Hide and seek is a fun game to play.

That’s true, unless you’re on the lam.

Unfortunately for this trickster, his playtime is over.

Man Who Has a Bounty of $5,000 on His Head by His Boss Sentenced to 15 Months Jail

On Tuesday (14 December), scammer Travis Ow Jin Yuan was sentenced to 15 months in jail after being caught for criminal breach of trust as an employee.

He works for the company My Digital lock, and in total, the real-like Loki cheated victims of more than $100 thousand under the company’s name.

He accomplished this with a few methods combined: asking for cash payments instead of credit card, opening a new bank account but cunningly using the company’s name rather than his own, before he would ask for PayNow transfers, and forging fake invoices to keep both the customers and company in the dark.

Clever, right? Not clever enough to escape the police, though.

Ow was arrested on 1 April and taken into remand.

The scam is a testament to his intellectual capabilities, but what about his physical?

Fret not; he has demonstrated that for us as well. The 23-year-old cheater was also convicted of voluntarily causing hurt to four other people in August 2019 and being a member of an unlawful society.

Manhunt? Man Hunted.

It all began when My Digital Lock started the manhunt.

When customers that didn’t receive their orders started to call the company, the company’s owner, Ron, grew suspicious.

The straw that broke the camel’s back was when Travis reported being sick with COVID-19 and was absent for 21 days.

The catch?

COVID-19 medical leaves then only lasted for 14 days.

Ron then released a series of posts on Facebook explaining the situation and commencing the manhunt for his vanished employee.

In the video, he unpacked the scenario to viewers and urged scammed customers to make a police report and come forward to the company.

He also mentioned that My Digital Lock was willing to fulfil all orders of the victims, even at the company’s expense.

Last but not least, in true manhunt fashion, he placed a $5,000 bounty on his head. Whoever could bring the criminal to the police would reap the reward.

Ron’s place? Wrong place.

It’s easy to say Ron’s employment choices are poor.

However, we need to understand the owner’s perspective in hiring a literal criminal.

Armed with a tearjerker, the then 22-year-old Travis explained that he was not only an ex-criminal but also a changed man. He said he had a daughter to raise and was trying to make a living for his family.

Out of pity, Ron closed an eye and gave him the job at My Digital Lock’s Bukit Batok and Westgate outlet in February 2021.

Turns out, that was his pricey undoing.

As the months passed, he realised that he’d actually never seen Ron’s wife or child before, further building on his suspicions about the employee.

After the search started, he offered an additional $500 to anyone who could confirm the authenticity of Travis’s resume cum sob story.

Join our Telegram channel for more entertaining and informative articles at https://t.me/goodyfeedsg or download the Goody Feed app here: https://goodyfeed.com/app/

Another Sob Story?

After the travesty of a changed man was caught, Travis’s lawyer said: “He foolishly committed (the offences) so he can provide for his infant daughter, who was born out of wedlock. He is truly apologetic to victims and has learnt a bitter lesson. He promises to no longer be on the wrong side of the law.”

Turning over a new leaf? Again?

Four Ways of Extracting Payments Illegally

Asking for Cash Payments Instead

The first method that Travis used was that he would tell customers that the outlet didn’t accept credit cards and only did cash payments—which is completely ridiculous, considering how the company might deal with large sums of money for each transaction—and then he would usually pocket the deposit money.

In order to keep up the pretence that the transaction was “real” and ensure that the company was none the wiser, Travis would forge fake invoices and send them to the customers.

It’s rather ingenious for all the wrong reasons, because it gives the customers the belief that they had made a “real” purchase, while keeping the company in the dark because those invoices aren’t actually keyed into the database, but the problem with that is no products would be manufactured to match the orders that Travis took.

Doing PayNow Transfers

Cash payments are typically the best mode of scamming for Travis because physical money is harder to track or retrieve.

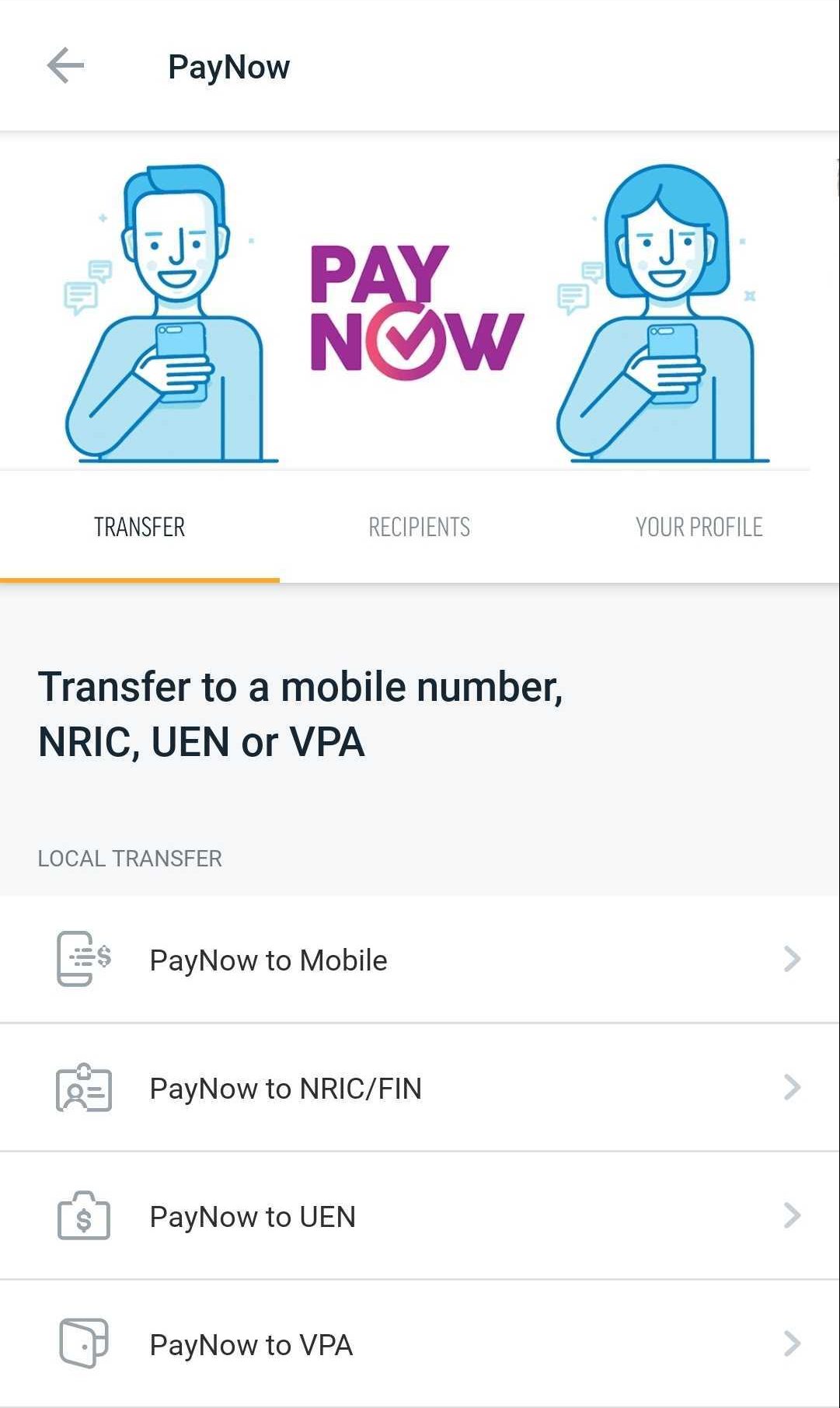

If the first tactic doesn’t work, he offers the customers another alternative instead of credit cards: PayNow Transfers.

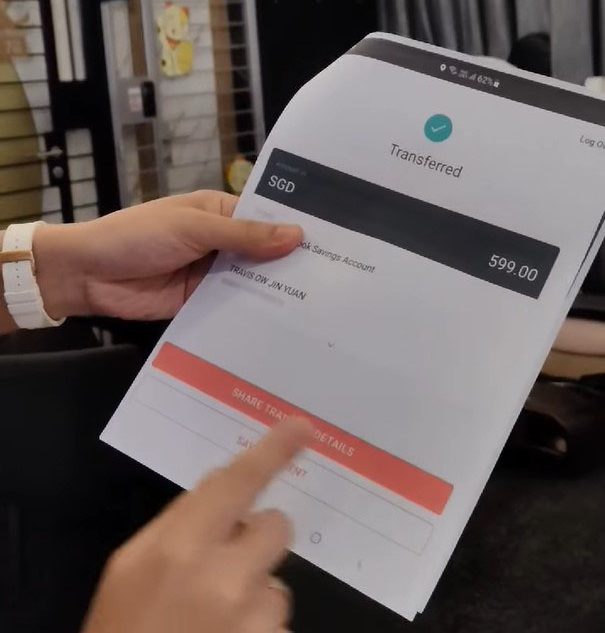

At first, he would use his own phone number to extract the money, but there were some customers that were more circumspect, suspicious as to why the money was going to the bank account under his own name of “Travis Ow Jin Yuen” instead of the company’s name.

Opening a UOB Account and Using the Company’s Name

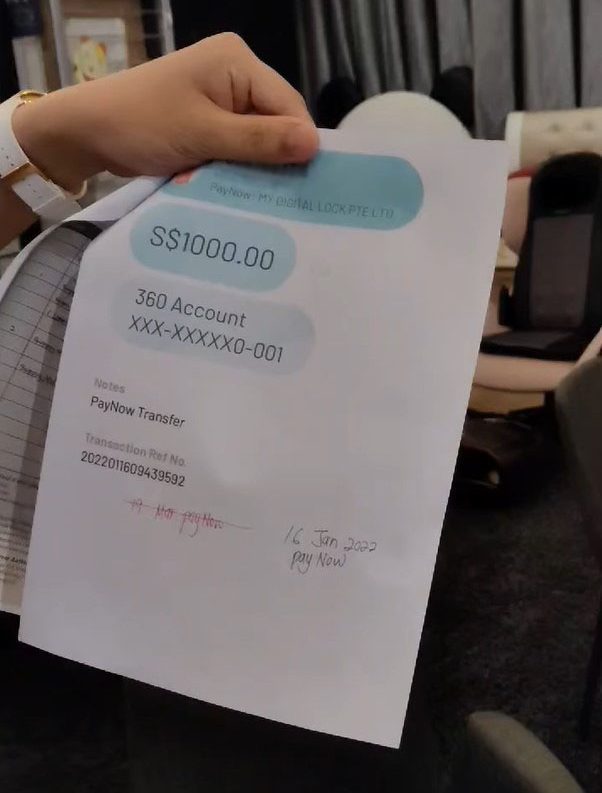

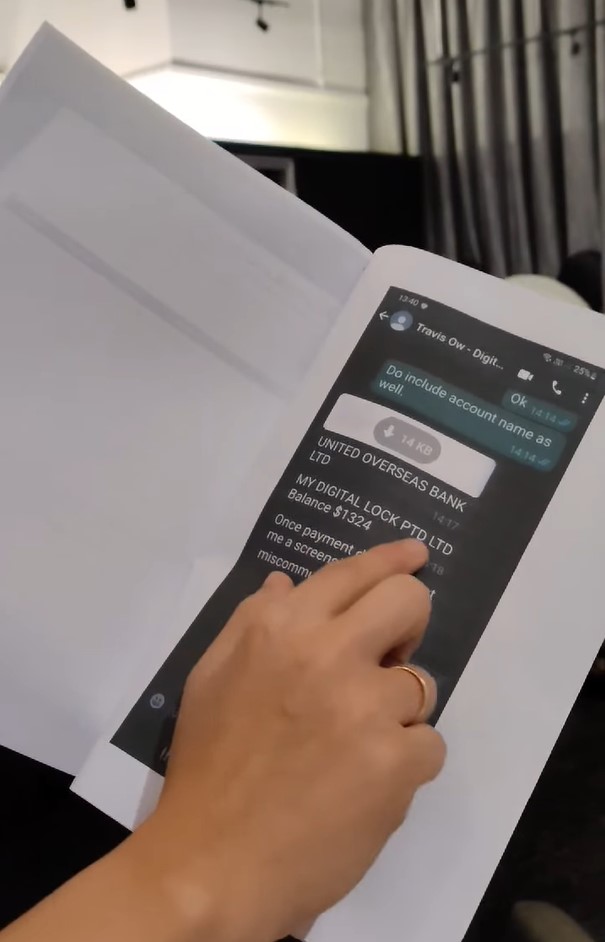

Realising that some customers weren’t as easy to fool, Travis decided to open another UOB account.

But this time, he changed the recipient’s name to “MY DIGITAL LOCK PTE LTD”.

Since it was now under a more credible name, customers were more inclined to believe that they were paying to the right account.

However, not all customers are aware that all companies’ bank accounts are registered under Unique Entity Numbers (UEN), which reflects their company registration number, not phone numbers.

Therefore, if a company ever requests a PayNow transfer, it’s typically done through the UEN option instead.

However, the problem with online banking is that they don’t mention this distinction explicitly, which allowed Travis to take advantage of this loophole.

Giving Special Discounts and Upselling

In order to lure in more victims, Travis would often offer “special discounts” to the customers and tell them to pay through the methods mentioned above. He would also tell them that they didn’t need to come down to the showroom after making the payment.

Then, Travis would follow up through WhatsApp, contacting his victims and offering more services like warranties and other products, sometimes at higher prices, and then extracting the money.

Sometimes, customers didn’t ask for invoices, which was to his benefit since there’s a smaller paper/digital trail.

He would also link the customers to the UOB account he created to facilitate the payments to himself.

Possible Penalty

For committing a criminal breach of trust as an employee, the cheater could have been jailed for up to 15 years and fined.

For submitting his WWE application on four innocent people, Travis could have been jailed for up to three years and/or fined up to $5,000.

Staying Safe From Scams

None of us have a foolproof radar to alert us on scams. After all, they’re called scams for a reason.

That does, however, not mean that we can’t decrease our chances in falling into these malicious traps.

Here’s how to smell a rat.

Tempting Offer

The most obvious red flag is a tempting offer. If the price is way below market rate and inconceivable, then you know something is off.

Remember, if it’s too good to be true, it probably is.

Unexpected Friend Requests

Next, unexpected friend requests. This mainly applies to love scams but still it’s important. If you get an online friend request from an unknown person, please be wary.

Unorthodox Payment

Third, when they ask you to pay by gift cards or shopping credit. Similarly, this applies to credit-for-sex scams where they ask you to pay for escort, massage, or sexual services.

Even if you’re tempted, just remember to keep it in your pants (I’m talking about the money).

Urgent Money Transfers

Moving on, those who ask you to make urgent money transfers.

Stuck in immigration? Need to pay off debts?

If you don’t know the person and have never seen him or her before, don’t wire the money.

Tell Me Your OTP

Last but not least, requests to reveal your One-Time Passwords. By leaking your OTP, you might as well give them access to all your personal information.

Not only do you give autonomy of the account to the hacker, you also put your finances and your physical safety at risk.

In the case of My Digital Lock, the trickster was sneaky. But as long as you’re observant and pick up on small details, you should be all fine.

Read also:

- Prices of Seafood Set to Increase as CNY Approaches

- Popular US Bakery, Cinnabon, Coming to Singapore in Feb 2023

- Jin from BTS Starts Military Service & is Given a ‘Risky’ Role

- Man Caught on Camera Manually Lifting Barrier to Exit Parklane Carpark

- Doctor in Yishun Had to Call the Police 5 Times in 2 Hours After ‘Patient’ Repeatedly Asked for Cough Syrup

Featured Image: Facebook (My Digital Lock Pte Ltd)

Would you be jailed for being half-naked in public? Well, the answer will shock you. Seriously. Watch this to the end and you'll understand: