The Budget 2022 Speech by the Ministry of Finance (MOF) was two-and-a-half hours long, mentioning a range of topics like the effects of the COVID-19 pandemic and its corresponding medical expenditure, the economic stimulus packages, long-terms plans for Singapore which includes greener and more technologically advanced city-state, whilst maintaining connectivity and general relevancy to the global market, and much more.

Some involve large and grand plans that will continue to develop into the mid-century, while some are temporary.

Regardless of what they are, here are 11 facts that you should know about Budget 2022 that are likely to affect you directly!

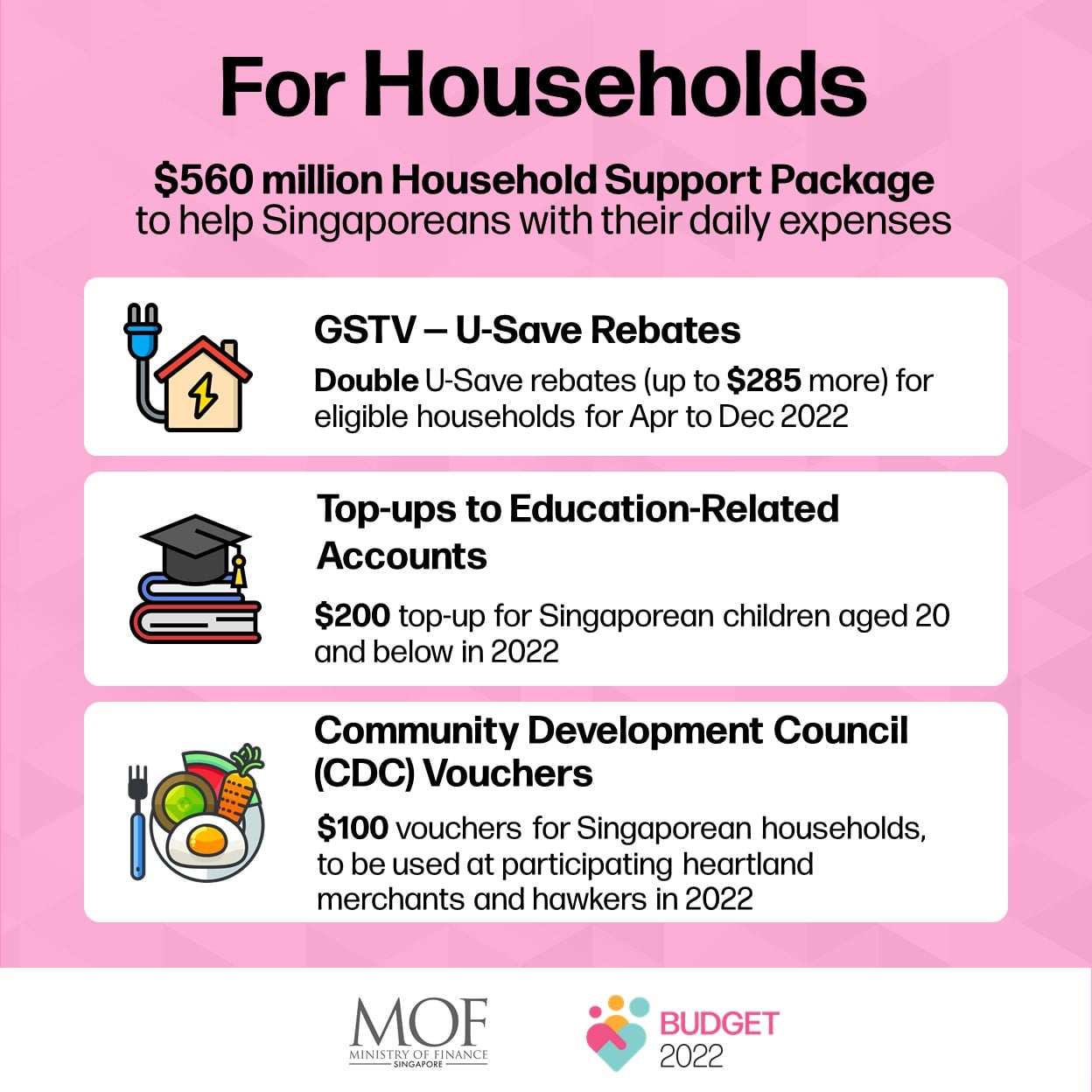

Household Support Package

The main goal of the S$560 Billion Household Support Package is to help Singaporeans with their utility bills, children’s education and daily essentials in 2022.

GSTV-U Save Rebates

Eligible households will receive a one-off GST Vouchers called U-Save Vouchers, which are rebates that can be credited to the HDB flat’s utilities accounts.

In order to help lower-income households, the U-Save rebates have been doubled, up to $285 or more, for eligible households for April to December 2022.

Top-ups to Education-Related Account

$200 will be topped up in Singaporean children’s education-related accounts for Singaporean children aged 20 and below.

The education-related accounts include Edusave Accounts and Post-Secondary Education Accounts.

Additional $100 CDC Vouchers

An additional $100 CDC Vouchers will be given to all Singapore households, which can be used at participating heartland merchants and hawkers in 2022.

GST Increases

For many years now, there has been talk among the parliament about an increase in the Good & Service Tax (GST) rates.

However, in view of the current pandemic, the regressing economy, the rising costs of living, and price inflation, Finance Minister Lawrence Wong announced that the GST increases will be delayed to 1 January 2023.

- From 1 January 2023, the GST will be raised from 7% to 8%.

- From 1 January 2024, the GST will be raised from 8% to 9%.

The GST increase in 2023 will not apply to government fees and charges for a year, as well as fees charged by government agencies for provision of services, publicly subsidised healthcare and education.

Furthermore, Town Councils will be given S$50 million to absorb the additional GST on Service and Conservancy charges.

To ensure that businesses will not use GST as a cover to raise prices, the Government will be setting up a Committee Against Profiteering to address such concerns.

Enhanced Assurance Package

However, to help cushion the financial burden of increased GST rates, the MOF will be introducing the Enhanced $6.6 Billion Assurance Package.

- Cash payouts from $700 to $1,600 will be given to every adult Singaporean adult aged 21 and above over the next five years

- $330 to $570 additional U-Save rebates will be given to eligible households over the next four years.

- Eligible Seniors aged above $500 will be given $600 to $900 cash payouts over the next three years through GST Vouchers (GSTV)

- $400 worth of Community Development Council (CDC) Vouchers will be distributed over 2023 and 2024 for Singaporean households

- $450 top-ups will be given to Singaporean children below the age of 20, and seniors above the age of 55

As a whole, the Assurance Package will cover at least five years of the additional GST expenses.

Enhanced Permanent GST Voucher Schemes

In essence, eligible Singaporeans are allowed to claim GST Vouchers worth up to $5,000.

To know more about GST Vouchers, watch this video to the end:

The assessable income threshold—the total income of an individual after deduction of business and employment expenses and donation—will be increased from $28,000 to $34,000.

For lower-income families, there will be additional cash payouts to alleviate their financial strains:

- For homes with annual values below S$13,000, they will receive S$500 cash payouts;

- For homes with annual values between S$13,000 and S$21,000, they will receive S$250 cash payouts.

For the lower-income households, the permanency of the GSTV Scheme will ensure that at least 10 years’ worth of additional GST will be covered and/or offset.

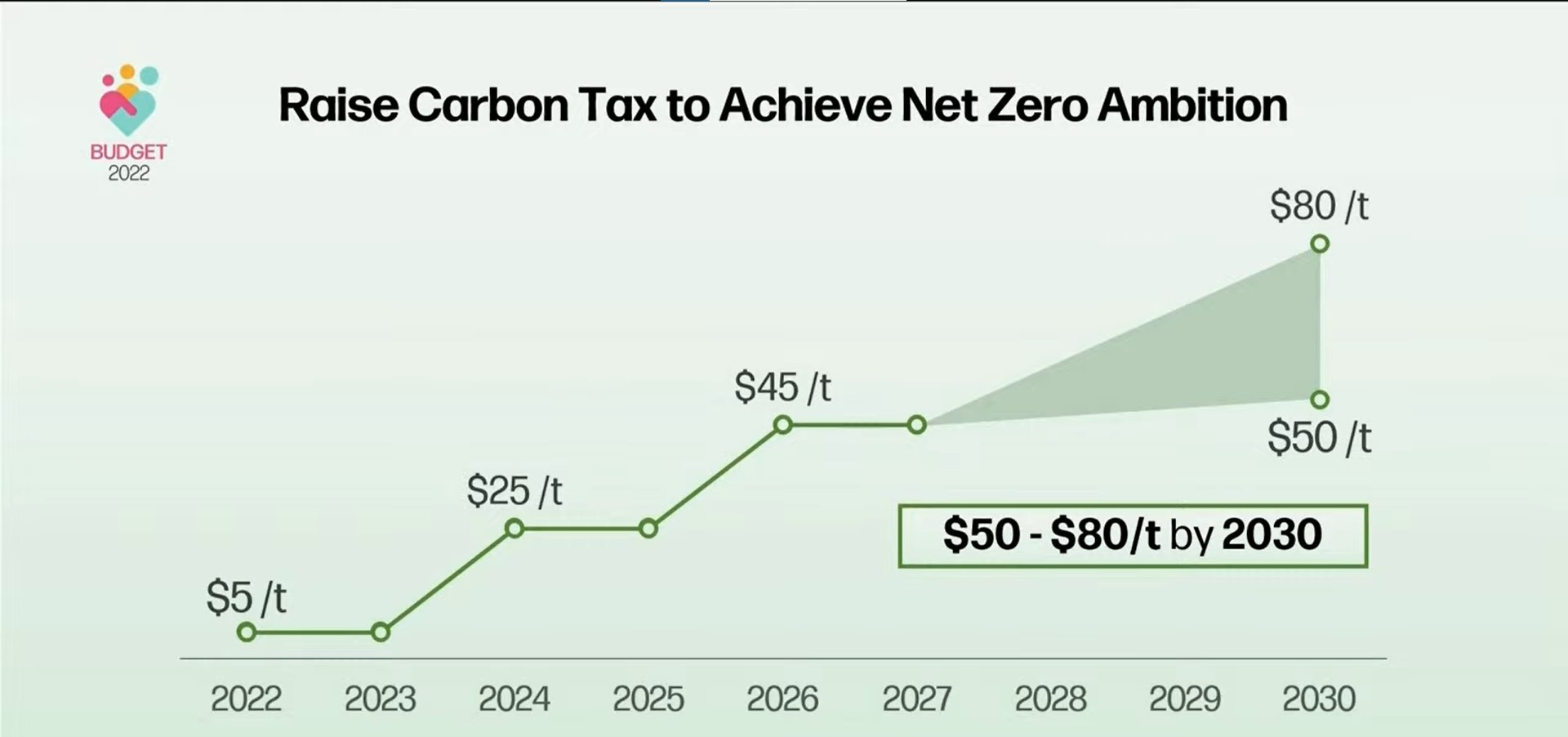

Increase in Carbon Taxes

One of the boldest claims made during the Budget 2022 speech was the declaration that Singapore would reach a net zero carbon emission by the middle of the century (2050).

In order to reach that goal, the MOF has a two-pronged attack, the first being the increase in carbon taxes.

From now until 2023, the carbon tax will remain unchanged at $5 per tonne.

- In 2024 and 2025, it will increase to $25 per tonne.

- In 2026 and 2027, it will become $45 per tonne.

- By 2030, it will be $50 to $80 per tonne.

As for the exact rates in the years following after 2027, more concrete details will be given then to sufficiently prepare businesses for any changes in the prices.

For households, however, they will feel the higher carbon tax through an increase in their utility bills.

For example, if carbon is priced at $25 per tonne, it would translate to a rough increase of $4 per month in utility bills for an average 4-room HDB flat.

However, this impact will be cushioned by the U-Save Rebates during the transition.

However, it should be noted that there will be no additional carbon tax applied on the use of petrol, disesel, and compressed natural gas, since there are already excise duties to encourage users to moderate their fuel consumption.

Moreover, MOF promises that the fuel excise duties will be reviewed periodically.

The Revenue Usage from the Increased Carbon Taxes

In his speech, Mr Wong emphasises that the additional carbon taxes is not to bolster government revenue.

Rather, the additional revenue will be funnelled back into the U-Save rebates to reduce the impact on households, and through other schemes to help businesses with the transition to a greener-energy model.

The majority of the revenue will go towards supporting a “decisive shift” towards decarbonisation through investments into new low-carbon and more energy efficient solutions.

Part of this initiative is to encourage the usage of electric cars.

Mr Wong notes that the registration of electric cars has increased from 0.2% to 4% last year.

In hoping to venture in that direction where internal combustion engines can be phased out by 2050, Mr Wong stated that it will be necessary to integrate some infrastructural changes like more electric charging ports at carparks to encourage such a change.

Join our Telegram channel for more entertaining and informative articles at https://t.me/goodyfeedsg or download the Goody Feed app here: https://goodyfeed.com/app/

In the Budget 2022 Speech, one of the points that Finance Minister Wong consistently reiterates is the fact that we are facing an ageing population which will shrink the work force whilst having the government increase social spending.

In fact, Mr Wong predicts that by 2030, Singapore will spend about S$27 billion or 3.5% of its GDP on healthcare.

Hence, changes need to be made to the taxing system, as well as how the healthcare system is configured, though the latter point will be addressed the Ministry of Health (MOH) in the future.

Wealth Taxes: Property, Cars, Income

With regards to taxing the wealthy, Mr Wong expresses that it is difficult to estimate the accumulation of wealth that an individual has, especially given its mobile nature, the existence of offshore accounts, as well as many other methods to evade financial scrutiny.

Therefore, the MOF has gone with the tried-and-true method of increasing property taxes; physical assets that are easier to track.

For non-owner-occupied properties, the marginal property tax rates will go from 10% to 20% to 12% to 36%.

For owner-occupied properties with annual values that exceed S$30,000, the property tax rates will increase from 4% to 16% to 6% to 32%.

Likewise, another physical asset that will come under the fire of additional taxes are luxury cars.

The first three tiers of Addition Registration Fees (ARF) for luxury cars will remain the same at 100%, 140%, and 180% respectively, but an additional tier will be added.

You can watch this video to the end to know more about what ARFs are:

For luxury cars sold at above S$80,000, the ARF rate will be 220%.

Last but not the least, there is personal income taxes.

In terms of this category, Mr Wong believes that there is room for “greater progressivity”, and that those who earn more should be made to contribute more.

The top marginal Personal Income Tax (PIT) will be increased with effect from the Year of Assessment 2024.

The portion of chargeable income in excess of S$500,000 up to S$1 million will be raised from 22% to 23%.

For those with an excess of more than S$1 million in PIT, their taxes will increase to 24% from the original 22%.

Higher CPF Contributions for Senior Workers

For senior workers aged 55 to 77, Singapore will continue to increase the employer and employee Central Provident Fund (CPF) contribution rates.

The increase will be paced out between 2022 to 2023, but workers from that age category should see a 3% to 4% increase in their CPF contributions over the next two years.

The CPF Basic Retirement Sum (BRS) will be raised by 3.5% each year for the next five cohorts turning 55 from 2023 to 2027.

Jobs and Business Support Packages

In view of how pandemic conditions have impacted the economy, the Small and Medium Enterprises (SMEs) especially, the government will be setting aside $500 million for the Small Business Recovery Grants.

SMEs in eligible sectors (so it’s not all businesses) will receive a payout of S$1,000 per local employee, up to a cap of S$10,000.

Likewise, local sole proprietors and partnerships in eligible sectors, as well as SFA licensed hawkers, market and coffee shop stallholders, regardless of whether they hire local employees, will receive S$1,000.

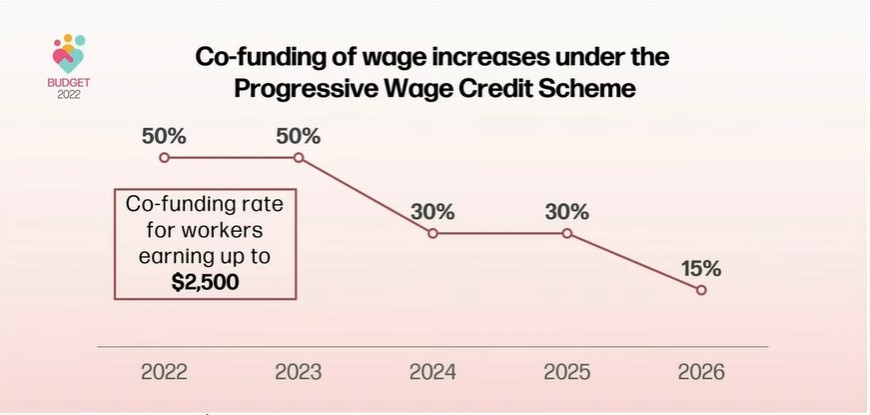

Progressive Wage Model

In order to uplift lower-wage workers, the government intends to expand the Progressive Wage Model to all sectors, like retail, food services, waste management, security, administrators, and drivers.

This means that companies employing foreign workers are required to pay all their local employees the local qualifying salary, which is currently set at S$1,400 per month.

Understanding that not all businesses might be able to bear the raising of costs so suddenly, the MOF has introduced the Progressive Wage Credit Scheme, which essentially co-funds wage-increases for lower-wage workers from 2022 to 2026.

In 2022 and 2023, the government will help by half, and the percentage will drop to 30% in 2024 and 2025, before tapering off to 15% in 2026.

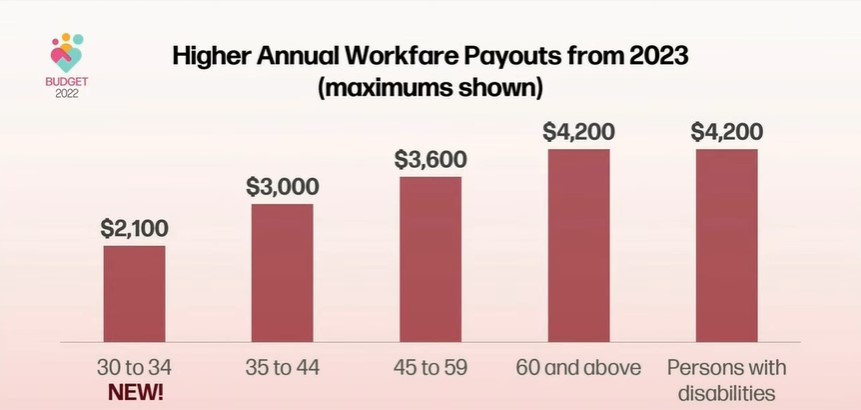

Changes to the Workfare Income Supplement Scheme

The workfare income supplement scheme encourages eligible workers to work up and build up the CPF savings for their retirement, housing and healthcare needs, by supplementing their income and retirement savings through cash payments and CPF contributions.

Coming into effect on 1 January 2023, the qualifying income cap for the Workfare Income Supplement will be raised from the current S$2,300 to S$2,500 per month.

A minimum income criterion for Workfare at S$500 per month will be introduced as well.

A new addition to this scheme is that workfare will be extended to workers aged between 30 and 24, and they will receive a maximum payout of S$2,100.

Those aged 35 to 44 will achieve a maximum annual payout of S$3000.

Those aged 45 to 59 will receive a maximum payout of S$3,600.

Those aged 60 and above will get the highest maximum payout of S$4,200 annually.

Read Also:

- More Details Have Emerged About the Murder of the 2 Greenridge Crescent Boys

- 2 Drug Traffickers Scheduled to be Executed Granted Respite from President Halimah

- Government Releases Their Stockpile of ART Kits to Retailers As They Run out of Stock Everywhere

- OnlyFans’ Titus Low, Who’s Now Also Very Active in YT, Handed 2 More Similar Charges

Image: YouTube (CNA)

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: