Low-income platform workers are getting the support they need.

Finally, a level playing field will be created across all the companies in their sector, ensuring platform workers receive as much protection as their employers.

Deputy Prime Minister Lawrence Wong first introduced the changes to their CPF contributions during the Budget Statement 2023 on Tuesday, 14 February.

You can watch this video to learn more:

The Level Playing Field Was Already Planned

The idea of gradually making the CPF contributions of platform workers and companies on par with that of employees and employers was initially proposed by the Advisory Committee of Platform Workers.

It was accepted by the government last year in November.

Senior Minister of State for Manpower Dr Koh Poh Koon said the new scheme would help workers increase their CPF Ordinary (OA) and Special Accounts (SA) savings.

“In principle, platform workers of the same age and income as employees should be able to achieve a similar level of retirement adequacy through their CPF savings if they have worked the same number of years.”

According to Dr Koh, this creates an even playing field where platform workers “receive similar basic protections as employees.”

Ministry of Manpower Provides Further Details

Dr Koh acknowledged the concerns of platform workers regarding the impact of the CPF changes on their take-home pay during the Committee of Supply debate on 1 March.

Dr Koh encouraged low-income workers, namely those earning a monthly salary of less than $2,500, to opt into the new CPF scheme sooner than later, as they would receive more support if they did so.

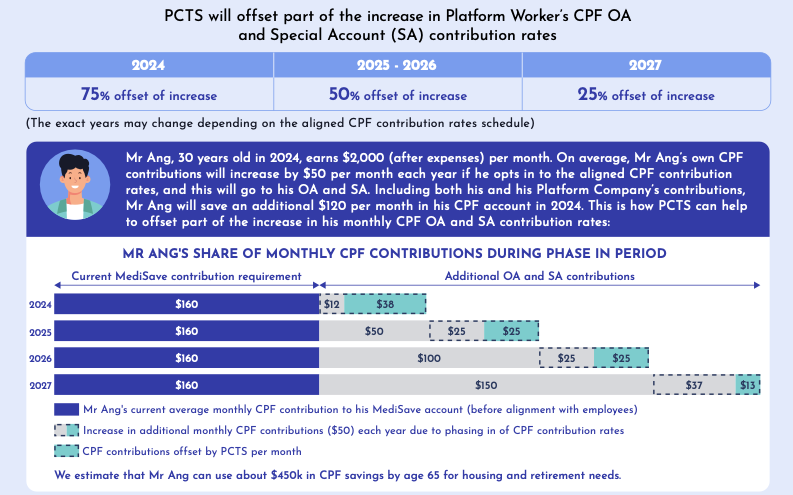

The new scheme, Platform Workers CPF Transition Support (PCTS), involves a 75% offset in 2024, which decreases gradually over subsequent years, to 50% in 2025 and 2026 and finally 25% in 2027.

Dr Koh mentioned in response to a question posed by Progress Singapore Party Non-constituency MP Hazel Poa that additional CPF contributions will be implemented evenly across five years.

It will be at around 2.5 percentage points per year for platform workers and 3.5 percentage points per year for platform companies and will be calibrated further “if necessary.”

Unlike employees, platform workers will only make Medisave contributions themselves (this is already compulsory) and will not receive CPF contributions from platform companies.

The increased contribution rates will be implemented in the second half of 2024. It is compulsory for those born on and after 1995. It is optional for those born before that.

Those who opt in will not be allowed to withdraw from their commitment later.

Workers earning between $50 to $500 per month will not have to make CPF contributions themselves but will receive them from platform companies (i.e. for example, if you deliver food for GrabFood and earn just $490 that month, Grab will disburse funds into your CPF account, but you’ll still receive $490 as it’s not a contribution from you).

Further Benefits

The Workforce Income Supplement (WIS), a scheme that pushes eligible workers to build their CPF savings by supplementing income through cash payments and CPF contributions, will be increased for platform workers to be on par with those of employees, according to Dr Koh.

Eligible platform workers could receive up to S$4,200 a year, a considerably significant increase from S$2,800 annually now.

40% of it will be given in cash, compared to 10% today.

The WIS payments will also be given monthly instead of yearly due to companies now deducting CPF contributions more regularly.