A 27-year-old Singaporean woman was fined $18,000 on 27 March 2025 after evading Goods and Services Tax (GST) on luxury items purchased in Europe and later posting tips online about how to avoid customs detection.

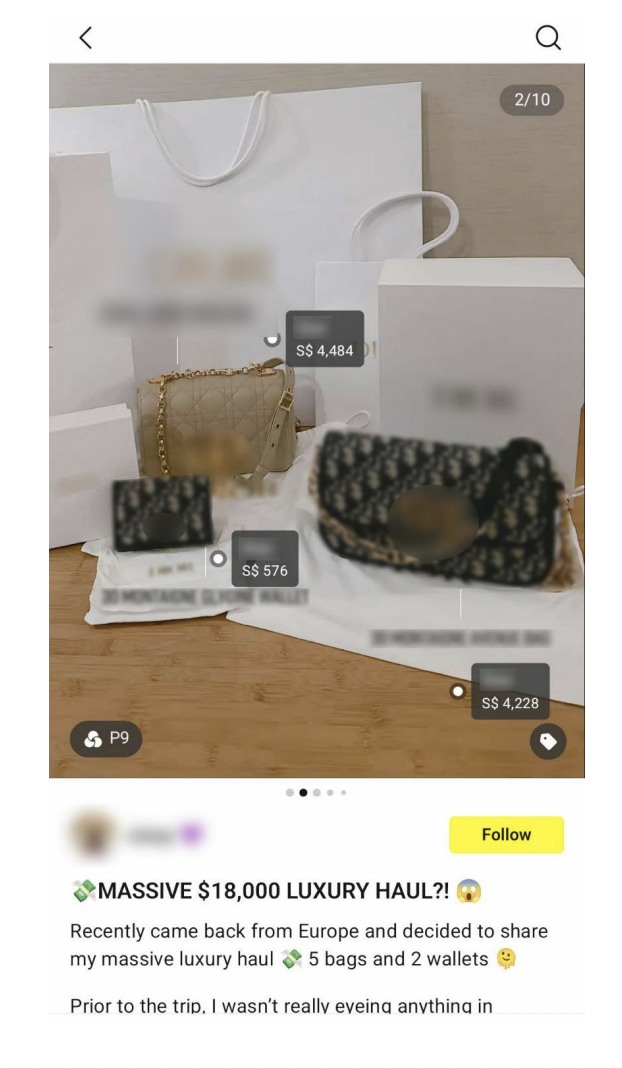

Cloey Tan Wan Qi travelled to the Netherlands and Belgium with her family and boyfriend in May 2024, where she bought multiple luxury items for personal use. Her purchases included five bags from Christian Dior, Gucci and Louis Vuitton, two luxury wallets, a pair of Michael Kors shoes, and an engagement ring from House of Gassan.

GST Evasion at Changi Airport

According to Singapore Customs, authorities later found 17 undeclared items with a total value of $25,350.92. Her actions resulted in GST evasion amounting to $2,281.58.

Despite knowing she was required to pay GST upon returning to Singapore, Tan cleared immigration at Changi Airport on 10 May 2024 without declaring her goods.

Singapore law grants GST relief for goods up to $500 for travellers who have been out of Singapore for 48 hours or more.

Smuggling Tips Shared on Social Media

Days after returning to Singapore, Tan posted about her European purchases on social media platform Lemon8, detailing how she evaded paying GST. One of her posts was titled: “Six tips on how to smuggle luxury goods and avoid detection by Customs”.

Authorities became aware of these posts, leading to her arrest in January 2025.

Court Proceedings and Judge’s Comments

In court, District Judge Eddy Tham noted that Tan not only evaded the law but had “the audacity to publicise what she did and teach others how to circumvent the law”.

The prosecutor sought a fine of $18,000, pointing out Tan’s initial lack of remorse demonstrated by her online posts. However, the prosecutor acknowledged that Tan subsequently showed remorse by making full restitution and pleading guilty.

Customs Regulations and Similar Cases

Under the Customs Act, those convicted of evading duties can be fined up to 20 times the amount of duty and GST evaded or jailed for up to two years.

In a statement, Singapore Customs stressed that evading duties and GST at checkpoints is “a serious offence that cannot be condoned” and that “this revenue belongs to Singapore, and its collection is essential to maintaining a level playing field for local businesses that pay these taxes”.

According to The Straits Times in November 2024, more than 13,000 travellers had been fined for evading taxes across air, land and sea checkpoints since January that year, with total fines exceeding $3.4 million.

Undeclared items included bags and accessories from Prada, Yves Saint Laurent and Balenciaga, and Pop Mart toys like Labubu figurines.