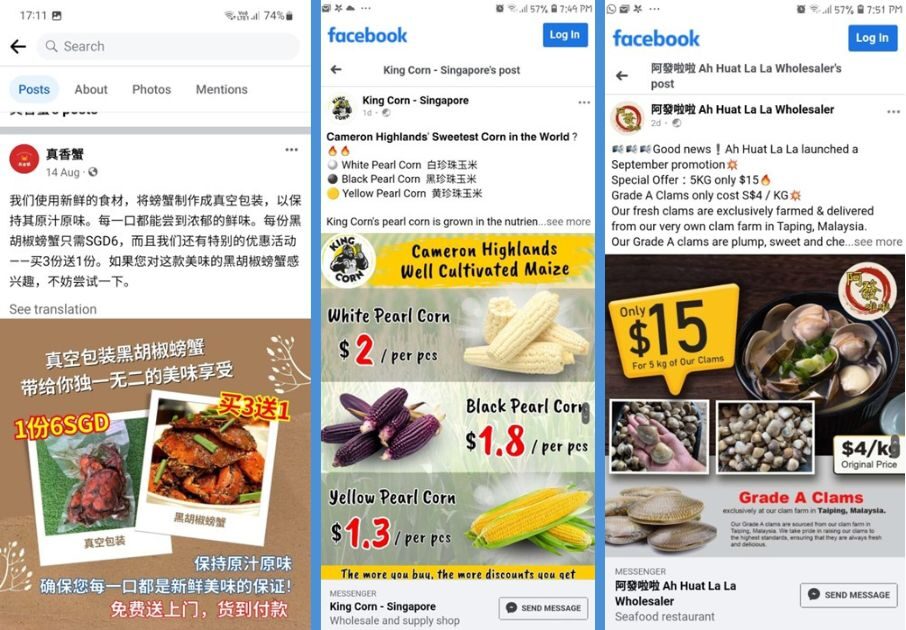

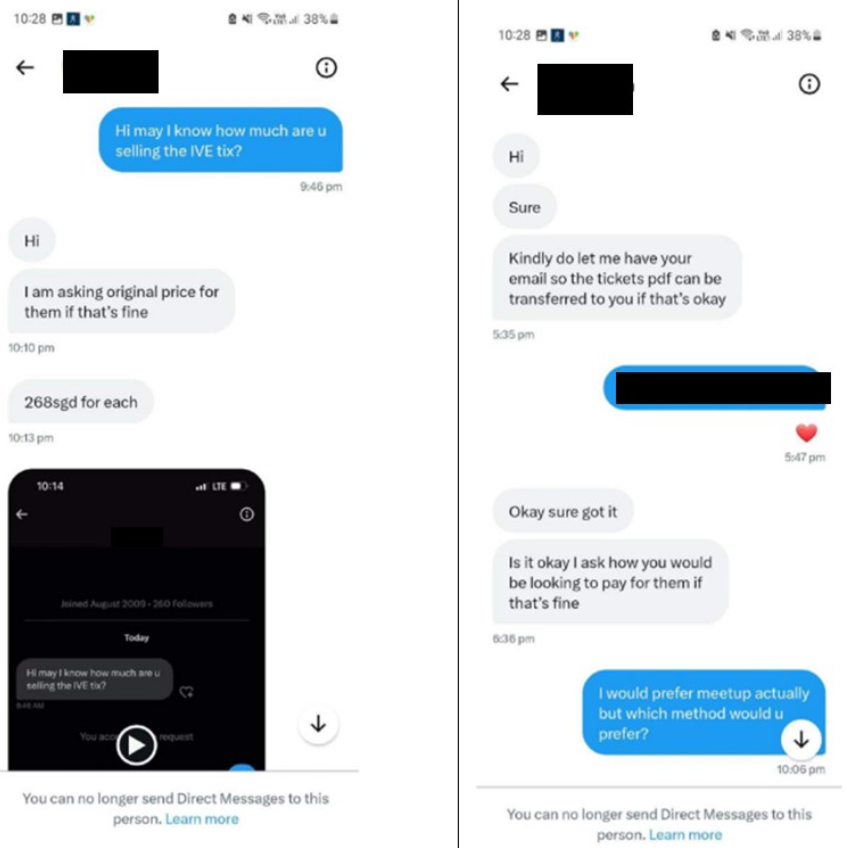

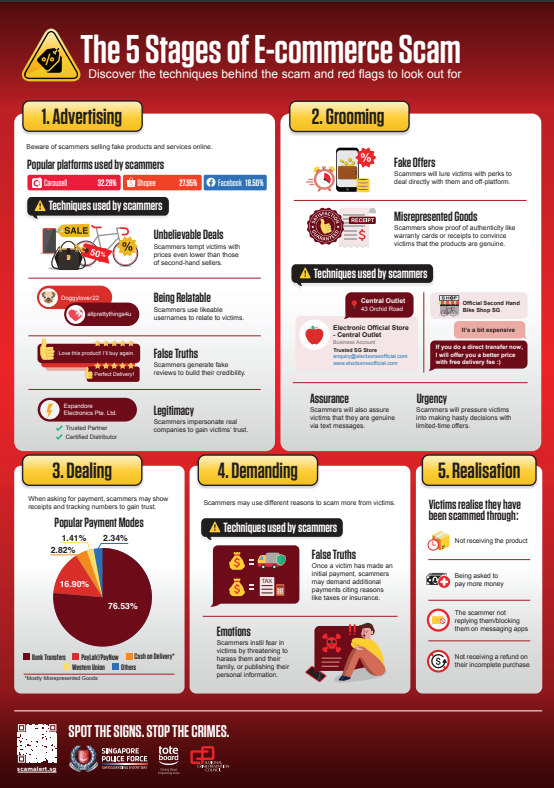

E-commerce Scams

Coming in second with a whopping 9,783 reported cases in 2023 is e-commerce scams. This is double the number of cases in 2022 (4,762 reported cases). This type of scam took $13.9 million from victims in Singapore last year.

These scams really appeal to people who just can’t stop buying things. Which is basically almost everyone in Singapore…

E-commerce scams, aka online purchase scams, feature an unusually good deal for a gadget, amusement park, or concert tickets. These online deals attract victims who then transfer payment to the “seller”, who promises delivery of the item.

In some cases, these “sellers” may demand further payment for delivery charges, admin charges, freight charges, or duties after the first payment is made. Ultimately, victims will not receive the item.

Another variant of this scam is when victims are asked to pay in cash for items they did not purchase. These items are different to what victims thought they purchased or are cheap replicas.

Many of these fake sellers may pose as legitimate online sellers on popular marketplaces, create fake websites, or even advertise themselves on social media to build credibility.

To protect yourself against this kind of scam, be wary of good deals that seem too good to be true. These deals often go for way below market price disguised as a one-time-only or flash deals.

A real iPhone 15 Pro Max is not going to be sold at $500. You might just receive some random phone with the Apple logo drawn on it.

Some scammers may also try to get you to communicate with them on another platform to avoid detection or get you to transfer money to them directly for a discount.

You may think these scams are obvious but many people have actually fallen for such scams. You could be next.

If it’s too good to be true, chances are it is. There’s no such thing as a free lunch.

Protect yourself by chatting and transacting within the platform. Use the platform’s secure payment method or insist on cash-on-delivery.

Always choose to deal with reputable sellers who have good ratings and reviews from numerous people and have been with the site for some time. For high-value items, use reputable platforms with consumer protection and return policies.

Moreover, always check the terms and conditions and ensure fees are stated upfront.

I know everyone never reads terms and conditions and just scrolls to the bottom the click the “I have read and agree to the terms and conditions” box, but when you’re shopping online, you don’t want to lose large amounts of money to e-commerce scams.

Job Scams

Finally, the top scam in Singapore in 2023 was job scams.

Surprised?

Most of us should be familiar with these job scams as they’re rather common on apps like WhatsApp and Telegram. You probably encounter a few of these scams every few months.

In 2023, 9,914 victims lost a total of $135.7 million to these scammers. That’s about 27 people getting scammed every single day.

These scams involved unsolicited job offers via messaging apps or social media. These potential “employers” offer easy jobs that allow you to make a lot of money for minimal effort.

“Affiliate Marketing” jobs involve victims being asked to pay for products in advance to boost the sales of sellers in return for commission.

“Agent” jobs require victims to process fund transfers using the victims’ personal bank accounts, then transfer the money through online banking or money transfer services such as Western Union or MoneyGram.

Like investment scams, job scams may show you tons of “testimonials of success cases” to convince you that the job is legitimate and entice you to join so that you, too, can earn big bucks for little effort.

Victims may be asked to reveal details like name, identity card number, phone security code or OTPs, giving scammers access to victims’ mobile phones to make online purchases.

“Male Social Escort” jobs promise introductions to wealthy female clients, but only after victims pay a registration fee. Victims may also be asked to pay additional fees such as insurance or membership.

Affiliate Marketing and Agent jobs can be found quite commonly on Telegram. If you’ve encountered an unsolicited text about a job offer on Telegram, that was probably a job scam.

If you don’t want to be one of these victims, be cautious of these offers. No legitimate organisation will ask you to pay upfront before starting a job.

Do not respond to dubious job offers, allow others to use your bank account, use unverified apps, or pay to secure a job offer.

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: