The Qoo10 situation may seem confusing, especially as it appears to be winding up, but it’s actually pretty straightforward.

Here’s everything you need to know, summarized in a way that even a five-year-old could understand!

If you prefer to watch a video about it, here’s one narrated by a cat:

Still here because you prefer to read? Well, here goes.

What is Qoo10?

Before anything, we need to explain what Qoo10 is, in case there are Skibidi kids who think that Shopee invented e-commerce.

Back in the days before we “Shopee” everything, and before influencers knew they’ve made it by appearing in a Shopee ad, online shopping was as messy and as risky as eating laksa while wearing a white shirt.

Retailers would set up their own online stores on their websites as there was no platform for retailers to sell their goods online.

Back then, there were only platforms for consumers to sell to consumers, kind of like Carousell.

However, it wasn’t simple: most were online bids, and in Singapore, it was mainly Yahoo! Auctions and eBay.

Then Qoo10 came in to save the world.

They were just like Shopee but in a website format (apps were still not a thing).

As someone who’s been through that period, Qoo10 was the bomb.

You could find everything there, and I’ll even go out on a limb to say that it was Qoo10, not Shopee or Lazada, that made people in Singapore believe in selling and buying through an online platform.

After all, remember: Amazon was already in the US, but their presence wasn’t strong in Singapore then.

What you might not know is that Qoo10 actually did continue with this until September this year, as people in Singapore were still selling and buying in Qoo10.

It was only in July that it got into the news for all the wrong reasons, and slowly, things started to decline.

So, what the heck happened?

History of Qoo10

For that, we need to look at two parts of Qoo10’s history first, because without it, this wouldn’t make sense.

Back in 2000, a platform called Gmarket was established in South Korea. It kind of worked more like Carousell + eBay.

In 2009, eBay, back then a giant that was trying to gain as much market share in the world, bought Gmarket for USD$1.2 billion.

That was when the ownership and its branding changed as often as Taylor Swift changing boyfriends.

But long story cut short, it eventually rebranded as Qoo10 in 2012, and raised funds from many investors in 2015. To be specific, they raised USD$82.1 million, whereby one of the investors was the then Singapore Press Holdings.

Everything seemed fine, right? They were just building their war chest to fight incoming competitors like Lazada and Shopee, which were launched in 2014 and 2015 respectively in Singapore.

So, for the next few years, the battle began as usual, with all the platforms aggressively acquiring both merchants and consumers.

And it was a very tough fight: do you know that back in the days, Shopee had almost no seller fees? Those were the good old days when companies fought to change our habits.

While we, the consumers, might not see the fight, it was obvious in the backend, when companies were burning through money just to gain market share.

While Shopee and Lazada continued to engage influencers to dance, and pay websites like goodyfeed.com to write articles for them almost every month, Qoo10 had a different strategy.

Qoo10 Buying Companies Instead of Marketing Massively

From the outside, Qoo10 looked perfect. You wouldn’t know that Qoo10 was in any trouble before 2024.

In fact, when news broke that they were buying Wish in cash, we all might have had the impression that Qoo10 was doing very well. Usually, companies buy other companies with both their shares and cash, so using fully cash to buy a company is not common.

But given that Wish is a listed company, it had to be done that way.

Now, what you might not know is that other than buying Wish in 2024, they also bought the AK Mall, a Korean online platform, for about half a million Singapore dollars.

Before that, Qoo10 also bought many similar online platforms, and two of which, which are in Korea, are TMON and WeMakePrice.

Note that Qoo10 is a Singapore-registered company, though these brands operate in Korea and have offices there.

Cracks then started to surface in the later part of 2024.

The Cracks in Qoo10 Started to Surface

All of a sudden, in early July 2024, it was about 500 merchants claimed that they didn’t receive payment from WeMakePrice since May 2024.

The total amount came out to be about USD$26.6 million as reported by the authorities on 11 July, or USD$2.9 million as mentioned by WeMakePrice CEO on 25 July.

Back then, they claimed that it was a glitch in its payment system, and that they’d complete the payments by the end of July.

But by mid-July, it was reported that even TMON wasn’t paying.

With that, the Korean authorities immediately sprang into action, investigating and monitoring the situation, as major merchants also started to leave the platforms.

Finally, in end-July, the founder and CEO of Qoo10, Young-bae Ku, was summoned for an emergency hearing with the South Korean government, because the situation had gone out of control.

It’s estimated that there are now about 60,000 merchants in WeMakePrice and TMON who were not paid.

It got so bad that the South Korean authorities even offered loans to affected merchants so that they could tide over the situation.

The Qoo10 CEO admitted that they had “temporarily” used funds from WeMakePrice and TMON to buy Wish.

However, he said the money had since been returned. He also said that within 30 days, he’d find the money to pay the merchants, saying that he’d use his personal assets, or even sell his stake in Qoo10, or use it as collateral to borrow money personally, to save the business.

All these happened in South Korea; is Singapore affected? Not yet.

During this period in Singapore, Qoo10 was still operating as usual, so we might not have known what was happening.

After all, WeMakePrice and TMON aren’t household names here, so we thought they were completely separate from Qoo10.

Singapore Qoo10 Started Showing Its Cracks

It was only in late August that it was reported that Qoo10 had been retrenching people in its headquarters, which is in Singapore, since mid-August.

By the end of August, over 80% of its staff had reportedly been let go, most of them Singaporeans.

Soon, reports of Qoo10 in Singapore not paying their merchants surfaced.

In mid-September, it was reported that the Singapore Police were investigating Qoo10 after merchants lodged reports of non-payment.

Now, several merchants have even gone to the Small Claims Tribunal, a small specialized court in Singapore for people or companies to seek claims of under $20,000 through the court.

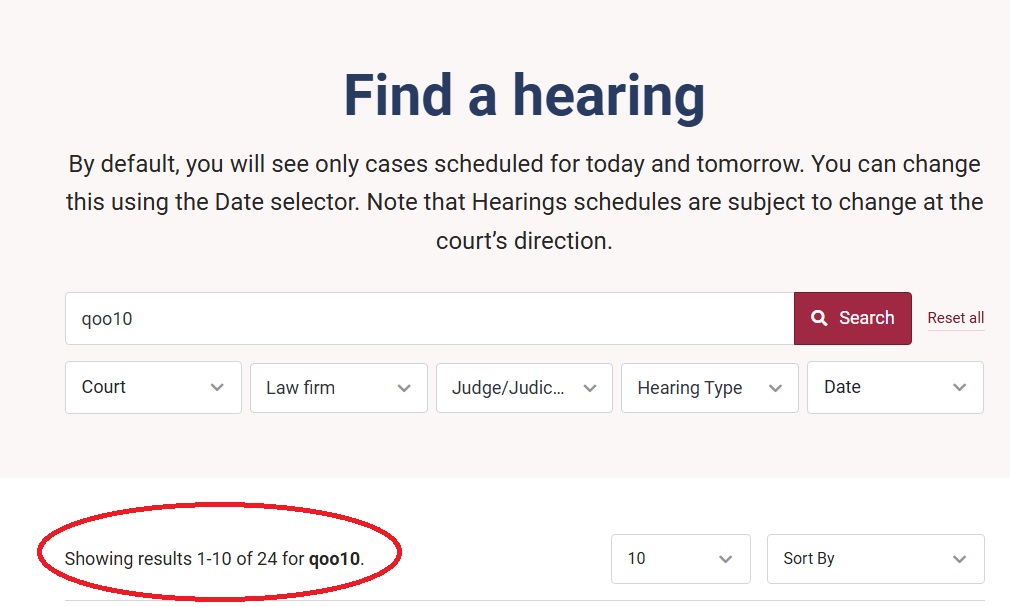

In fact, these claims are still ongoing, because if you go through the Singapore hearing list, there are well over 20 ongoing cases as of now.

Qoo10 then started to ghost everyone, including reporters who headed to their office.

Later, on 23 September, MAS stepped in. For Qoo10 to accept payment from customers or to send payment to merchants, they kind of needed MAS’ permission.

MAS suspended Qoo10’s payment service from 23 September, and if Qoo10 wanted to continue payment services like receiving payment, they had to use a third-party payment service instead, kind of like using PayPal.

In early October, Korea prosecutors requested an arrest warrant for the Qoo10 CEO, TMON CEO, and also WeMakePrice CEO.

They were afraid that the CEOs would destroy evidence and flee.

In addition, they also suspected that Qoo10 may have misused money from WeMakePrice and TMON to buy Wish.

However, the court denied the arrest warrants for them, because there was a low probability that they would flee or destroy evidence.

The Final Nail in Qoo10’s Coffin

Before we could wonder if Netflix was going to buy the story rights of Qoo10, the final nail in the coffin came.

Remember: throughout the whole saga, Qoo10 was still a live company. But soon, it might not be.

When a company is suffering from so many debts, they can either declare bankruptcy and creditors won’t be able to seek money from them while they slowly find ways to return the money, or they wind up, so their assets can be sold off to pay off the debts.

Several companies applied for Qoo10 to wind up, and one of Qoo10’s creditors said they owed them over S$72 million.

With so many creditors, the high court in Singapore approved the winding-up application by a creditor, which was supported by six other creditors, and therefore, ordered Qoo10 to wind up.

This means Qoo10 must now sell off all their assets to pay off their debts, and after that, close down. In other words, this time, it’s really the end for Qoo10.

If you go to Qoo10’s website, it’s almost like nothing has happened.

However, a liquidator has taken over the company, so they would be trying to pay off creditors using whatever assets they have. This means this is, indeed, the end of Qoo10; even if the website still looks like it’s still operational.

Once again, to have a visual understanding of this article, watch this video to the end: