Scams nowadays seem like what TikTok trends are to non-Gen Zs—there’s a whole bunch of new ones coming up all the time and we can’t keep track of them at all.

In this case, Mr Adrian Kong was led to download an app that gave scammers control and oversight over his phone—and he thought he was just getting a good deal for beer.

OCBC’s inconvenience saved him…but DBS’ convenience didn’t.

Here’s what happened.

Scammers Marketed Alcohol at “50 Per Cent Retail Price”

Mr Kong first saw the advertisement promoting alcohol while browsing through Facebook.

Seeing that this was a total catch of a deal, he contacted the seller, “Mr Dizzy”, to buy 12 cans of Asahi beer, which amounted to a total of $42.

“Mr Dizzy” then sent him a link on Whatsapp to download an app to his Android phone to receive a rebate.

After receiving a notification that the rebate had been given to him, the seller then insisted he check his DBS banking app to ensure he had received it.

This was probably the point at which the scammers could access his details and gain control of his phone.

The next morning, much to Mr Kong’s horror, he found that there were four unauthorised PayNow transactions made, with a total of about S$60,000.

This money was purportedly saved up and meant to be used for his two children and their expenses.

Needless to say, this was an incredible shock, and Mr Kong proceeded to make a police report the same day.

Money Not Taken From OCBC Account

However, unlike his DBS account, his OCBC account was untouched, and even warned him that something like this might happen.

At around 2 a.m. in the wee hours of the morning, Mr Kong wanted to enter his OCBC app when he realised he was locked out.

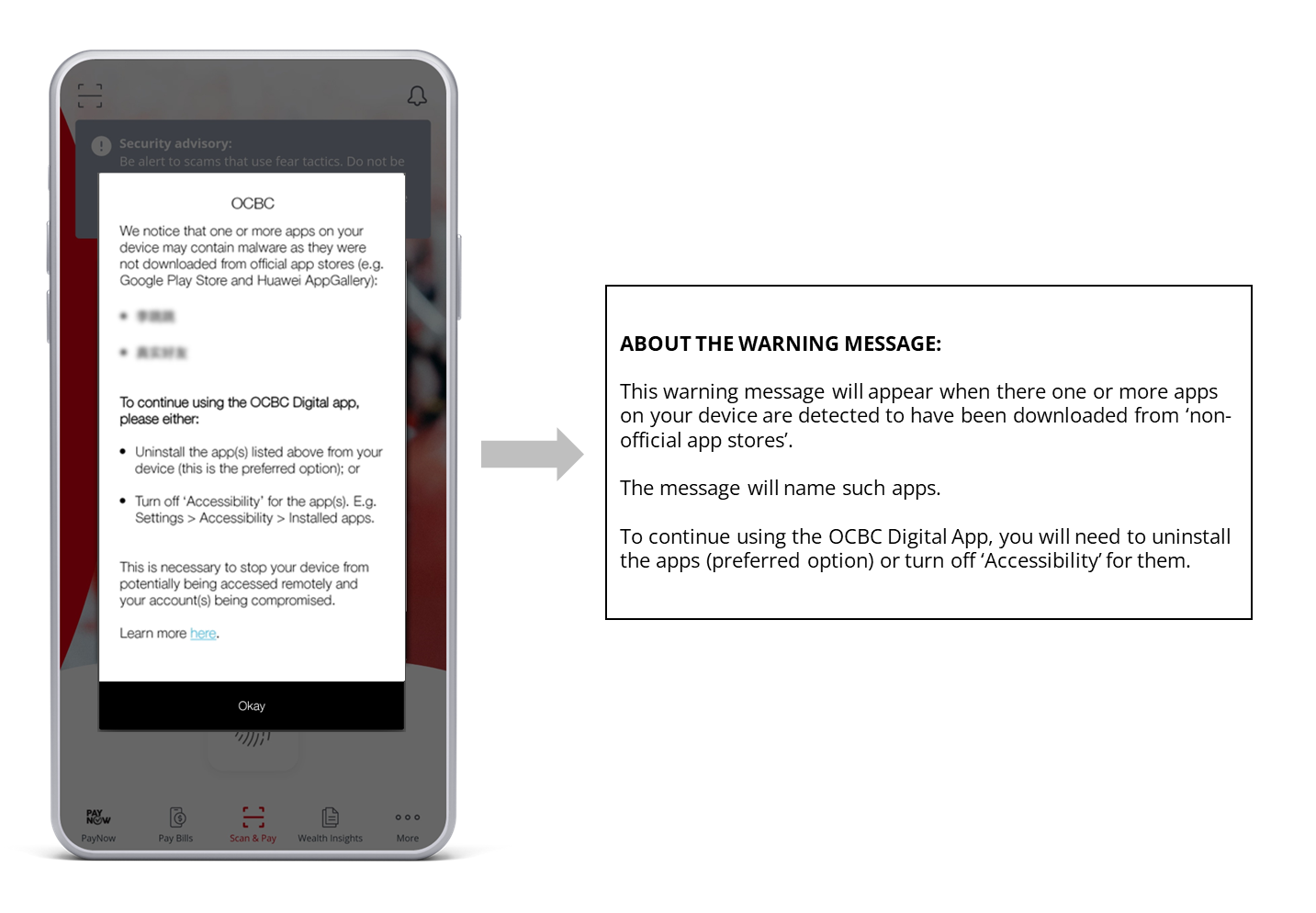

As part of a new security feature rolled out in August, OCBC informed him that a third-party app was interfering with the banking app.

Within one month of its launch on 5 August 2023, “OCBC’s anti-malware security feature has prevented scammers from making away with more than $2 million in savings from more than 30 customers.”

According to a media release from OCBC, “more than 30 customers reported having their Android devices compromised” by apps outside of official app stores.

According to OCBC, this new anti-malware feature will block access to OCBC bank accounts if the mobile phone has other apps on it that:

- Are downloaded from websites and sources other than official app stores and;

- Have the ‘Accessibility’ permission turned on

Mr Kong can thank this new feature for preventing more money from being taken from right under his nose.

DBS Account was Targeted

DBS, on the other hand, does not have the same feature in place to protect users like Mr Kong.

It is worth noting that DBS does have email notifications that alert users in cases where, for example, transfer limits are increased, as is the case with Mr Kong.

However, DBS is currently working closely with the Government and industry partners to protect its customers better.

Increase in Scams Linked to Third-Party Apps

There has been a spike in malware-related scams as of late, especially for Android users.

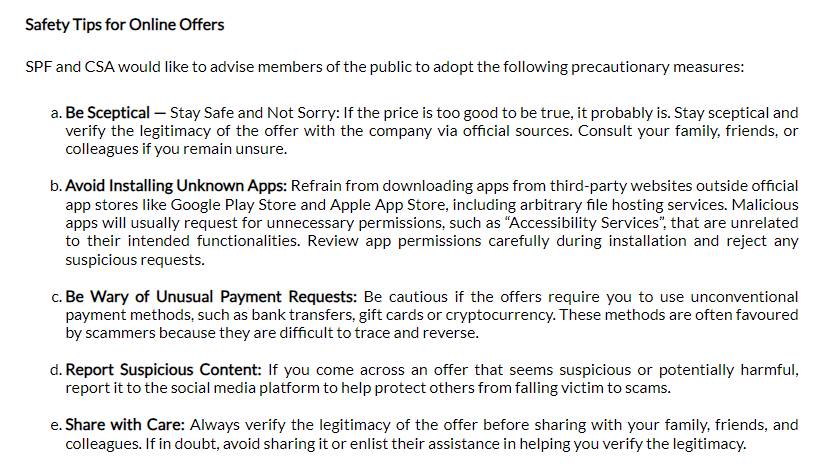

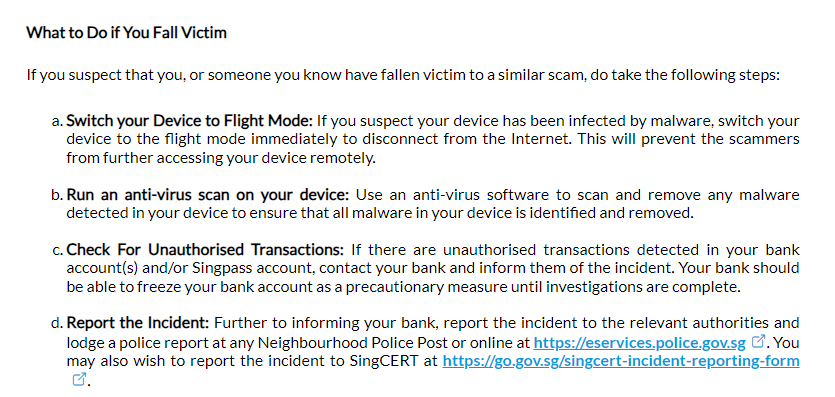

On 15 August 2023, the Singapore Police Force put out an advisory together with the Cyber Security Agency of Singapore (CSA) to “highlight the increasingly sophisticated tactics employed by scammers to deceive users into installing malicious apps on their Android devices.”

Maybe this is another reason to change to iPhone? #NotSponsored

According to SPF, “Android’s open nature allows for greater flexibility and customisation for developers and users, but it also makes it easier for scammers to develop and distribute malicious apps.”

SPF even gave some great tips for online offers, as well as what to do if you were to fall victim to one of these scams:

It’s the Wild West out there now with all these scams everyone, so stay safe and stay vigilant.

But if you want to calm your nerves and feel more at ease, here’s an explainer for insight into how OCBC implements the new security measure to protect us better and we will explain it to you faster than scammers can scam.

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: