While the status quo of transportation in Singapore is public transport, cars still make up a considerable portion of travel.

But cars are no affordable alternative to public transportation as purchasing a car often requires a six-figure commitment. Thus, many people consider leasing rather than purchasing a vehicle.

However, while leasing a car requires lower up-front costs and peace of mind regarding maintenance and insurance, will it save the driver money over the long term? We break down the costs below.

Owning a Car Costs More Initially, But is Cheaper Long-Term

When deciding whether to buy or lease a car, drivers consider more than just the price of the vehicle.

In the case of leasing, the convenience is an attractive benefit since you get a brand new car for a neat monthly price that includes insurance, roadside assistance, maintenance and road tax.

Another benefit with leasing that can entice financially constrained drivers is that the upfront cost is an affordable deposit that is typically one to months of the monthly lease and is also refundable.

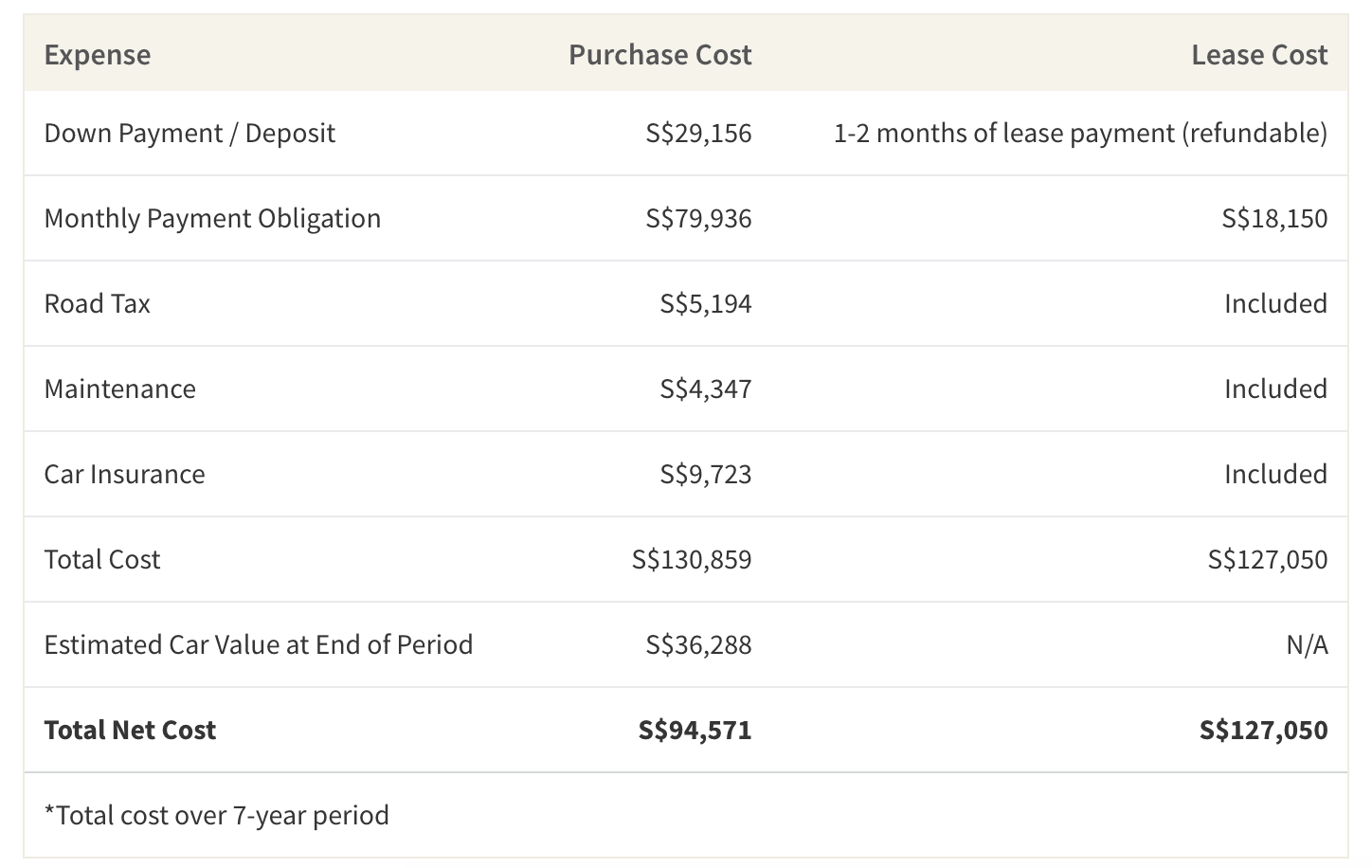

However, how much do you pay for this convenience over the long-term? All in all, we found that the average monthly lease price of a Toyota Corolla Altis 1.6 is S$1,513, making the total cost of leasing a Toyota for 7 years about S$127,050.

7-Year Cost of Leasing vs. Owning Toyota Corolla Altis 1.6

On the other hand, while buying a vehicle requires a large down payment and more upkeep, we estimate that the total net cost is actually lower than leasing. Let’s say you are looking to purchase a standard Toyota Corolla Altis 1.6.

If you choose to take out a 7-year car loan with an interest rate of 2.5%, your total expenses including monthly loan payments, insurance, annual maintenance, and road tax over 7 years will be S$130,859.

However, you also retain your car’s value at the end of the 7 years, unlike a leased vehicle. This value consists of rebates or the potential sale price, which we estimate to be either S$21,780 or S$36,288, respectively.

Not only that, if you decide to keep your vehicle after the 7-year period, we estimate that your ownership costs will be 71% lower than leasing, albeit with an older vehicle than if you were leasing.

What About Luxury Cars?

One appealing aspect of leasing a vehicle is that you can get your luxury dream car for a fraction of the upfront purchase cost.

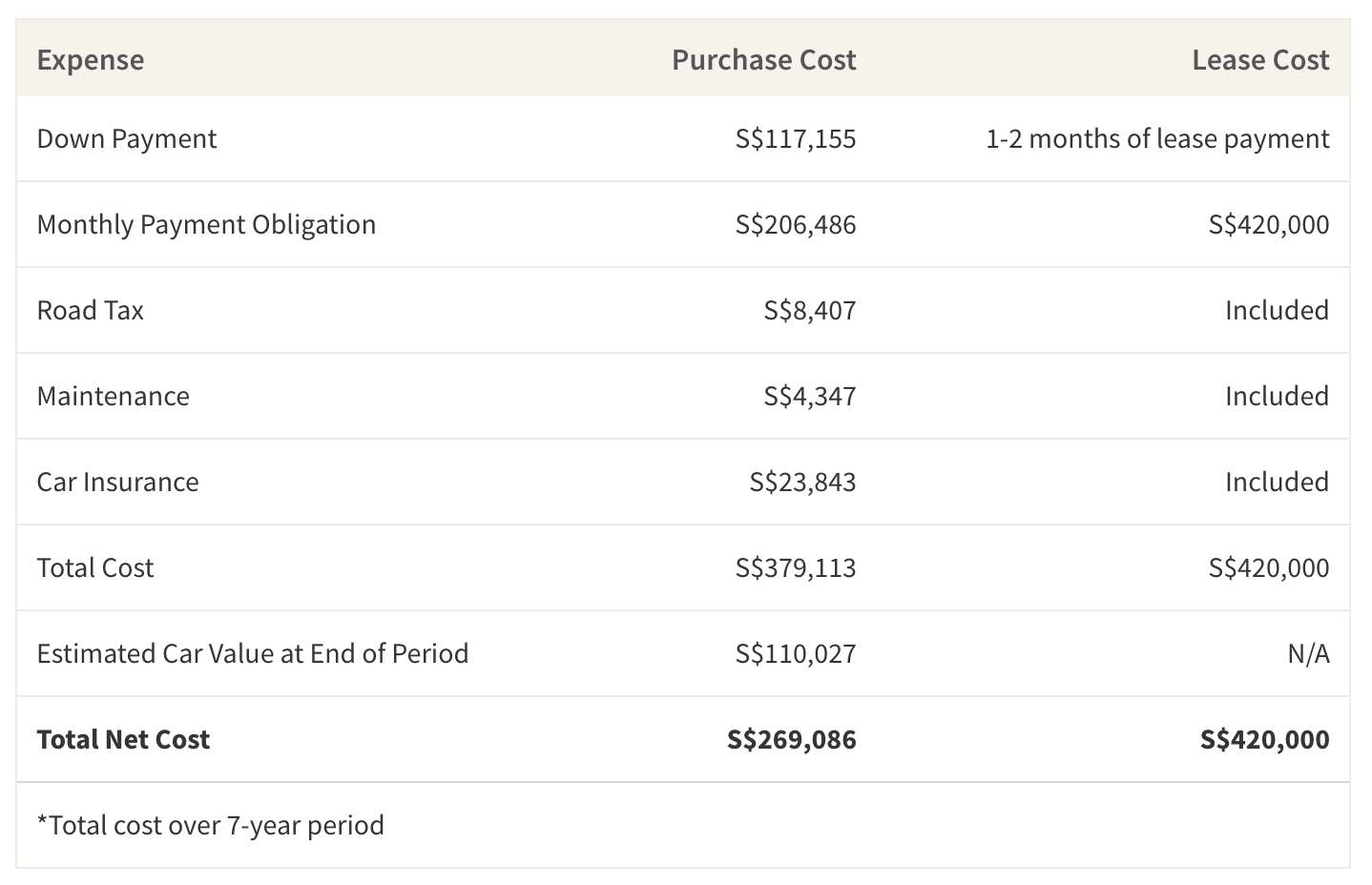

Because drivers may want to consider leasing a luxury car as opposed to buying a more affordable sedan, we wanted to compare the cost of leasing and purchasing luxury vehicles.

We looked at two BMW 5 Series models and found that purchasing can save you between 35% compared to leasing, over a 7-year period.

For instance, while the new BMW 530i Luxury series is expensive both to purchase and to lease (the monthly lease price was approximately S$5,000), your total net cost at the end of a 7-year loan term can be up to 35% lower than if you leased it.

Even when looking at the slightly slower and less powerful BMW 520i model with a more modest lease price of around S$2,500, your net cost of the purchased version will be around half of that of the leased.

Estimated 7-Year Cost of Leasing vs. Buying BMW 530i Luxury

Which Path is Better For You?

There is no right answer to what would work best for your needs. However, one way to determine whether you should lease or buy depends on how much cash you have available. For example, car loans only cover up to 70% of the purchase price, requiring that you make a down payment of at least 30%, which can amount to tens of thousands of dollars for many vehicles.

If you are unable to make a down payment of this size, leasing may be a better option. Furthermore, we looked at mid-range costs of owning a car. If you require a car for a smaller period of time, say one to three years, then leasing may be the easier and cheaper alternative.

Lastly, leasing is a win for drivers who prefer to stay up to date on the latest car models since you can swap out your car with a brand new version every few years.

On the other hand, there is a certain value to owning your own property. You don’t have to worry about finding a new lease every few years and you can choose to sell your car whenever you want.

Furthermore, after you finish paying off your car loan, you will have a fully functioning vehicle with an annual operating cost that is considerably less than a leased one.

Lastly, there are ways car owners can save even more, such as with their insurance. For instance, if our Toyota and BMW drivers were safe drivers, they can save several thousand dollars over the course of their car ownership after they qualify for a 50% NCD on their car insurance.

Regardless of what you choose to do, driving a car in Singapore is expensive and the costs have to be considered and tailored to your budget.

We’d love to know, do you lease or own a car? Which method do you think is better for you?

Methodology

To make our calculations, we used a combination of publically available data and several key assumptions. Using SGCarmart, we were able to find the purchase price, lease price, COE, ARF and other key figures for calculating cost, depreciation and rebates. W

e then calculated the annual cost of purchasing and leasing a car. When it came to leasing, available data gave us an estimated deposit figure of 1-2 months of the lease price.

Since the deposit is refundable, we did not add it to our total lease cost calculations.

Furthermore, since a typical lease ranges from 4-8 years and the standard loan is 7 years, we assumed a total lease period of 7 years. This meant we used two 3-year period leases and a 1-year lease.

To account for the value of owning a car, we considered not only the expenses you’ll encounter, but also its inherent value and rebates. When calculating the left-over value of a purchased car we took into consideration its value after 7 years of depreciation and its potential PARF and COE rebates.

For the Toyota, we assumed an average annual depreciation rate of S$8,700, which left us with a value of S$36,288. Using the equations for COE and PARF rebates, we found that the total rebate value for a Toyota can be S$21,780.

Since you can receive this rebate in cash upon deregistering your car, it essentially cuts down on your total car expenses just as selling your car would.

However, because the typical resale value was higher than the rebates, we used the resale value for the total net cost with the assumption that most people would want to maximise their returns.

We did not include annual fuel calculations because we assumed the driver would drive the same amount whether he leased or bought the car.

We also made several assumptions in our calculations.

First, we assumed an average maintenance cost of S$621 for both the BMW and Toyota. However, since a BMW is a luxury vehicle, the average maintenance cost may be much higher if serious repairs are needed.

Furthermore, to calculate insurance costs, we used the average insurance rate of S$1,389, which is the rate for a 45-year old male driver.

However, please note that these figures are estimates and may or may not be representative of your personal experience as a driver.

This article originally appeared on ValueChampion