Since June, the founders of Three Arrows Capital have been making headlines for allegedly fleeing overseas, being uncooperative with liquidators to sell off their remaining assets, and dodging court orders.

Oh, and also for being mega-rich, with one co-founder owning not one or two but three houses in Singapore, while the rest of us are still struggling to get a single BTO.

Now, it appears that the pair are pulling out an UNO reverse card and demanding that they too, are entitled to a large sum of claim from their company assets.

The Downfall of the Singapore-based Cryptocurrency Firm

In case you haven’t been up to speed, Three Arrows Capital ran into deep waters earlier this month when they had to file for bankruptcy because of the ongoing cryptocurrency crash.

From the infamous Terra blockchain crash, to the utter obliteration of the LUNA coin value, financial woes have been hitting cryptocurrency-investing firms and private entities alike.

The two founders, Zhu Su and Kyle Livingstone Davis, had allegedly fled the country following this, going off the radar completely for about a month, until the former posted this cryptic tweet accusing the liquidators from consulting and advisory firm Teneo for “baiting”.

The bankruptcy was filed in the US, but the liquidators of Three Arrows Capital have since gotten the High Court’s approval to carry out their duties in Singapore and hopefully pay off the affected creditors.

If what the once thriving cryptocurrency firm claims is accurate, they had about USD$10 billion in assets under their management as of March this year. In other words, a whole lot of money was at stake.

Why and How are they Demanding to get a Slice of this Broken Pie?

The Singapore-based crypto hedge fund has a lengthy list of digital asset firms it needs to account to. Amongst this, are crypto lenders Genesis and Blockfi, both based in the US and being hit with hundreds of millions of dollars in losses.

Basically, some of the biggest digital asset firms are getting in line waiting to get their payouts.

The last people you’d expect to get some sort of cut from the liquidation are the debtors—the founders themselves.

According to a series of over 1,000 pages of court documents released by Teneo as part of the liquidation proceedings, Kyle Davis had submitted a claim for about USD$66 million to be paid out to his wife. Co-founder and house collector Zhu Su himself was also mentioned in the statement that he is entitled to a USD$5 million claim.

Hearing this, their outstanding creditors are probably ready to shoot three arrows their way.

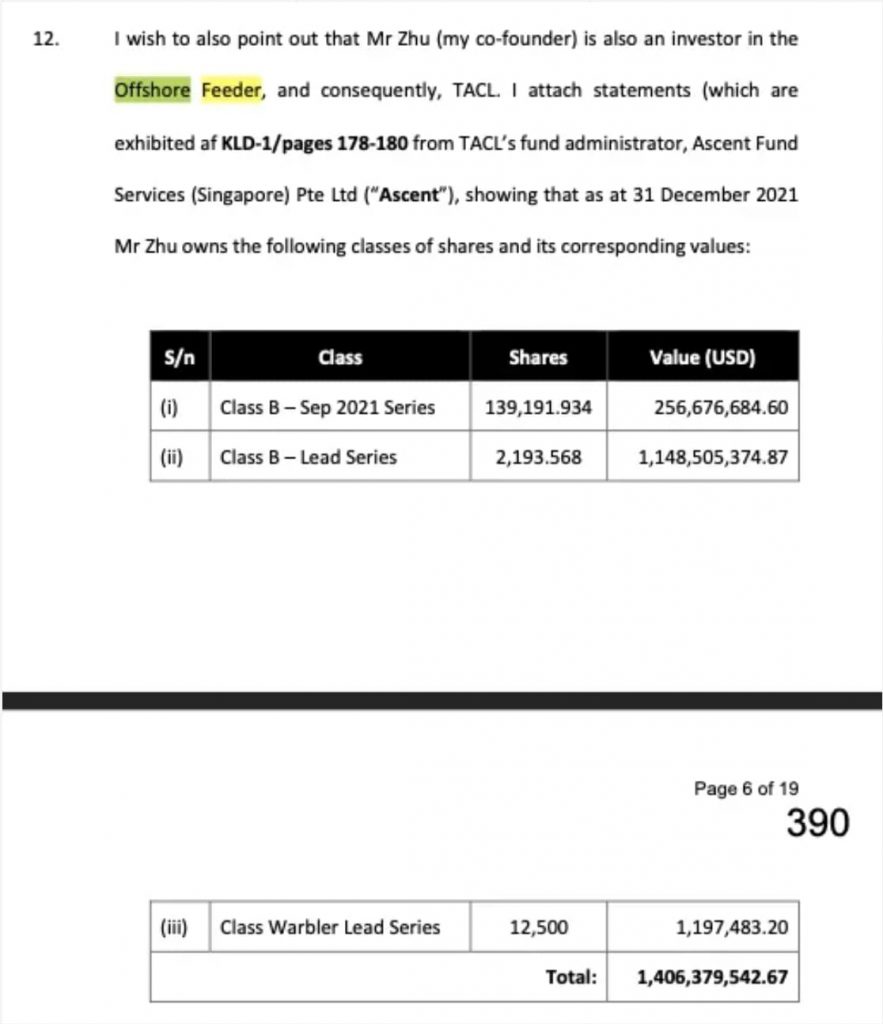

While it was not clear at first how the firm was structured to enable Mr Zhu to be listed as a creditor himself, the recently surfaced court documents have revealed that he had a $1.4billion stake in the company’s offshore fund comprising their crypto fund assets.

This sum has clearly tanked in value in tandem with the cryptocurrency crash, making him apparently eligible for a payout as well.

Kyle Davis Claims his Co-founder Should be Compensated for His Losses

In an affidavit, which is a signed written statement voluntarily made under oath, filed on 27 June by Mr Davis under the pseudonym of “Robert Gardner”, he said that “much of the value of these investments have been wiped out [because of the cryptocurrency market crash]. Investors, like Mr Zhu, have suffered immense losses in [the company].”

But so have their major creditors, arguably.

The court documents have also revealed that Three Arrows Capital owes its creditors, some 25 different companies, a staggering USD$3.5 billion. Amongst this is Genesis, the crypto trading company that was owed USD$2.3 billion, and has since filled for a USD$1.2 billion claim from Three Arrows Capital as its top creditor, according to those familiar with the court filing.

Digital Currency Group (DCG), the parent of Genesis has since released a statement to calm worried stakeholders: “Both the DCG and Genesis balance sheets remain strong. With no remaining exposure to Three Arrows Capital, Genesis continues to be well-capitalised and its operations are business as usual.”

In the business world, people do register a company to free themselves from its liabilities, which is why sometimes, when a company goes bankrupt, the founders aren’t affected.

But in this case, the founders pulled an UNO reverse card instead…so what’s new?

Read More:

- Uncontactable S’porean Founder of Three Arrows Capital, Zhu Su, Reportedly Has 3 Houses in S’pore

- Subway Gives Woman A$2,664 After Viral Story Of Her Being Fined for Half-Eaten Subway Sandwich

- Couple Who Scammed $32 Million Had Their Passports Impounded But Still Allegedly Fled S’pore

Featured Image: Twitter (@zhusu) & Praveen Goli / shutterstock.com

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: