The cruise operator Dream Cruises has tentatively suspended new bookings for a period of two weeks.

According to The Straits Times, Genting Hong Kong has confirmed that the suspension of new bookings started last Friday (21 Jan) and will last until next Friday (4 Feb), but as to whether the suspension will be prolonged is unclear.

However, to customers who have already booked with Dream Cruises, rest assured, you are not affected at all.

Your cruises will sail as per usual.

A String of Unfortunate Bankruptcies

To understand how Genting Hong Kong landed itself with a US$7.28 billion debt, a sum so crippling that Genting Hong Kong had to file a wind-up petition and force the company into compulsory liquidation, we need to back track a bit first.

The initial trigger was actually a German-based ship builder called MV Werften filing for bankruptcy on 10 January, mostly due to the loss of Asian tourism income and casino-gouers that the coronavirus pandemic had caused.

Before the pandemic had struck, MV Werften was in the midst of securing the funding for the completion of the “Global One” mega-liner, which was already 80% completed by that point.

The Global One was designed to carry 5,100 passengers in 2,500 cabins, due to make its maiden voyage in 2021, but COVID-19 shredded the company’s timetable and pinched its budget.

Approximately €600 million (S$921 million) was required to finish up the last touches for the grand vessel and the shipbuilder had been seeking assistance from the government.

The decision to file for bankruptcy only came about after drawn-out discussions with the officials had proved that there was no common ground to be found.

In June, the state took a stake worth €60 million in business in exchange for a €47 million loan to the company, which was barely one-sixth of what was needed.

In total, the government had attempted to give financial support to the crumbling shipbuilder, amounting to around €300 million, since the beginning of the pandemic, but it was evidently not enough.

The delayed payments of wages to workers and the slow-going completion of Global One had been seen as a stain and it exhausted the cooperation of both sides.

Moreover, with travels being severely restricted, especially in Asia, the demand for huge cruise ships and luxury mega-yachts plunged hard, thus cutting off another source of revenue to make up for the losses.

COVID-19 had erased travelling demand off the map ever since the beginning of the pandemic, and cruise operators were the first to be halted, by virtue of the isolated and cramped spaces on board.

Most unfortunate of all, Genting Hong Kong indirectly and wholly owns the shipbuilding subsidiary.

Like dominoes in a supply chain, the crumbling of MV Werften meant that Genting Hong Kong was in trouble too.

Genting Hong Kong had attempted to offer a US$88 million lifeline, but the German court refused to accept it.

Reportedly, the salvage talks between the German authorities and Genting representatives had sputtered due to an internal dispute, with both parties blaming the other for MV Wreftren’s collapse.

Left with no other recourse, MV Werften could only file for insolvency and declare that it “has exhausted all reasonable efforts to negotiate with relevant counterparties under its financial arrangements.”

Hence, the shipbuilder, one of the sources of Genting Hong Kong’s top-liner cruise makers, has gone to bust.

Join our Telegram channel for more entertaining and informative articles at https://t.me/goodyfeedsg or download the Goody Feed app here: https://goodyfeed.com/app/

Losses Accumulated Over Three Years

Alas, having MV Werften falling into pieces isn’t Genting Hong Kong’s only problem.

With the coronavirus going into its third year, the havoc it has wreaked on the global tourism and travelling industries is difficult to summarise in a few words.

For Genting Hong Kong alone, the company’s stock has lost more than half of its original value since 2018, with US$766 million of capitalisation slowly trickling out without any returns.

Genting Hong Kong also owns and operates the Resorts World Manila casino and resort in the Philippines, which has reported a US$1.78 billion setback in 2020, in addition to a US$283.3 million loss in the first half of 2021.

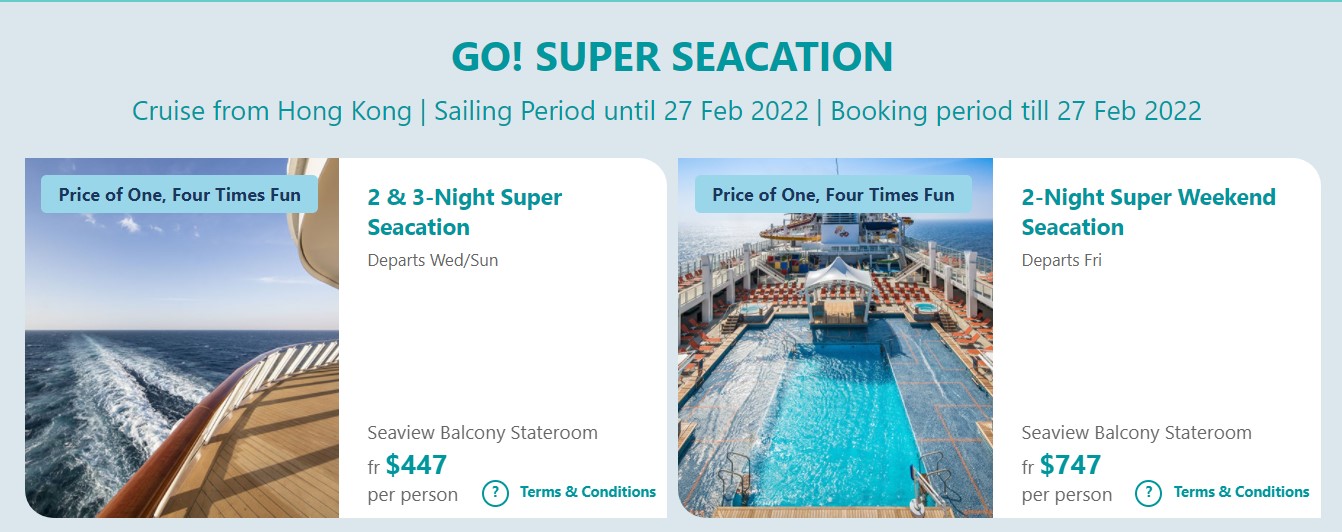

Its line of cruisers has attempted to stay afloat with “seacation” packages that last for two to four nights, which can cost anywhere from HK$500 to HK$28, 776 (S$4,970).

However, due to COVID-19 safety management measures that involve social distancing, a vessel that can accommodate up to 3,000 passengers can only fill up 75% of its capacity.

Furthermore, that’s not taking into account whether the Hong Kong consumers would be interested in the prospect of sailing to the middle of nowhere instead of a fixed destination for a vacation.

That is clearly exemplified in how only 1,070 passengers were on board in such a cruise trip in August 2021, after the seacation packages were introduced in July 2021.

Still, Genting Hongkong will continue to maintain its cruise schedules for Hong Kong cruises to three times a week in February and March, which is way better than having a white elephant at the docks.

Similar arrangements have been made for Singapore’s Dream Cruise, as well as the cruise ships in Malaysia.

Whilst an argument can be made about Hongkongers and Singaporeans loving luxury and delicious food, it does not detract from the fact that the local passengers on board have little to no interest in the gambling tables on board of the cruise.

Gambling makes up a significant portion of Genting Hongkong’s financial success, and yet the tables are left empty.

Thus, it should come as no surprise that Genting Hong Kong reported a record loss of US$1.7 billion (S$2.3 billion) last May.

More Troubles Seaward

To add more salt to their financial wounds, Genting Hong Kong’s Crystal Symphony, which sails around the coasts of the United States, was forced to end its final voyage in the Bahamas instead of Miami, Florida, like it was originally planned.

The reason for its diversion was that there was a US marshal and court-appointed custodian ready to arrest the vessel for its unpaid fuel bills of US$1.2 million if it landed in Florida.

The arrest warrant was issued by a US federal district judge of Miami, according to Stephen Simms, the lead attorney representing Peninsula Petroleum Far East.

The company he was working for has filed a lawsuit in the US district court to recoup a total of US$4.6 million for bunker fuel that went unpaid for, of which had been delivered to three of Genting’s ships since 2017.

That’s another checkmark on the list of financial agenda to settle.

Liquidation Process

In the face of the US$7.28 billion debt, Genting Hong Kong had no choice but to file for provisional liquidation with the courts in Bermuda.

The owner of Dream Cruise Holding has appointed Alvarez & Marshal’s Edward Simon Middleton and Tiffany Wong Wing-sze as its provisional liquidators.

All in all, Genting Hong Kong’s winding-up petition and appointment of provisional liquidators will be heard by the Supreme Court of Bermuda at 2:30pm on 20 January.

Presently, the liquidation of such a large tourism and travelling company stands to be the biggest casualty in Asia’s tourism industry.

In a statement on the Hong Kong Stock Exchange last Wednesday (19 Jan), Genting Hong Kong declared that the company’s available cash balances are predicted to run out by January. Majority of the group’s operations are expected to stop.

Malaysian Tycoon and once-Genting Hong Kong Chairman and Chief Executive Officer (CEO) Lim Kok Thay has resigned in the wake of Genting Hong Kong’s bankruptcy.

Mr Lim, who used to own 76% of Genting Hong Kong shares, stepped down from the company effective 21 January.

Similarly, Au Foo Yew, the Deputy CEO and President has resigned as well.

Future Hope for Dream Cruise

It’s hard to determine what the future of Dream Cruise will be.

The suspension of any further cruise trips “was implemented to protect the interests of the Dream Cruises’ guests”, the company stated, as it toils in troubled waters.

Currently, the joint provisional liquidators are inspecting the state of business and to identify and examine the future prospects of the company.

Singapore Tourism Board’s (STB) Director for Cruises, Ms Annie Chang, says that she is aware of the suspension and that she is keeping a close eye on the developments.

Ms Chang continues to add that “STB is confident in the recovery of the cruise industry and will continue its effort to anchor more cruise ships in Singapore”.

Only time will tell, I suppose.

But it can certainly be said that an old behemoth from the previous century in the cruise industry has sunk, but unlike the Titanic that hit the iceberg blindly in the middle of the night, this conclusion might have been foreseen earlier on when the pandemic dragged out for as long as it did.

Read Also:

- 4 People Between 19 to 22 to be Charged for Impromptu NYE Party at Clarke Quay

- Healing the Divide’s Iris Koh & a Doctor Charged for Cheating MOH With Fake Vaccination Records

- Istana to Hold CNY Open House on 5 Feb; Tickets to be Allocated by Balloting System

Featured Image: Dream Cruise Line