For Grab users with a plethora of funds in your Grab wallet and the exactly reverse in your bank account, rejoice;

Because the ride-hailing service has just done you a great… service.

You’ll now be able to transfer your GrabPay funds… to your own bank account.

Though like everything else, it appears that there is a slight catch.

You Can Finally Transfer Your GrabPay Funds to Your Bank Account

According to Grab, all users will be able to transfer their GrabPay wallet funds to their bank account, effective from 8 February 2021.

Transfers can purportedly be made via FAST and PayNow.

Apart from your bank account, funds can also be directed to PayNow-registered mobile users, other bank accounts and other e-wallets in Singapore.

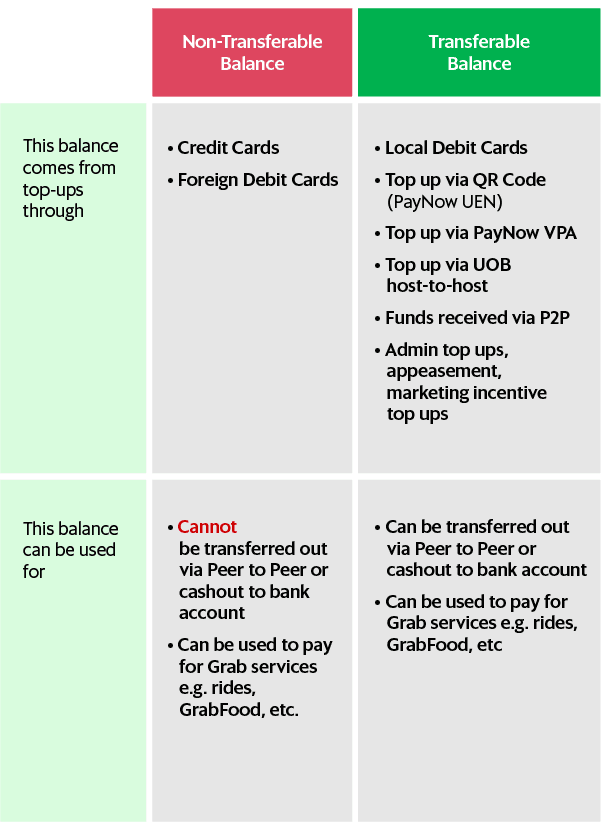

However, do note that there are two types of GrabPay balances: Transferable and non-transferable.

Transferable balances would include top-ups via local debit cards or QR codes. Non-transferable amounts entail top-ups through credit cards and foreign debit cards.

For a more concise explanation, you can peruse the following image:

Transferring

To attain a transfer-eligible license, you would first have to go through two relatively-punishing tests:

Firstly, you’re required to verify your identity via either SingPass or a form, in order to upgrade to a Premium GrabPay Wallet.

Thereafter, you’ll have to set up your own GrabPIN to make a transfer.

Once you’ve cleared both levels, you’ll gain access to the “Transfer” feature – which displays the respective transferable and non-transferable balance, as well as the different transfer-eligible options.

Please note that you’re only allowed to make up to two transfers a day. And though there is no minimum transfer amount, there is a cap in the form of S$5,000.

Not sure about you but I’ve never come across anyone with more than $1,000 in their GrabPay Wallet #truestory

Other FAQs

According to Grab, transfers to your own PayNow account (i.e. the bank account connected to your Grab mobile number) will not count towards your annual spending limit. Transfers to other accounts or e-wallets, on the other hand, will be counted towards your annual spending limit of S$30,000.

Meanwhile, funds can be transferred to any bank account, as long as they are part of the FAST bank transfer network in Singapore. Eligible banks are as follows:

- DBS Bank/POSB

- OCBC Bank

- United Overseas Bank

- Standard Chartered Bank

- CIMB Bank

- Citibank NA

- Citibank Singapore Ltd

- ANZ Bank

- Deutsche Bank

- HL Bank

- The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch (HSBC)

- HSBC Bank (Singapore) Limited

- ICICI Bank Limited Singapore

- Industrial and Commercial Bank of China Limited

- Maybank Singapore Ltd

- Malayan Banking Berhad

- Mizuho Bank

- Bank of China

- RHB Bank

- BNP Paribas

- Sumitomo Mitsui Banking Corporation

- The Bank of Tokyo Mitsubishi UFJ

- Sing Investments & Finance Ltd

At the moment, only local Singapore bank accounts can receive funds from your Grab Wallet. International bank accounts are still a no-go.

For more details, you can click here.

What’s Next For Grab?

Apart from GrabPay Wallet transfers, the ride-hailing service will also be rolling out another new feature: PayNow VPA top ups.

Known as a PayNow Virtual Payment address, hence VPA, the feature is essentially a unique identifier that’s linkable to your GrabPay wallet.

Once connected, you’ll be able to make PayNow transfers to your VPA from your choice of banking app – a notion that’s similar to how you make PayNow transfers to mobile numbers.

Or in other words, more convenience, less fuss.

For a more detailed explanation, you can click here.

Featured Image: msyaraafiq / Shutterstock.com

Read Also:

- Multiple Vehicles, Including a Bike, Slid Down Carpark Ramp Uncontrollably in Funan Mall Due to Wet Weather

- Lawrence Wong Immediately Went to Yew Tee After Swearing In As PM

- Everything About Google’s New AI Tools & AI Search Revealed in Google I/O

- McDonald’s New Yakiniku Burgers Have Reportedly Sold Out “Earlier Than Expected”

- Here’s The Science on Why We’re Obsessed With Our Chou Chou

- 6 Ways Buffet Restaurants Use Mind Games to Make You Eat Cheaper Food (Buffet Hacks)

- Facts About Vesak Day in Singapore

Advertisements