As the New Year unfolds, Singapore is set to witness several significant changes.

While some of these changes might be daunting, it’s crucial to stay informed about what’s happening in the city-state.

Let’s delve into five major developments for 2024:

Full Subject-Based Banding in Secondary School

While some may be concerned about rising prices, secondary school students have reason to rejoice.

In 2024, the traditional categorization of students into Express, Normal Academic, and Normal Technical streams will be replaced by full subject-based banding.

This means students will study in mixed classes and have the flexibility to choose core subjects like English, Maths, or Science at levels that match their abilities.

However, subjects such as Art, Music, Food, and Consumer Education will be taught at a common level for everyone.

Property Tax Set to Rise

Property taxes are set to rise due to increased market rents and annual property values for both HDB and private properties.

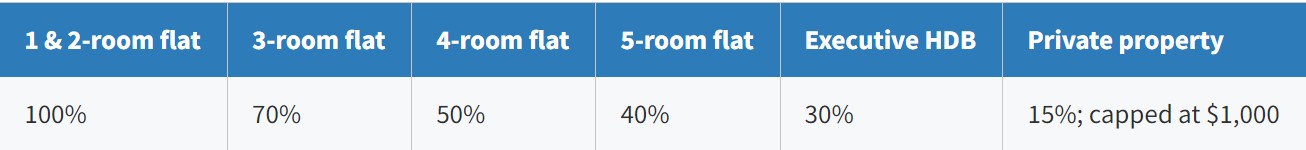

However, if you live in your own flat, do not fret as the government will be providing one-off rebates of up to 100%.

However, if you don’t own the flat you live in and it’s not your primary residence… good luck as it can be quite expensive.

The government will increase property taxes for properties that are not owner-occupied. This includes residential properties that are rented out and owner-occupied properties that exceed an annual value of $30,000.

The intention is to maintain a tax system where those with higher-value properties contribute more.

Increase in Stamp Price

Standard regular mail for domestic postages will be $0.52, an increase by $0.01 from 2023. Of course, this adjustment applies to international mails as well.

This probably doesn’t bother you unless you’re a Carousell seller that doesn’t do meet ups.

GST Increased to 9%

I’m sure you already know about this change and have been dreading it.

Starting from January 1st, 2024, the Goods and Services Tax (GST) has risen from 8% to 9%. This hike marks the second phase of the GST increase that was initially announced in Budget 2022 speech. The first phase occurred in 2023 when the GST was raised from 7% to 8%.

Let’s pray that we will receive more cash payouts this year during the upcoming Budget 2024 speech.

Changes in CPF Contributions

CPF contribution for some people will change, too this year. This only affects higher income people, so if you regularly buy groceries from Cold Storage and Scoop Wholefoods, do take note.

These changes will be phased in gradually. The CPF monthly salary ceiling will rise to $6,800 in 2024, up from $6,300. The long-term goal is to reach a monthly ceiling of $8,000 by 2026.

If you earn more than the monthly salary ceiling, the total CPF contributions from you and your employer will increase which means the salary you bring home will be slightly lower.

This measure aims to encourage higher savings for a comfortable and financially secure retirement, according to Deloitte Singapore’s tax partner, Yap Hsien Yew.

You can watch this video for more information: