Travel is often associated with relaxation, adventure and fulfilling wanderlust. However, amidst the positive associations we have with vacationing abroad, there are also stressors that can put a damper on our trips. Unexpected accidents, medical issues, trip cancellations and lost baggage are all common worries that creep to the forefront of our mind as our trip gets closer. In fact, around 9 out of 10 Singaporeans have relied on a travel insurance policy to quell these anxieties. But while purchasing travel insurance can be prudent, there may actually be times when it may not be beneficial. Below, we explore when you should consider buying travel insurance—and when you can consider skipping it.

Trips to New Destinations

While travelling to new countries is exhilarating, new languages, different cultures and unfamiliar local laws can become overwhelming when facing an emergency. If you are travelling to a destination you haven’t previously visited, travel insurance can provide peace of mind that goes beyond simple baggage loss and medical coverage. Travel insurance policies usually provide emergency assistance services that will guide you to the nearest hospitals, help you navigate emergencies and walk you through filing a claim. Additionally, travel insurance can be a financial lifesaver if your destination is a country with exorbitant medical costs or has high crime rates. In fact, some travel insurance plans have medical coverage as high as S$2,000,000 and credit card theft coverage up to S$1,000 for as low as S$68 for a global one-week trip.

Short Trips to Malaysia or Thailand

If you are planning a short trip to see family in your hometown outside of Singapore, you most likely do not need a travel insurance policy. This is especially the case when you are driving to your destination, as you won’t be able to take advantage the travel insurance benefits that are specific to flying, such as trip cancellation, baggage loss or trip delay benefits. Additionally, if you are taking the quick flight to a neighboring country, your credit card may already offer travel insurance coverage that provides basic trip cancellation and baggage loss protection.

Additionally, visiting your hometown or family means that you will either be familiar with the healthcare system or will be in constant contact with someone who does. For instance, if you get sick, you’ll know where to get medical attention, how much it will cost and be close enough to Singapore where cutting your trip short and coming home may be a reasonable alternative. Additionally, you may even save a couple hundred dollars if you take these trips several times a year without purchasing a travel insurance policy each time.

Read Also: MapleStory M Review: It Could Well Be Better than Pokemon GO

Adventure or Sports Trips

If you are planning a trip that involves adventurous activity such as scuba diving, hiking, skydiving and other sports, you should definitely consider travel insurance. While insurers generally don’t cover extreme activities, such as hang-gliding or ice climbing, they do cover many activities that interest adventure tourists.

Whether you are planning a Mount Kinabalu hike or going scuba diving in Thailand, travel insurance will provide coverage for costly expenditures such as repatriation to a hospital, hospitalisation coverage and personal accident coverage. Additionally, some insurers will even provide protection for your sports equipment (such as skis and golfing equipment), adding peace of mind whether you’ll be renting or bringing your own. You should just be careful to read the policy wording of your travel insurance policy to make sure your activities will be covered.

Business Travel

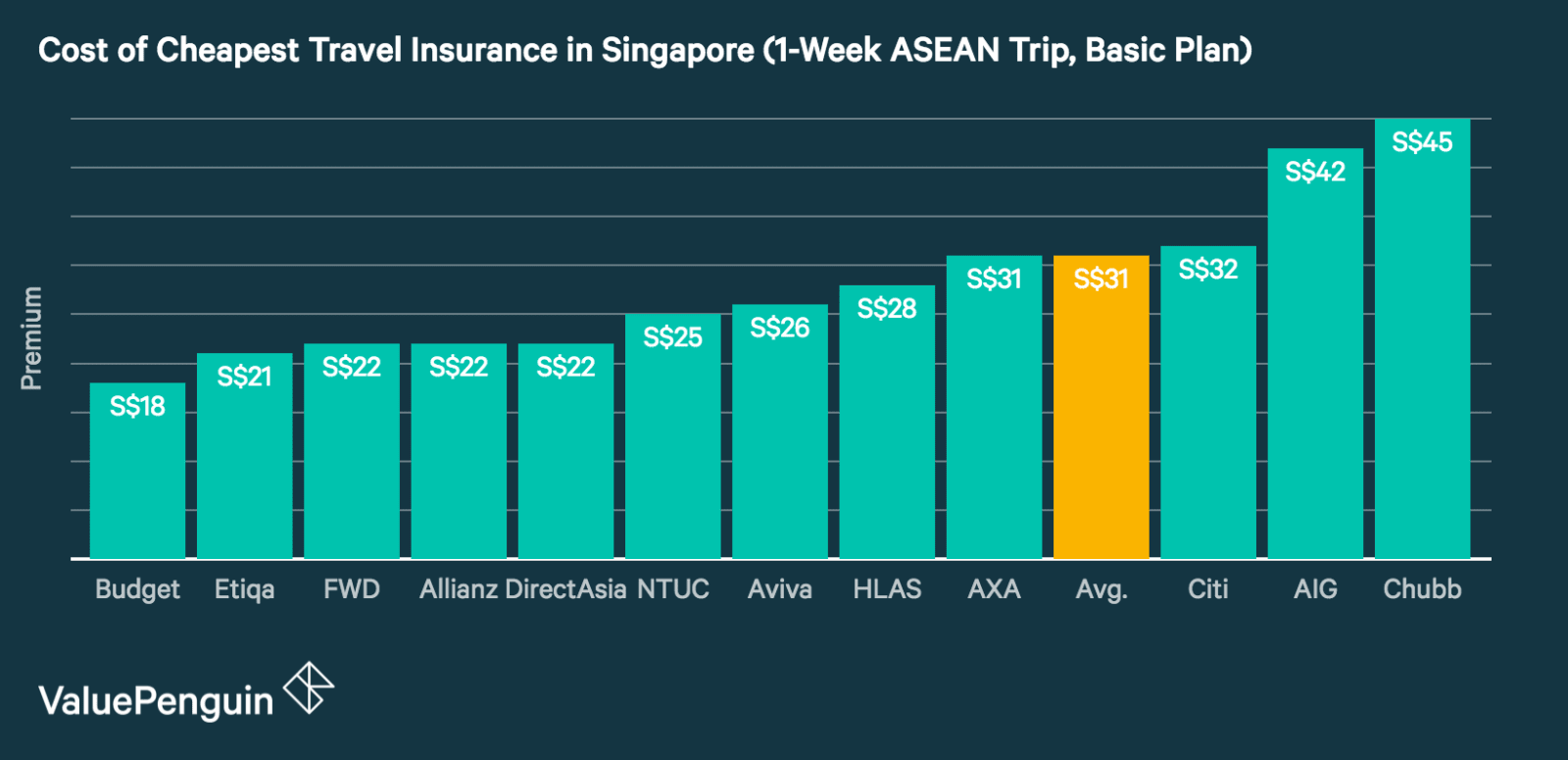

You can probably get away with skipping purchasing a travel insurance plan if your company is sending you on a business trip. This is because most companies will usually order a group travel insurance policy, relinquishing you from the need to purchase your own. These policies cater to the business traveller by offering benefits such as coverage for having to change your companion, changing your business itinerary and coverage for document loss or damage. However, in the event your company doesn’t offer travel insurance, you can grab a cheap yet effective policy with similar benefits for under S$30.

Alternatively, if you take business trips often you can consider buying an annual travel insurance policythat will keep you covered on all your trips throughout the year. This is an especially good deal for those travelling more than 6 times a year, as it can lead to savings of over 20% compared to multiple single trip plan purchases.

Trips Booked Far in Advance

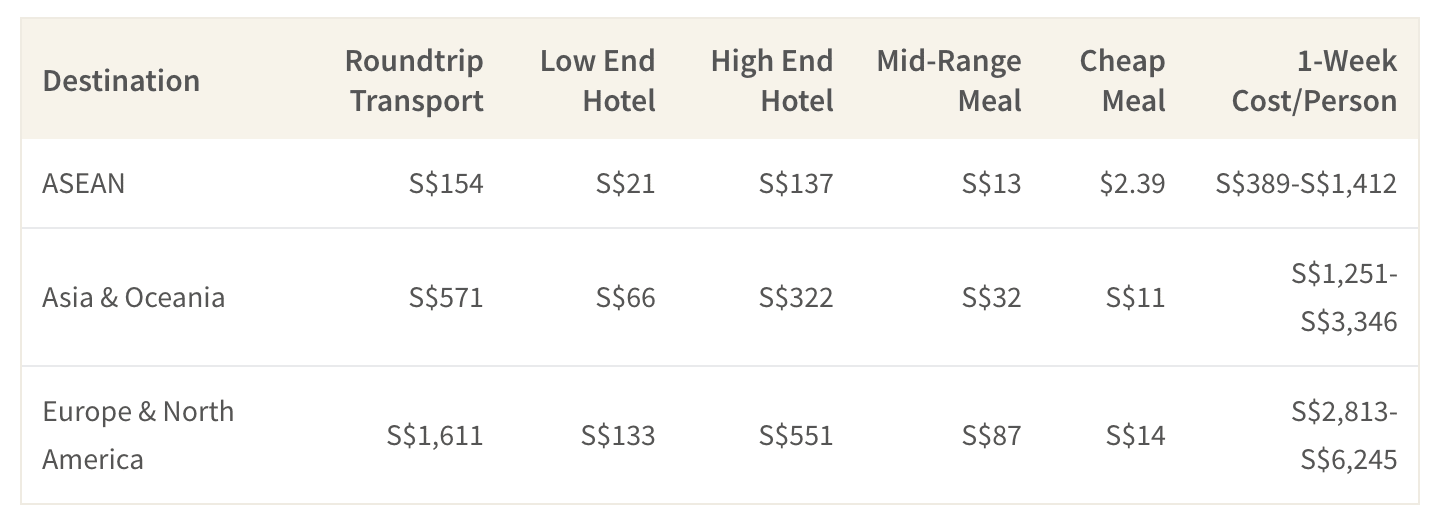

It is wise to consider purchasing a travel insurance policy if you are planning a trip far in advance. This is because in a span of a few months, unexpected emergencies or sudden political turmoil could derail your travel plans, but travel insurance will be able to reimburse you. For example, if you have to cancel your trip due to an unanticipated natural disaster (such as the recent volcano eruption in Bali) and there were no public travel warnings for your destination at the time of purchase, you’ll be able to claim for your cancelled itinerary. Similarly, travel insurance will also cover you if you or your travel partner experience a medical emergency before your trip or if a terrorist attack at your destination makes you reconsider travelling. Because the average vacation can already set you back a few thousand dollars, knowing you will get reimbursed can lessen the blow of cancelling a long-awaited holiday.

Cruise Vacations

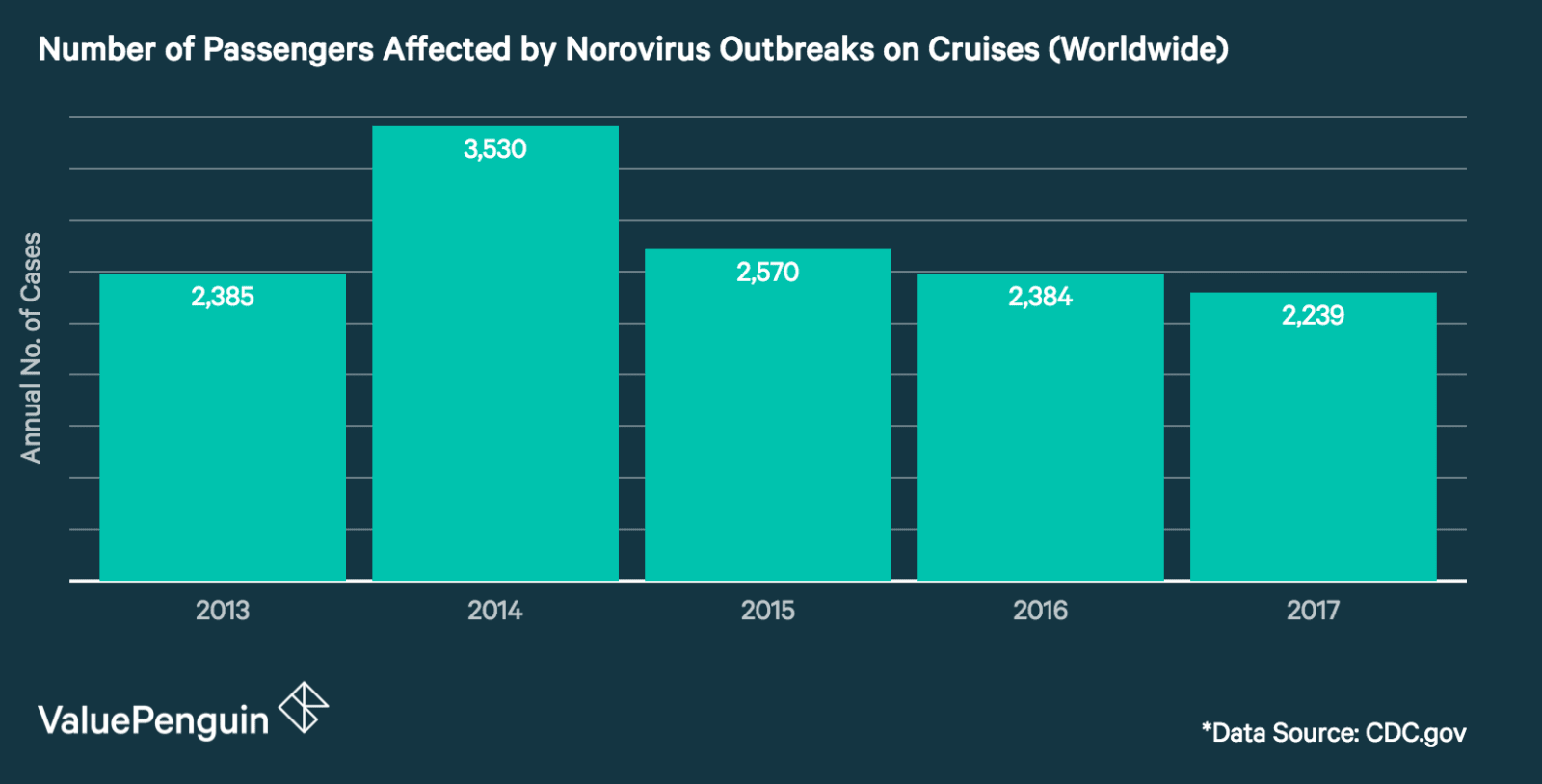

If you are going on a cruise, it is highly recommended that you purchase a travel insurance policy for several reasons. First, cruises are expensive, usually non-refundable and can pose a variety of risks. Furthermore, the cruiseliner will rarely reward you compensation. In fact, cancelling your cruise a month out before your departure means a cancellation fee of 100% and losing your baggage will rarely result in adequate compensation. However, with travel insurance offering trip cancellation coverage for nonrefundable events and baggage loss coverage, you will be able to save the few thousands dollars you would have otherwise lost. Lastly, travel insurance can also provide medical coverage if you end up suffering from one of the common medical problems that affects cruise-goers, including maladies such as the norovirus and the flu.

Consider Travel Insurance on a Case-by-Case Basis

In many cases, travel insurance can be a great way to mitigate the risks associated with travelling. Its plethora of benefits can grant peace of mind whether you are flying to a brand new destination or going on your annual family holiday. However, there are some trips that may warrant skipping travel insurance. To make sure you are getting the most out of your money, we recommend carefully analysing your travel plans to determine whether you could benefit from travel insurance. Ultimately, the decision to buy a policy comes down to considering your hotel or flight’s cancellation and refund policy, your itinerary, the health of your travel companions and what your travel insurance plan covers.

This article originally appeared on ValuePenguin

Always bored during your commute to and fro work or school? Here’s the best solution: download our app for new articles, Facebook videos and YouTube videos that are updated daily…and most importantly, exclusive contents that are only available in our app! It’s your perfect companion for your daily commute!

Click Here to Download the App!

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: