Going overseas is a great way to take a breather, but it can also bring some challenges: needing to find physical SIM cards abroad, having to exchange money beforehand, and more. And though technology is advancing rapidly, you’ll still be hard-pressed to find all these solutions in one place.

Until now.

Enter Revolut. An all-in-one travel companion that enables you to spend in 150+ currencies and store 39 currencies in-app as well as withdraw money from overseas ATMs, Revolut is also the first fintech that offers eSIMs with regional and global data plans.

In addition to travel, Revolut is trusted globally by over 60M users for payments, remittances, investments and more.

And yes, you can even personalise your own card!

So, what can you expect when you sign up for Revolut?

eSIM

For ages, travelers have struggled with the hassle of securing an overseas SIM card right after landing. But what if you could simply use Revolut’s eSIM instead?

Cost-effective and convenient, Revolut’s eSIM allows you to stay connected wherever you are without unexpected roaming charges and interruptions.

Revolut customers with eSIM-compatible devices can buy and activate it directly in-app, and top up data anytime without a physical SIM. eSIMs are fully digital and work alongside your existing SIM. As long as you’re connected to the eSIM, you can use the Revolut app without dipping into your mobile data allowance.

Prices per location start at S$2.50 for 1GB.

Revolut’s eSIMs are compatible with the majority of 4G/5G Apple and Android smartphones. They are easy to install, and do not require the download of additional apps.

Spending Like a Local When You’re Overseas

Pre-exchanging money before your trip can be a real hassle, especially if your destination is mostly cashless. You might be tempted to use your everyday debit card, but local banks often offer terrible conversion rates.

Here’s where Revolut steps in.

Revolut lets you spend in over 150 currencies at great exchange rates with no additional fees charged by them You can also hold and exchange over 39 currencies, including Singaporean favourites like, CNY, VND, THB, KRW, and more, all within the app.

Compared to traditional banks and money changers, Revolut usually gives you more bang for your buck.

It’s basically a debit card but with good conversion rate.

ATM Withdrawal

Sometimes, you do need cash. And pre-exchanged cash might run out quickly, especially if you end up spending a bit too much at the night market.

At that point, you could accept the local money changer’s abysmal rates… or choose Revolut’s ATM withdrawal feature.

With Revolut, you can withdraw cash from overseas ATMs with minimal fees. Depending on your plan, you can withdraw up to a certain monthly limit fee-free, after which a small fee applies.

All you need is Revolut’s physical card to access cash conveniently abroad, and if you’ve no idea where the nearest ATM is, fret not: you can locate the nearest ATM with the Revolut app, too!

And did I mention that you can customise your card, which will be sent to you for free?

Oh, yes, I did.

Split Bills & Budgeting

If you’re someone who looks at every single cent you spend, Revolut helps you budget by automatically sorting your spending into categories, showing clear analytics for you to deep dive into.

But…when you go overseas with your friends, that might go haywire, since we might sometimes share a bill.

And let’s face it: Splitting bills overseas can be a headache. Doing mental math and chasing manual transfers can get tiring fast.

With Revolut, splitting the bill is a breeze.

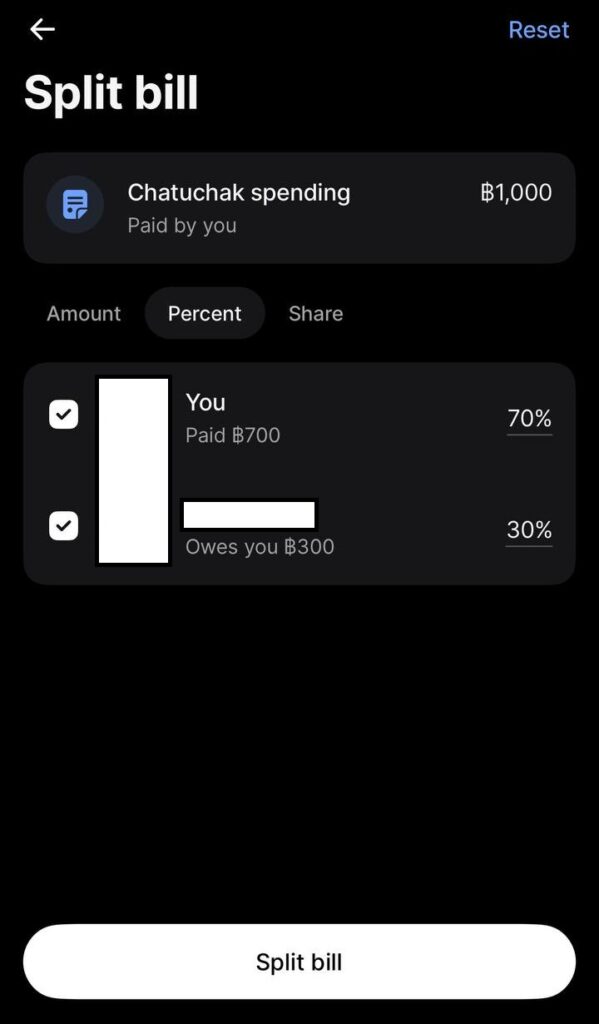

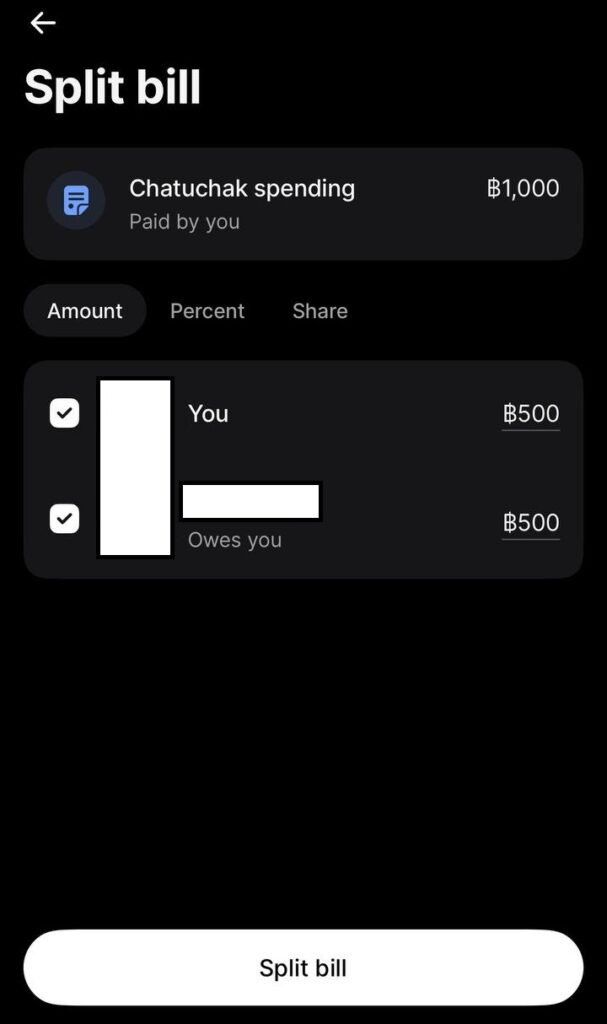

As long as everyone in your group uses Revolut, you can split the bill within the app itself. The in-app “Split Bill function” allows you to either adjust individual amounts…

Or divide the bill evenly.

Once you’re done, the rest of your group receives a notification requesting the required sum. When accepted, the funds will go right to your account with no extra fees.

Well, at least you’d know that you’re not going to lose any friends when you travel with them.

Built-In Travel Insurance

No need to hassle your insurance agent anymore.

Besides payment features, Revolut offers travel insurance covering medical emergencies, baggage loss or delay, accidents, evacuation, and transport to bedside.

As long as you pay at least 50% of your return travel cost with Revolut, both you and your spouse will be covered under Revolut’s travel insurance.

-

Up to S$5,000 for lost, stolen, or damaged baggage

-

Up to S$200,000 for emergency medical and dental expenses

-

Up to S$100,000 for travel accidents (death, permanent disability, or loss of sight/limb)

Please note, this benefit is only available to Revolut’s Premium and Metal plan users.

And well, Revolut doesn’t just protect you; they also protect your money and data using powerful security tools like biometrics (face or fingerprint), multi‑factor authentication, end-to-end encryption, and machine‑learning fraud detection that flags suspicious transactions instantly.

Convinced that you need the card?

You can now get $30 cashback when you sign up for Revolut and an additional $188 if you’re the 8th or 88th user! Click here to register now!

Or you can watch this video to see how a Blue Cat saves his marriage (and a Japan trip)…by getting a Revolut account:

This article is written in collaboration with Revolut.