Fixed deposits used to be so safe, now not so much anymore.

The Singapore Police Force has released an advisory on a new scam on the rise, where scammers impersonate legitimate banks, offering high fixed deposit interest rates.

This new scam has claimed at least 12 victims since January 2024, with losses collectively amounting to $650,000.

This vindictive scam is unlike the $1 laundry machines or rusty vending machines that eat your coins and leaves you with a broken heart and empty hands.

These scams can leave you hundreds of thousands poorer, so read on to prevent yourself from becoming a new victim.

The Scammers Modus Operandi

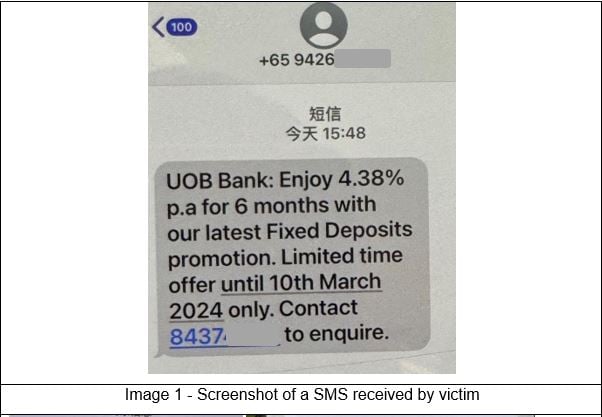

Victims would first receive SMS messages from an unknown number starting with +65 claiming to be from legitimate banks, offering promotional fixed deposit accounts with high interest rates.

These “promotions” had a limited time period, increasing the urgency in victims to secure this “promotion” fast.

Victims would then be invited to contact an unknown number to find out more.

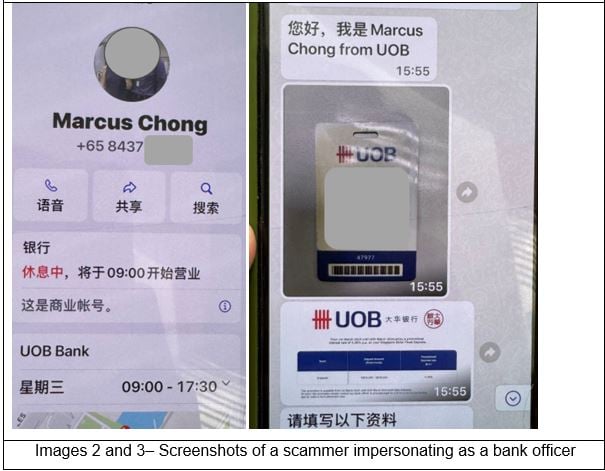

Once contacted, the scammers would impersonate bank agents, producing fraudulent staff passes, tricking the victims.

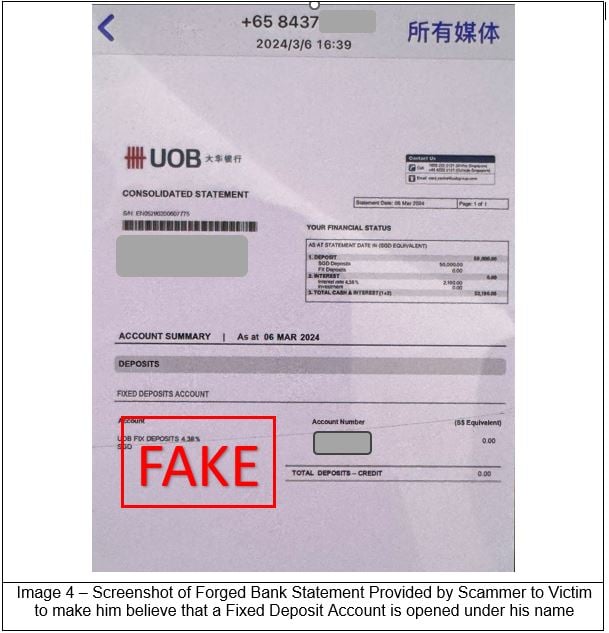

Personal details would be requested, under the pretense of opening the fixed deposit accounts for victims. Fraudulent bank transactions will also be forged and shown to convince victims that new bank accounts have been created under their name.

(The author would like to remind viewers that personal details such as banking credentials, card details and NRIC numbers should be kept private.)

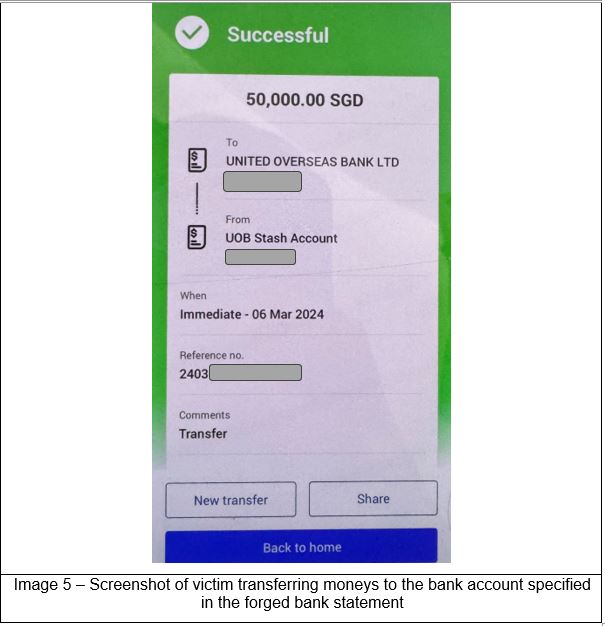

Victims were then told to deposit large sums to these accounts and that these accounts were meant to “hold the funds prior to the creation of their account”.

Victims would only realise they have been scammed after logging into their banking application and finding no changes to their bank system records.

In some cases, scammers would reassure victims by quoting an “activation period” for the bank accounts which delays the discovery of the scam. Eventually, when victims directly checked with the bank, they would find out that the accounts they transferred funds to belonged to other individuals and were not the alleged fixed deposit accounts created under their names.

How to Prevent falling for Scams

Here’s how to protect yourself so you don’t get scammed.

- Download the ScamShield App to prevent scam calls and SMSes.

- Check for scam signs with official sources such as this site or call the Anti-Scam Helpline at 1800-722-6688.

- Set security features such as transaction limits for internet banking transactons, enable Two-Factor Authentication (2FA), Multifactor Authentication for banks and e-wallets.

- Activate “kill-switch” if you have given away your bank information to suspected scammers.

- Contact banks directly at their official call centers on how fixed deposits can be placed.

- Tell the authorities, friends and family about scams. Report any fraudulent transactions to the bank authorities immediately.

You can protect yourself from scams, if advertised postings seem too good to be true, they usually are.

Let’s all stick to those vending machine coin scams, alright?

In the meantime, you can watch this video to know more about the top 10 scams in Singapore: