Unlike the Malaysian Government that heavily subsidises a particular type of petrol (Ron95) to make it affordable for its citizens, Singapore will never take that route.

There are a multitude of reasons for this: rises in petrol prices are not unique to Singapore and mostly stem from uncontrollable external circumstances, it goes against Singapore’s goal to reach a net-zero carbon emission by the mid-century, and that subsidising or reducing fuel duties will only serve to benefit a small population of Singapore, who are already well-off.

Of course, if you prefer summary for the increase in oil prices, you can refer to our helpful Goody Feed mascot for a short take:

Naturally, the video is not the end-all be-all of the reasons.

Without further ado, let’s break down the reasons why Financial Minister Lawrence Wong wouldn’t advise subsidising pump prices.

Global Increase in Oil Prices

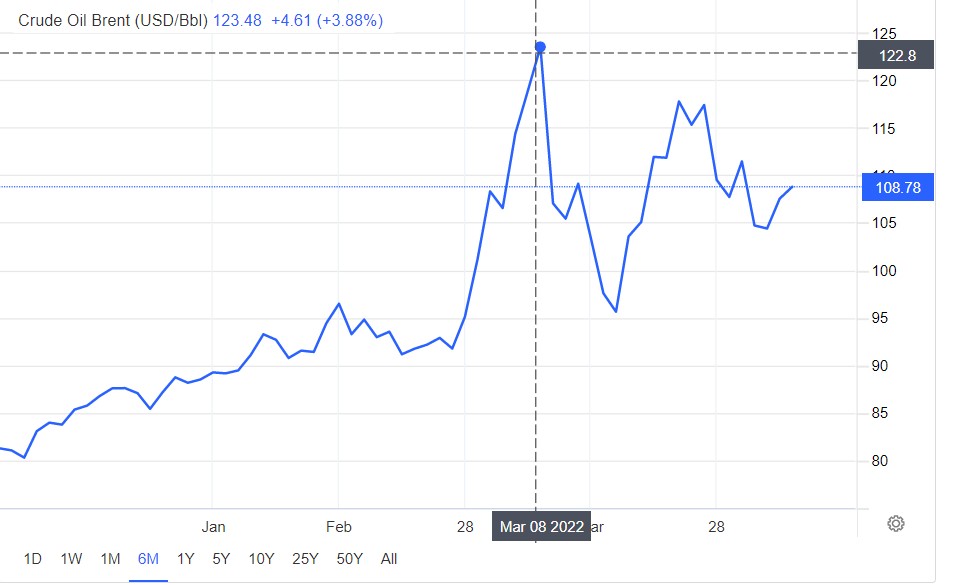

With or without the Russo-Ukrainian crisis, oil prices were already on the rise, and it was predicted that by the third quarter of 2022, Brent crude oil would reach the $100 per barrel mark.

Finance Minister Lawrence Wong offers the facts regarding the moving pieces of the global economy freely in his Parliament speech on 4 April:

Firstly, after the United States and the European countries have shifted their focus away from containing and controlling the pandemic, the countries’ governments have implemented expansionary economic policies.

In simpler terms, these policies are intended to boost business investment and consumer spending by injecting money into the economy, either through direct government spending or increasing lending to business and consumers, all of which drives up the demand for energy sources.

Energy, at its literal core, is critically essential to the global supply chain.

However, the supply of oil sources—be it natural gases, crude oil, or shale oil—has not managed to keep up with the increase of demand, especially since there has been a lack of investments into the fossil fuel processing industry.

This is partially because of The Paris Agreement, which you might have heard of in the last few years because of Donald Trump’s insistence to get the US out of the legally binding international treaty to combat climate change.

As more countries shift their energy investments towards renewable energy sources like wind, hydraulics, solar, and geothermal, this has led to a decrease in investment in the fossil fuel industry.

It is crucial to move away from the burning of fossil fuels, since it has largely contributed to the increase of carbon emission and consequently the rising temperature for decades. Not only are fossil fuels exhaustible, but they are harmful to the climate as whole.

That being said, green technology is still in its infancy and its production of energy has yet to catch up with the efficiency of the developed process of burning fossil fuels, wherein the heat energy is converted into other energy sources.

Hence, there is a shortage of energy sources in the face of rising demand, which gradually affected diesel and petrol prices worldwide.

The Russo-Ukrainian War

The next fact is pure regurgitation at this point: yes, the Russo-Ukrainian War has caused the prices for Brent crude oil and natural gases to spike.

Firstly, Russia is the second largest oil-producing country besides Saudi Arabia, and it provides 50% of the world’s supply of natural gases.

War in itself, requires diesel and petrol to run the jets, tanks, military cargo vehicles, and other military-based operation, which is also factors into rising demand.

Besides that, the European continent’s reliance on Russia for energy sources cannot be ignored; Germany, the fourth largest economy in the world, is extremely reliant on Russia for natural gases to operate its refineries and petrochemical industries.

Given the harsh sanctions they have unleashed upon Russia, the European Union is wary of possible retaliation, with Germany going as far as rationing their natural gas supplies in fear of future energy shortages.

While it is possible for countries to reconfigure where they obtain their energy from, or build new infrastructure to cope with the potential energy losses, such developments will take time, which means that the problem of strained energy resources will continue to persist.

Global Inflation

Due to the pandemic situation, many advanced and large economies have been facing “labour tightness”, which have in turn, led to a rise in inflation.

“At the start of 2022, there were initial hopes that global inflation would ease over the course of the year, as the supply situation improved. But with the war in Ukraine, it is likely that the global inflation will be higher for longer,” Mr Wong said.

It doesn’t help matters that the war has adversely affected other essential resources.

For instance, Ukraine is known as the “breadbasket” of Europe for its agricultural production of wheat, corn, and barely. Due to the war, there are bound to be shortages for certain products, which have already been felt in Singapore.

The war will have long-term effects on food supplies too; with a reduced supply in fertilisers, crop yields will be lower than previous years, which tightens the supply even more.

Moreover, Russia is a huge supplier of industrial metals like palladium which is used in catalytic converters in cars, and nickel which is used in steel and batteries. The supply of neon, an essential part in the chip-making process, is partially covered by Russia as well.

The increase in production costs from the shortage of raw materials despite the constant and/or rising demand will also cause inflation.

Seriously, this is why everyone hopes that the Ukrainian crisis can be settled at the negotiation table, and the sooner the better.

Let alone the catastrophic loss of human lives and heavy damages to the infrastructure, it’s causing terrible shockwaves through the global economy.

Singapore’s Goal of Net Zero Carbon Emission

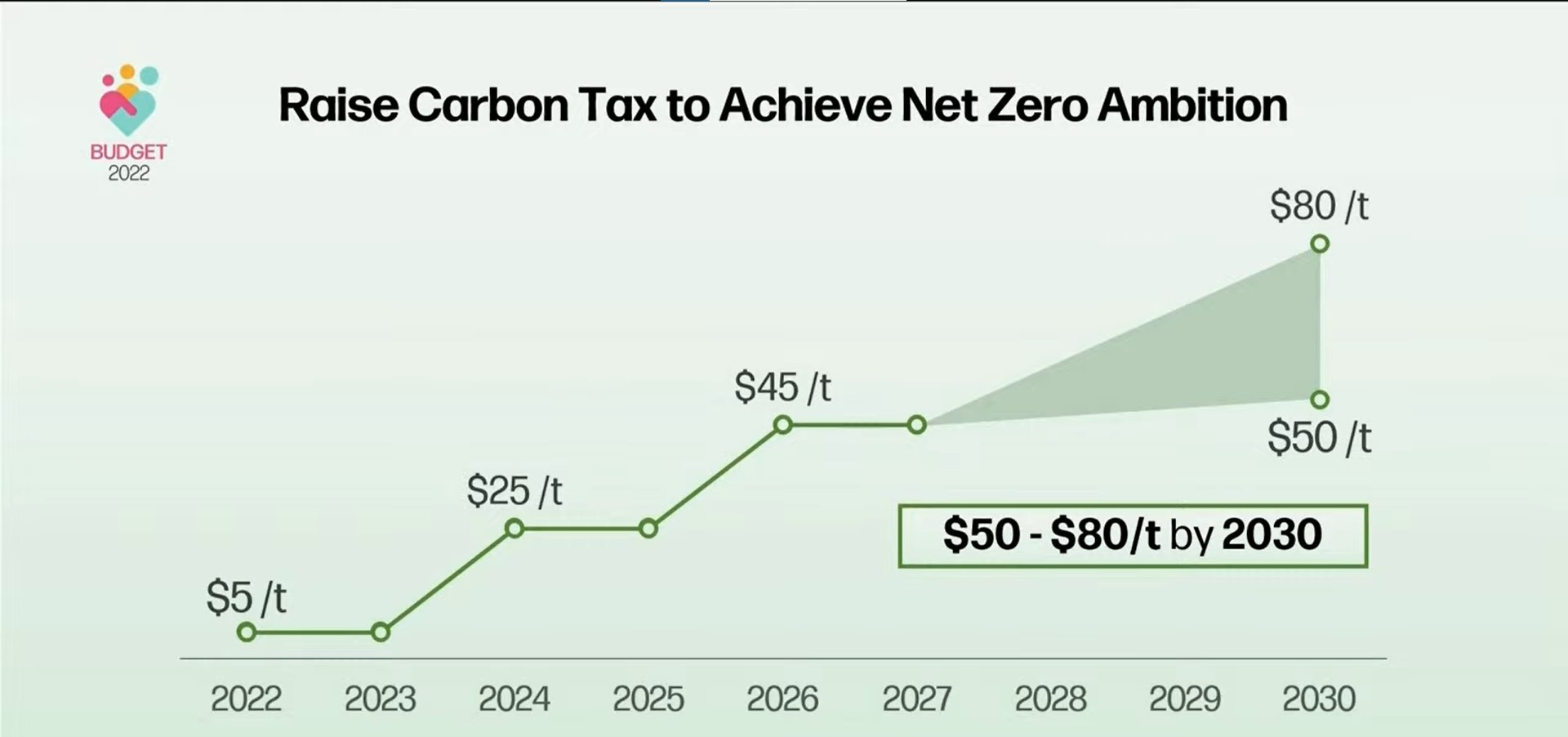

Among the many items covered in the Budget 2022 Speech, the Ministry of Finance has boldly declared that they hope that Singapore will reach net zero emissions around the mid-century.

When Mr Wong was asked by the MPs if fuel duties will be reduced, or if there will be road tax rebates to combat the rise in pump prices, his answer was a straight-up “No”.

Mr Wong argues that such policies will essentially become a subsidy on private transport, which will have “counter-productive effects” on Singapore’s grand goal of reducing its carbon emission.

The Finance Minister points out that fewer than 4 in 10 households in Singapore own cars, and in the lowest quintile, only one in ten households possess a vehicle.

Therefore, subsidising private transport would only benefit “a relatively small but generally better-off group”.

Next, he states that even if the government were to cut down on fuel duties, the subsidies might not necessarily flow towards the consumers completely. The producers and supplies themselves might take a portion for their own profit, while only reducing the price of fuel marginally.

As for why Mr Wong says that subsidies are “counter-productive”, it’s because subsidies will decrease the motorists’ motivation to switch to more energy-efficient models of transport, which is a critical element in the government’s long-term plans for sustainable living.

Lastly, Mr Wong likens fuel duties to “carbon tax”, and highlights that Singapore doesn’t impose such a tax on fuel.

In the Budget 2022 speech, Mr Wong has already laid out the specific details as to how the government was going to increase the carbon tax from 2023 to 2027.

Since the government plans to increase the tax on carbon, reducing fuel duties would run contrary to such plans.

The Contribution of Fuel Duties and Road Taxes to Government Revenue

Given Singapore’s plans to become a green and sustainable country, fuel duties, road taxes, penalising the negative externalities from vehicular emissions based on their impact on public health and the environment are par on course.

Mr Wong bluntly states that the fuel duties collected over the past five years average around S$920 million, and the revenue from the duties and taxes add to the pool of resources available for carious programmes and subsidies that “directly benefit” Singapore.

In hopes of discouraging any notions of subsiding private transport, Mr Wong urges the Parliament to “think carefully” before giving up or decreasing the source of revenue, especially when Singapore is facing “considerable revenue changes”.

Naturally, Mr Wong is alluding to the shrinking workforce due to the ageing population, which in turn reduces the amount of income tax the government collects, the increased expenditure on healthcare, the stimulus and support packages to help households and businesses with GST increases, so on and so forth.

Plus, the COVID-19 pandemic has drawn out a lot of resources from Singapore’s reserves, it wouldn’t be wise to cut off a source of revenue.

Join our Telegram channel for more entertaining and informative articles at https://t.me/goodyfeedsg or download the Goody Feed app here: https://goodyfeed.com/app/

Groups Affected by High Petrol Prices

However, Mr Wong does acknowledge that some groups like taxi and private-hire car drivers, as well as delivery riders, are particularly affected by the increase in pump prices.

He notes that some taxi and private-hire car operators have instated temporary increases in fares to share the burden of operating costs with the consumers.

Besides that, these companies have partnerships with petrol companies to offer fuel at discounted prices, to help drivers and riders with the higher fuel costs.

If there are individuals whose incomes are badly affected and require financial assistance, Mr Wong suggests that they can approach social service officers, community centres, or self-help groups.

Mr Wong then reiterates that there are better methods to help Singapore cope with the rising costs of living, like the support measures detailed in Budget 2022.

Offering Help to Small and Medium Enterprises

Later in the parliament session, MP Jamus Lim asked if there will be targeted help for small businesses that utilise commercial vehicles, emphasising that the prices in the transportation sector have increased more than others.

Although Mr Wong doesn’t want to be a broken recorder, he repeated that the increased costs are already being shared between drivers and consumers, in the systematic way the free market functions.

The Government will also help cushion the impact on consumers through the different packages addressed in the Budget.

The packages sought to assist households in different aspects, such as children’s education, utility bills and daily essentials.

At this point, it almost feels like the Finance Minister is giving an abridged version of his nearly two-hour-long budget speech.

Nonetheless, he assures the House that if the situation worsens, the Government “will not hesitate to take further actions to protect jobs, and to help households and businesses deal with increased costs”.

All in all, the Government won’t be providing any kind of rebate for the pump prices, or relenting on the fuel duties, but it will continue to monitor the domestic situation and the circumstances abroad.

Read Also:

- Former SAF Regular Sexually Assaulted Daughter So She Won’t ‘Seek Out Other Boys Who Might Trash Her’

- All Nightlife Establishments, Including KTV Outlets, Can Fully Reopen From 19 April

- 55 Vehicles Have to Turn Back for Not Having 3/4 Fuel at SG-JB Checkpoints

- M’sia McDonald’s Offering Apple Pies or Sundae to Replace Fries Due to Potato Shortage

Featured Image: Shutterstock / Trong Nguyen