Have you ever come across “online trading courses”? These courses are often advertised by individuals who present themselves as “financial gurus”, flaunting lavish houses and expensive cars, all while promising that by following their guidance, you can achieve wealth and success just like them.

However, this narrative is often far from the truth.

Are you interested in delving into the world of trading as an additional source of income but feel lost about where to begin?

The good news is that you don’t necessarily have to invest in online trading courses to acquire the skills required. This is because some of these so-called “financial gurus” might be fake and may not provide you with reliable information.

Or to be precise, to teach you the real thing that you should learn instead.

We’ve gathered insights from a colleague at Goody Feed who is actively involved in trading and explained why learning those “skills” are completely useless.

Value Investing vs Trading

Before immersing yourself in the realm of trading, it’s essential to understand that there’s another form of investment that differs significantly from trading: Value investing.

According to Investopedia, value investing is a strategy that involves buying stocks that appear underpriced relative to their intrinsic value. This means that investors believe that the stocks have potential for future growth and would buy them at discounted rates, with the goal to earn profits over time.

To illustrate, consider an investment of $1,000 in Apple stocks in the year 2000, which would now be worth approximately $213,000.

This approach is a long-term strategy that necessitates thorough research into the companies you intend to invest in and demands a lot of patience… I really mean a lot.

In the above example, you need to wait 24 years to see such massive results.

Hence, you will rarely find trading gurus promoting this approach. It’s like they’re selling you a university course instead of get-rich-quick scheme.

On the flip side, trading involves the buying and selling of securities like stocks, bonds, and currencies over a short period, with the aim of generating a profit.

Unlike value investing, trading is a short-term method that capitalizes on price fluctuations occurring within minutes or days.

But why would prices go up and down in minutes or days?

Price Changes Due to Emotions

It’s all due to one word: emotions.

This is especially so for new traders, who would just buy based on what they’ve heard. Nvida stock is going up the roof due to more demand for AI?

Buy, buy, buy!

This lack of a plan is predictable among many new traders, who lost lots of money as seasoned traders would use indicators, which you would read later, to determine how these new traders trade.

In other words, their loss is the the seasoned traders’ wins.

Usually, professional traders stuck to a trading plan, and trade religiously to that plan. For example, they would cut their losses when the amount hit a certain number, or take the profit when it has reach a certain price. They would do that even when the trend clearly shows that the price is going to continue going up.

Known as risk management, it encompasses a set of strategies used by traders to control risks and maintain long-term profitability. Ultimately, trading carries risks and even the most skilled traders can experience losses.

Effectively managing emotions, maintaining composure, and adhering to a reliable trading plan or strategy can help reduce the chances of impulsive actions that could jeopardize your profits.

Three Things to Keep in Mind when Trading

Although you may learn various “skills” from trading courses, most could be unhelpful if you do not have a basic understanding of the approach.

First and foremost, it’s advisable to delve into learning about indicators to gain a better understanding of the types of actions to take when trading.

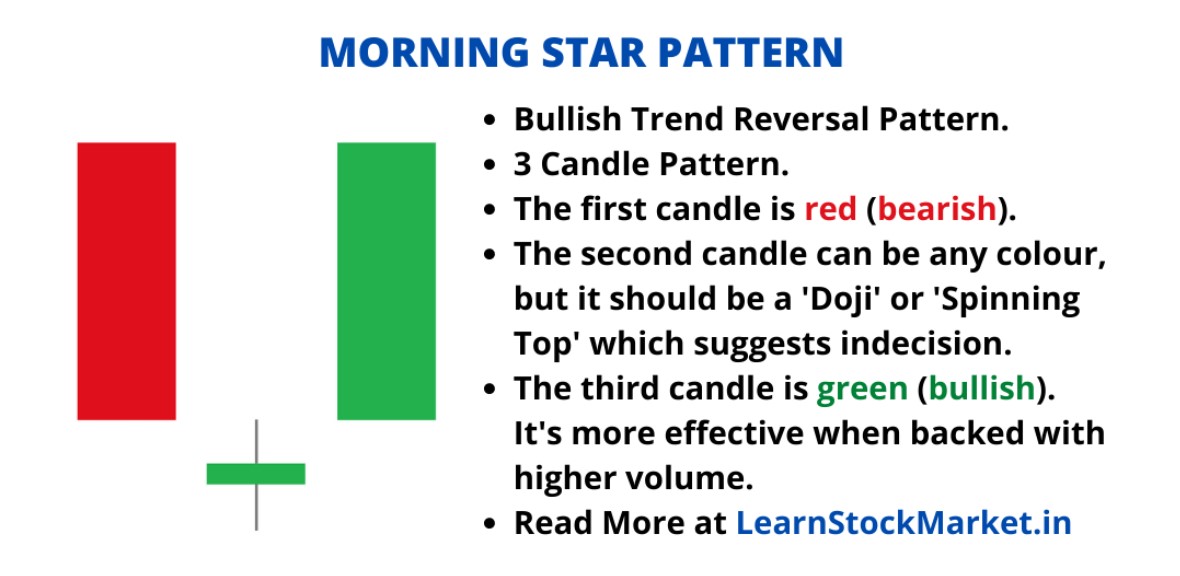

Trading indicators are mathematical calculations which are plotted as lines on price charts, enabling traders to identify market trends. For example, one of the most popular is the Morning Star candlestick pattern.

To put it simply, the Morning Star pattern is a visual three-candle pattern that indicates the possibility of a stock going up.

It transitions from red (indicating bearishness) to green (signifying bullishness). The red candle suggests a downward trend in the stock, while the green candle signals an increase in buyers and the potential for the stock to rise.

In this scenario, a well-trained trader might view this as a suitable time to consider purchasing the stock. However, they must exercise caution, as even the most informed predictions may not be entirely accurate.

Trading gurus would often teach newbies these indicators, which could be useful since they’re just trying to predict the movement; but the most important takeaway is to come out with a trading plan with good risk management, and stick to it.

You can watch this video if you prefer to hear a cat talk about this topic instead: