Sam Bankman-Fried Receives 110-Year Sentence for Fraud in High-Profile Crypto Case

“A learned fool is more a fool than an ignorant fool.”

This insightful aphorism was penned by the renowned 17th-century playwright, Molière, whose words seem to resonate with the contemporary saga of Sam Bankman-Fried, an MIT alumnus and legendary entrepreneur, now facing up to 110 years in prison.

What? 110 years?

Indeed, this intellect-driven transgression may consign Bankman-Fried to spend a lifetime behind bars, earning him the moniker of the “disgraced crypto king.”

Here’s an overview of the events that led to this outcome.

Born With a Silver Spoon

Samuel Benjamin Bankman-Fried’s birth in 1992 at Stanford University—an institution celebrated for its sub-4% acceptance rate—marked the beginning of a life amid academic distinction.

His mother, a Harvard Law School alumna, is an esteemed lawyer and professor emeritus at Stanford Law School.

His father boasts a J.D. from Yale Law School, is a distinguished professor at Stanford Law School, and a practicing psychologist.

His brother’s experience as a former Wall Street trader and his aunt’s position as the dean of Columbia University Mailman School of Public Health further underscore the family’s impressive credentials.

Following his graduation from MIT in 2014, Bankman-Fried quickly made his mark as a trader at Jane Street Capital. His entrepreneurial journey then led to the founding of Alameda Research and the cryptocurrency exchange FTX.

During an interview with Forbes, Bankman-Fried reflected on his university days, admitting to “half-assing” his physics degree and dedicating more time to video games, such as League of Legends, than his studies.

Well-Timed Business Amidst the Bitcoin Craze

The cryptocurrency exchange FTX, founded by Bankman-Fried, facilitated the buying and selling of digital assets, including bitcoin and Ethereum.

Within a mere three years, FTX reached a staggering valuation of $32 billion.

In that same timeframe, Forbes estimated Bankman-Fried’s net worth at an astounding $22.5 billion by age 29, swiftly elevating him to the 32nd spot on the Forbes 400.

The Unfulfilled Altruism & Collapse of FTX

Bankman-Fried aspired to emulate business magnates like Steve Jobs and Elon Musk, with their claims of altruism driving their ventures.

He adopted the “earning to give” philosophy but, despite his vast wealth, he had donated less than 0.1% of his fortune—a sum amounting to $25 million—by 2022.

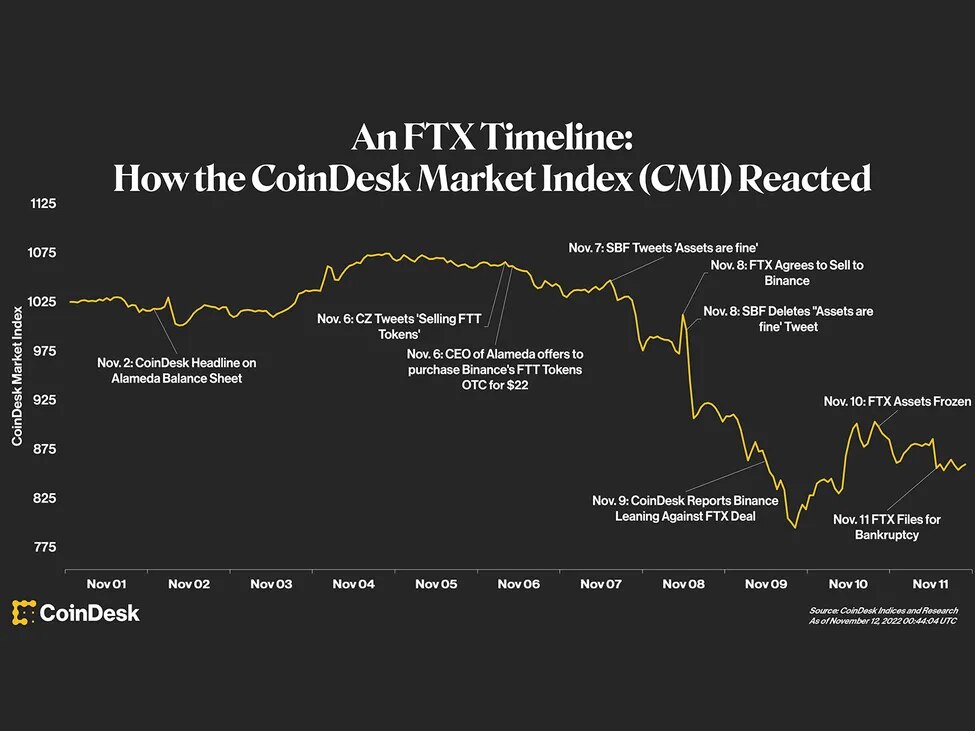

The downfall of FTX unfolded rapidly over a span of 10 days, beginning with a CoinDesk article and a leaked balance sheet in Nov 2022, significantly affecting numerous stakeholders, including Singapore as the second most impacted entity.

Justice Finally Prevails After a Year… Or Has It?

In 2022, Bankman-Fried became an emblem of the crypto industry’s excess when FTX collapsed. He faced allegations of misappropriating up to US$10 billion from customers for various personal expenditures, including political donations and venture capital investments.

The consequential trial, presided over by Judge Lewis Kaplan, took place this past Thursday, 2 Nov.

Prosecutors contended that Bankman-Fried had extorted funds from FTX to Alameda Research, despite assurances made via social media and TV ads about customer fund security.

Alameda Research reportedly utilized these funds to fulfill obligations to lenders and facilitate loans to Bankman-Fried and other executives.

These loans supported speculative ventures and substantial political donations aimed at influencing cryptocurrency legislation in his favour, as per the prosecution.

A tense cross-examination saw Bankman-Fried evading direct responses to critical inquiries.

A panel comprising nine women and three men ultimately convicted him of wire fraud, conspiracy, and money laundering—a combination of charges carrying a maximum sentence of 110 years.

An appeal from Bankman-Fried is anticipated.

His Friends Turned Their Backs; Yet, He Never Turns Over A New Leaf

With the implosion of FTX, Bankman-Fried’s situation grew increasingly dire.

Three of his top aides confessed to fraud, agreeing to cooperate with the prosecution in exchange for leniency.

Throughout the trial, these individuals testified that Bankman-Fried directed them to deceive the public and redirect customer funds from FTX to Alameda Research.

Despite this, Bankman-Fried remained adamant, never entering a guilty plea, maintaining that, though he erred in his management of FTX—omitting the establishment of a risk management team—he never misappropriated customer funds.

He defended his actions by claiming ignorance of the extent of Alameda’s liabilities until the verge of both entities’ collapse, saying in his testimony, “We thought that we might be able to build the best product on the market. It turned out basically the opposite of that.”

Consequently, Bankman-Fried upheld his innocence, once again, prolonging the verdict.

The court trials are likely to continue in early 2024.